THE US Government’s shutdown of non-essential services has had the global grain market holding its breath ahead of the February World Agricultural Supply and Demand Estimates (WASDE) report.

Released by the USDA on Friday, the figures filled the gap left by the absence of the January monthly report, and were met in some trade circles, perhaps unfairly, with a yawn.

No wheat surprises

USDA lifted its world 2018-19 wheat production estimate to 735 million tonnes (Mt) in February from the December estimate of 733Mt, mostly on account of Russia’s already well-publicised yield improvement in its wheat crop just harvested.

Consumption, international trade and stock estimates were tweaked accordingly, taking into account a greater volume of exports from Russia, Paraguay, Pakistan and Brazil balancing Australia’s shortfall this year.

China’s 2018-19 wheat imports estimate was cut to 3.5Mt, 500,000t below USDA’s December estimate, but China’s consumption of wheat was seen as 2Mt higher at 125Mt, indicative of greater usage of local production.

Trade commentators noted that significant cuts to US wheat planted area estimates were expected. Soft Red Winter wheat plantings in 2019 were forecast 7 per cent (pc) lower than previous year; US winter wheat planted area in 2019 aggregate was forecast 4pc lower than 2018, including the wheat classes, Hard Red, Soft Red and White.

Wheat futures markets barely shifted on Friday after the 11am US central time release of the reports.

US Soft Red Winter (SRW) wheat remained the cheapest wheat in the world and price-wise it still calculated into virtually all destinations.

Barley tightens

Drought, and the high internal grain prices it has supported, deposed Australia from its position as the world’s biggest exporter of barley.

With 9Mt shipped in 2016 and 6Mt in 2017, Australia had been the biggest global supplier of barley in recent years, with the EU in second place at a little under 6Mt in both years.

USDA trimmed world barley exports to 27Mt in its February estimate, the top seven exporters being the EU on 5.3Mt, Australia on 5Mt, Russia on 4.7Mt, Ukraine on 4.2Mt, Argentina on 3.1Mt, Canada and 2.2Mt, and Kazakhstan on 2Mt.

A substantial cut in China’s 2018/19 barley imports, 8Mt in the February estimates compared with 9.2Mt in the December, was partially offset by higher import projections for Saudi Arabia, 8.5Mt compared with 8Mt in December estimate.

Turkey’s import projection was lifted to 300,000t from 100,000t and UAE to 500,000t from 400,000t.

Soybean knock-on effects

Brazil’s soybean stocks were heavy reduced following its record export year in 2017/18, and its smaller crop this year would have a knock-on to export availability this year and next.

USDA said soybean exports from Brazil in 2017/18 had been a record 84.2Mt in local marketing year February/January, 15.4Mt above the previous record volume of 68.8Mt recorded in 2016/17. This had reduced carryout stocks to 1.2 million tons and would cut 2018/19 exports to 70Mt.

World oilseed production was forecast 593Mt, of which soybeans comprised 361Mt. USDA’s December estimates had been 600Mt and 369Mt respectively, the decline mainly attributable to Brazil’s 2018/19 soybean crop being cut by 5Mt from 122Mt to 117Mt.

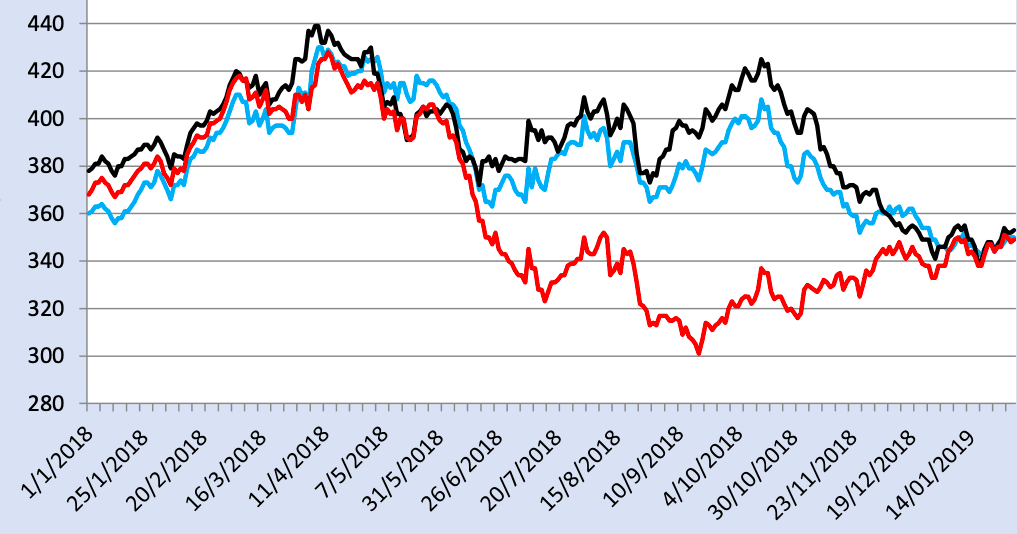

Soybean export prices US$/t free on board. The divergence occurring from end-May 2018 reflects trade-war discounts applied to US soybeans for export. Red line, US Gulf, blue line, Argentina up-river, black line, Brazil Paranagua. Source: USDA.

Cotton up

USDA forecast world cotton production in 2018/19 slightly higher in its February estimates, 118 million bales (Mba), on increased output in China, Brazil and Australia, 27.5Mba, 11.4Mba and 2.6Mba more than offsetting cuts in Turkey (4.3Mba down to 3.7Mba) and India (27.5Mba down to 27Mba). See separate Grain Central story link here today.

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY