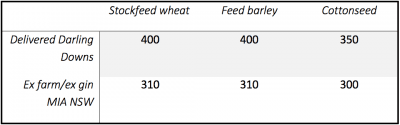

Table 1: Indicative market values this past week for feedgrain trade quantities even spread over delivery period June/July/August, A$/t.

NOTHING cures high prices like high prices, this week cooled a little by rain scattered in parts of eastern Australia’s winter-crop belt.

Cottonseed backed off a little

Heavy offtake of cottonseed from gins appears to have the grazier category of consumers satisfied for the moment, chewing through the truckloads they’ve brought home and tipped on to pads as they wait for rain to ease their pain.

White cottonseed has been unusually cheap this year when compared with grain, the apparent surplus in 2018 this week has trimmed around $5 per tonne from offers delivered to southern Queensland’s Darling Downs, trading at $350/t this week.

However, it will continue to supplement whatever dry feed is left in paddocks, as well as supplying energy, fibre and protein into ruminant least-cost ration formulations.

Wheat, barley toppy

Capped, too, are wheat and barley prices on to the Darling Downs. Traders said wheat and barley offers delivered Downs were nominally back about $5/t over this week, as $400/t plus carry would still buy wheat for June onwards.

Barley was quoted at values equivalent to wheat.

Traders said grain growers, gloomy about the poor seasonal outlook, have pretty much shut the contract book.

Current-crop grain prices have increased, in steps and jumps, since late 2017 by roughly $50-$90/t in eastern states.

One southern Queensland trader said it was virtually impossible to extract grain from growers for less than $400/t ex farm, even though it was available from the trade at the same money delivered.

Shipments from Western Australia, South Australia and Victoria of top-end barley and wheat for human consumption have given feedgrain a leg-up into the southeast Queensland market.

A trader said sellers were offering boat wheat ex Brisbane at $390/t free on truck.

Regardless of international factors which will inflate or depress ocean-freighted wheat prices, southern Queensland prices are expected to hold at a premium of at least A$100/t to equivalent grades in export zones in southern Australia while dry conditions grip New South Wales.

Cottonseed export trade not looking promising

In recent years, China’s burgeoning demand for oilseeds has fuelled demand for white cottonseed from Australia, which has been popular among crushers in China for oil and meal, and among various commodities consumed in southern China’s growing dairy industry.

China is not looking like a strong prospect for Australian cottonseed exports over the coming months because the window to ship in volume to China is limited. Not only would Australia’s key shipping period May to August be switched off by China’s own cotton supply becoming available, but also other origin new-crop seed including US would compete hard in the months following.

One trader said licences for volumes of China’s imports of Australian seed have not been issued, and if Australia were to lose that opportunity to shift even 50,000t a month into China, the export-clearance of tonnage couldn’t be made up later, and the opportunity foregone would end up being stockpiled in country NSW and Queensland.

The DCT (delivered container terminal) Melbourne market, a proxy for the activity in nearby-month export trade, reported no demand from China this week. It was quoted weaker, nominally bid and offered either side of A$370/t.

Nor were sales of cottonseed from Australia to the US west coast, feeding the dairy cow market in California, expected to emerge any time soon.

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY