THE value of Australia’s farm production is forecast to remain relatively unchanged at $60 billion in 2018–19, well above the 10-year average of $55b, despite very dry conditions in some places, according to ABARES’ Agricultural Commodities: September quarter 2018 report released today.

A cereal crop in Moree in northwest NSW shows the effects of late germination rain and little moisture since.

ABARES executive director, Steve Hatfield-Dodds, said the latest forecasts reflected dry conditions in eastern Australia, and support for farm incomes from strong production in Western Australia, rising grain prices, high livestock prices, and a lower Australian dollar.

“The value of crop production is forecast to decline by 3 per cent to $30b in 2018–19, reflecting a 12 per cent fall in the volume of winter crop production nationally, especially in drought-affected cropping regions in New South Wales and Queensland,” Dr Hatfield-Dodds said.

“Offsetting this lower volume we are expecting higher prices for canola, coarse grains, cotton and wheat, and a favourable exchange rate will result in a much smaller decline in the value of production, and help maintain returns to Australian exporters.”

Based on tightened supply, the commodities forecaster said indicative world prices for wheat and coarse grains were expected to rise 9 per cent and 12pc respectively in 2018-19.

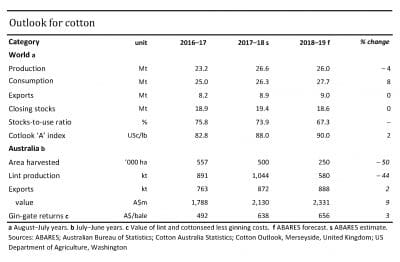

In cotton, returns to Australian growers have been forecast to hit a 16-year high, and are expected to climb 2pc in 2018-19 based on growing global demand and lower production.

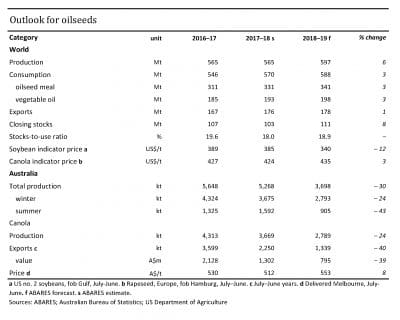

The world oilseed price has been forecast to climb 3pc over 2018-19, with canola prices expected to rise in response to higher Chinese demand and reduced production in Australia and Canada.

“A warmer winter has supported the production of a range of fruits and vegetables, and sugar and winegrape production have not been significantly affected by the drought.”

Livestock production is expected to increase 2pc to $30b in 2018–19, driven by increased supply of livestock as farmers destock in response to scarce pasture and rising feed costs.

“Relatively high world prices for meat are providing some support for cattle prices in Australia, but we are expecting cattle prices to fall by around 9pc from the historically high levels of recent years.

“As we’ve seen, rising input costs are a significant challenge for some producers and we can expect increased competition in export markets as more cattle are turned off in the United States in response to dry conditions there.

Total export earnings are forecast to drop 5pc from $49b to $45b, largely due to reduced exports of canola, coarse grains, and wheat, and an increased domestic demand for grain.

“These declines will be offset by a rise in export earnings for lamb, mutton, rice, cotton and cheese, due to strong global demand resulting from an increase in global economic growth.”

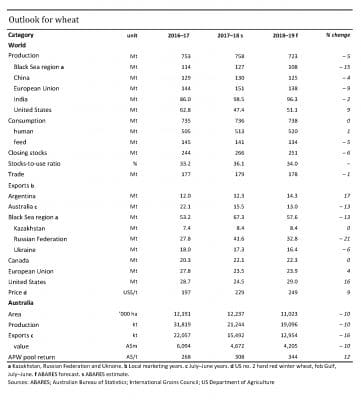

Wheat

- Argentina, Canada, the US and North Africa are expected to jointly produce 7 million tonnes (Mt) more wheat than they did in 2017-18.

- Australia, China, India and Ukraine will jointly produce 10Mt less wheat in this year than the previous.

- Production drops over 2018-19 of 14Mt for the EU, and 17Mt for Russia, will have the biggest tightening effect on world wheat stocks.

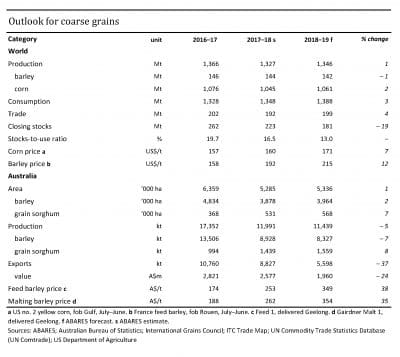

Coarse grains

- A dry winter in Queensland, NSW and parts of Victoria has caused a drop in Australian barley and oat production;

- Prospects for the 2018-19 sorghum crop have been constrained by forecasts of continued dry conditions;

- Globally, hot and dry conditions in Australia, the EU and Russia are forecast to result in increased use of corn as a substitute for reduced supplies of wheat and barley

Oilseeds

- Australian canola exports are expected to drop by a greater percentage than production in response to increased domestic demand in eastern states for canola meal to satisfy protein demands.

- Argentine soy oil is expected to provide increased competition for canola in the EU, which is a big user of Australian seed.

- The China-US trade dispute and climbing prices for soybeans are forecast to bolster China’s interest in importing canola.

Cotton

- Ex-gin cotton returns to Australian growers are forecast to reach $656 per bale in 2018-19, down $2 from the previous June forecast;

- Rising world demand and populations are boosting demand for cotton;

- China is importing high-quality cotton to complement its government’s release of lower-quality stocks.

Source: ABARES

The full analysis can be found at agriculture.gov.au/ag-commodities-report.

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY