A DISASTROUS French barley harvest has again focused the eyes of Asia’s maltsters on Australia to satisfy its near-term demand, bolstering shipments of Australian old-crop and new-crop premium barley.

While countries in the region, mature and emerging, are buyers of either Australian barley or Australian malt, the biggest market, China, in particular, relies on clean, dry barley to make malt for beer. China imported around two-thirds of its barley requirements from Australia this past decade.

Asia beer world’s biggest

Demand for beer is at the core of malting barley premium prices (a tonne of barley makes around 750 slabs of beer). China has, for 14 consecutive years, produced more beer than any other country, and is dominant in overall Asian beer production.

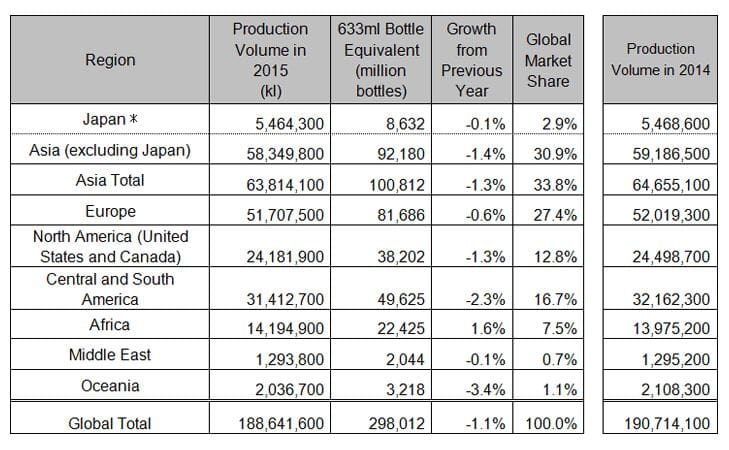

Top regions’ beer output 2015 versus 2014. (Source: Kirin). Less beer in 2015 means marginally less barley and malt required.

While many are drinking less beer in 2016, people in Vietnam, India, and parts of Europe and South America are consuming more.

A potted history

Australia’s first exports of barley to China occurred in the 1980s. Since then, the country’s thirst for beer has made it the world’s largest importer of premium barley, and its malting and brewing sector is innovative.

Global beer heavyweights like Anheuser Busch InBev SA, Asahi, Carlsberg and Heineken have significant and long-term brewery investments in China and throughout the region.

Chinese maltsters source barley primarily from Australia, significantly also from the EU, Canada and Ukraine regularly, as well as sometimes Argentina. Their usage is a combination of high specification malting barley grades and feed grades (F1 classification), the feed grades providing an economical addition to brewers’ inputs.

It’s all about latitude

Barley Australia chairman, Andrew Gee, told Grain Central most Asian countries were ‘mature’ markets, serviced under long-term supply agreements with maltsters and some barley suppliers.

The geography of Asia helps determine each country’s demand.

“The closer you get to the equator the less malting capacity there is because of climatic conditions, so they’d buy less malting barley per-se, and it makes more sense for them to buy malt,” Mr Gee said.

“Humidity near the equator requires a huge energy demand for kilning to remove moisture before you’ve got dry air available for the drying process. China has diverse geography and has got a lot of malting capacity.”

Watching the weather

The northern hemisphere harvested cereals in wet conditions this year.

Unseasonal rain in France and Germany, during a sodden spring then into summer, meant crops were challenged from germination through to harvest. Quality and quantity had suffered.

France’s 2016 barley crop of 11 million tonnes, which at three million tonnes below its 2015 crop, curbs its ability to supply exports to China.

UK and Denmark came to the rescue to fill the shortfall in European (French, German) malting requirements, however exports of EU barley and processed malt, which normally compete heavily into Asia, have been reduced.

Another northern hemisphere heavyweight, Canada, had a 2016 harvest prolonged by wet weather.

Spring is the make-or-break season for Australian malting barley. This year’s wet spring has been conducive to the protein range, and consistent grain size, premium malting grades require.

Therefore, Australian growers and traders have their fingers crossed for fine conditions into early December so barley can maximise its considerable yield and quality potential.

Australia’s harvest weather cleared in early November, benefiting the main barley states, Western Australia, South Australia and Victoria. These three states produce more than 80pc of Australia’s malting barley, operate most of Australia’s million-odd tonnes of malt-for-export processing capacity and generate around 90pc of all barley exports.

Chinese malt processing investment in Australia?

Could Chinese interests buy malt processing capacity in Australia? It’s a fair question to pose.

Cofco, for example, now owns Noble Grain and will soon complete its ownership of Nidera.

Industry sources said Chinese investment in malting in Australia was not seen as likely at this time. While there may be no major barriers to entry, the ‘real estate’ is quite tightly held.

It would seem the foreign and locally-owned businesses operating maltings in Australia’s prime spots won’t have new neighbours any time soon.

HAVE YOUR SAY