The Snapshot

- The Canadian canola crop is in a terrible state and has been since seeding.

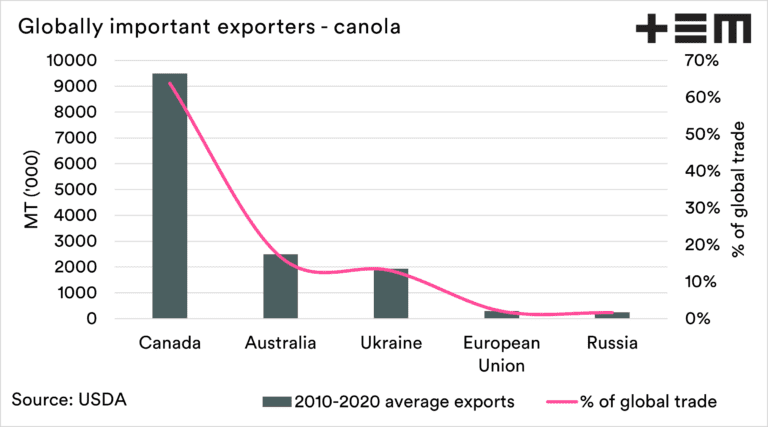

- Canada is the world’s largest exporter of canola. Their absence will benefit us.

- The Canadian canola futures price has settled above A$1000/t.

- Our local pricing has responded with pricing in Kwinana at A$915+.

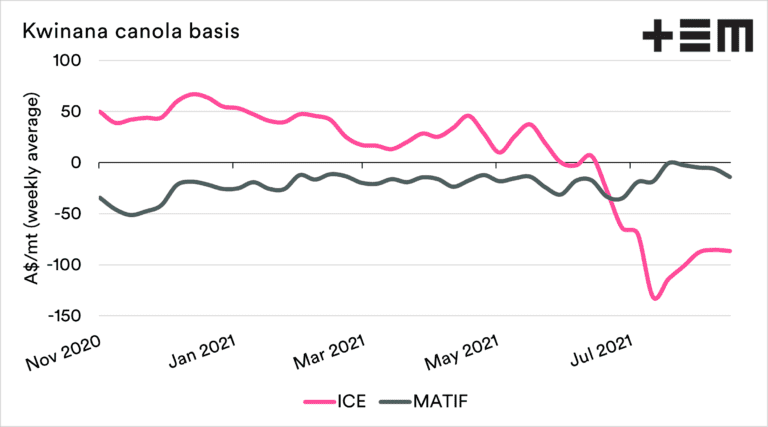

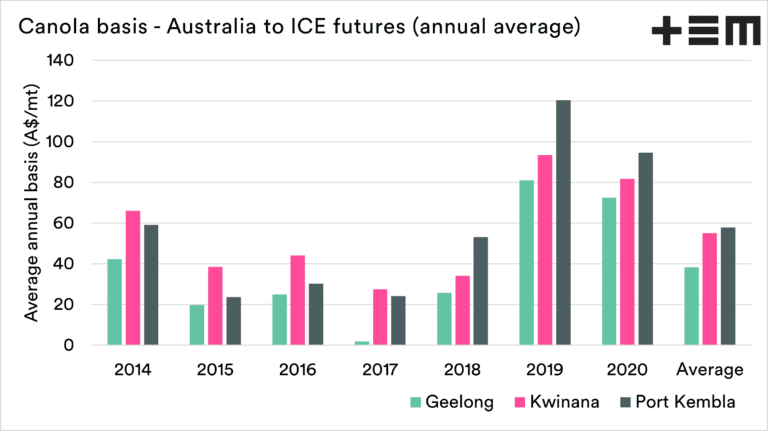

- Our basis to Canadian futures is discounted heavily but is at typical levels when compared to French.

- It’s not a surprise to see our basis erode to Canada, as they experience the same drought premiums we received in recent years.

The Detail

We have been bullish on canola throughout this season; when it dipped during June, our view based on the data (and logic) was that this would recover. And recover it has.

What logic were we using for our view on canola? Well, it wasn’t rocket science. The Canadian crop was in a sorry state and wasn’t improving.

Canada is the world’s most important exporter of canola. The absence of Canada was going to lead to a shortage. Australia and Ukraine are in the front seat to benefit from the Canadian cropping crisis. The Canadian farmer’s loss is our gain.

Futures above A$1000!

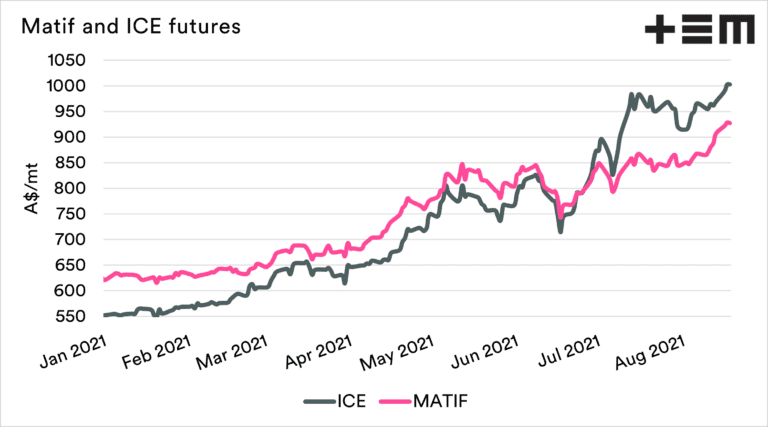

ICE canola futures had been a bit flat through July, but in recent days have been on an upward trajectory. Yesterday they hit and settled above that beautiful A$1000/tonne figure for the contract corresponding to our harvest.

We have also seen MATIF (French) futures rising as well and have hit A$928/t.

This is great news as the futures price makes up the majority of price direction in Australian canola. If the futures price goes up, then that sets the trend for our pricing.

What’s happening locally?

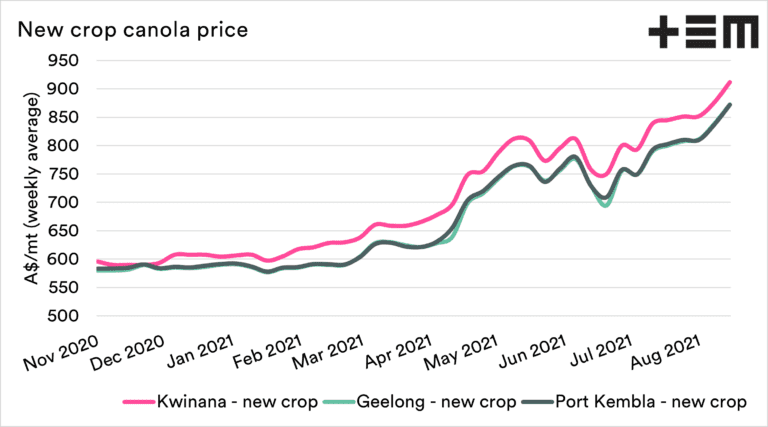

The chart below displays the weekly average canola price for the coming harvest since November. Since seeding, the price has been on a positive trend (for farmers), except for that dip in June.

The data in the chart below is the public bids and is intended as a guide of the trend. When the market rallies quickly, we know that real bids are generally higher than the advertised market.

The west is getting the best pricing levels at >A$915/t, while the East lags behind at >A$875/t. They are both historically strong levels.

What about basis?

Our price locally is attractive but still remains at a substantial discount to ICE canola futures. Normally Australian canola would trade at a premium.

At its simplest, the basis level is dictated by conditions. The price of canola/rapeseed is rising around the world. This is due to the importance of Canada to global trade. The bulk of the rise is being seen in Canada.

In 2018-2019, we experienced the ASX wheat contract rising massively compared to the rest of the world. The situation is no different to our local drought pricing.

This shows that it is not a case of our basis levels being pushed lower to buy cheaper from Australian producers. It is a symptom of the poor Canadian crop.

Does it matter?

Let’s be honest, as a farmer it doesn’t really matter if the price is at a discount to what is normally expected. If you have the canola to sell it’s a good price.

There was a concern with selling canola in advance of harvest, as washouts are a nightmare. The reality is that we are getting closer to harvest, and there is more certainty in the crop. At this point in time, the pricing is fantastic, and strong pricing levels are likely to persist – as there isn’t much volume available elsewhere.

This article was originally published on the Thomas Elder Markets website: https://www.thomaseldermarkets.com.au/

To view original article click here

HAVE YOUR SAY