La Niña has impacted Argentina’s wheat yields, and is clouding prospects for its summer crops now being planted in regions including Cordoba. Photo: Farmers No Borders

WEATHER woes afflicting Argentina’s cropping regions this year have been extensive and look set to worsen in December, with the La Niña phenomenon running at its strongest level in almost a decade. Many areas of Argentina have been in a moisture deficit since March, and the spring rains have been very sporadic, seriously impacting winter-crop production and the summer-crop planting program.

There has been a troubling trend across Argentina this year that is very familiar to Australian farmers. The weather forecasts have not been matching reality, the expected rain has not been turning up for the dance, and the dryer-than-normal pattern is expected to slow the Argentine summer-crop planting program.

The Buenos Aires Grain Exchange (BAGE) reported soybean-planting progress jumped in the week to 19 November, propelled by scattered rains that brought light relief to key drought-hit regions. BAGE estimates that 28.8 per cent of a total projected soybean area of 17.2 million hectares (Mha) has been sown thus far, up from 19.9pc planted a week earlier, but still 2.5 percentage points behind last year’s pace.

Conversely, the seeding of this season’s corn crop has stalled, due to both the extremely dry seedbed and a reluctance to plant during November to avoid flowering in the peak of summer. Moisture permitting, seeding will resume in earnest in December, with the total planted area forecast to reach 6.3Mha this season, down from 6.5Mha in 2019-20.

However, many parts of the country remain woefully dry, and it is believed that some of the early sown row-crop fields in the driest regions will have to be replanted when soil-moisture levels improve sufficiently.

BAGE called the corn crop 31.4pc planted as of 19 November. This was virtually unchanged from 31.2pc a week earlier but well behind last year’s pace of 46pc. The corn area planted to date is rated 10pc poor, 55pc fair, and 35pc good to excellent, but a moisture top-up is urgently required.

Corn vs soybeans

The first phase of corn planting in Argentina typically sees around 45-50pc of the crop planted by early November. With less than one third of the crop now in the ground, what will farmers do come December? Will they continue with their original corn-area intentions and plant more of the lower-yielding late crop? Or will they swing some corn area across to soybeans?

It seems several local analysts are expecting the latter, which places a downward bias on corn production estimates and an upward bias on soybean production estimates, assuming the planting rains arrive in time to complete the seeding campaign. However, corn does have a later planting window than soybeans, so if November and December remain dry, and wide-scale planting doesn’t resume until January, it could easily swing the other way.

In terms of production estimates, the United States Department of Agriculture pegged the Argentinian soybean and corn crops at 51 and 50 million tonnes (Mt) respectively. The BAGE estimates are a little more conservative, currently running at 47Mt for soybeans and 46.5Mt for corn.

Wheat yields poor

Meanwhile, the winter-crop harvest is progressing slowly, and early yields are abysmal as a result of the extremely dry growing season, particularly in the northern provinces.

As of Thursday last week, 19.8pc of the forecast wheat area had been harvested, up from 15.5pc a week earlier. The yields improved slightly week on week from an average of 1t/ha to 1.2t/ha.

However, with a planted area of 6.5Mha, there needs to be a dramatic recovery in yields if final production is going to get remotely close to the BAGE production estimate of 16.8Mt, let alone the USDA’s 18Mt forecast. In fact, the balance of the harvest will need to average almost 3t/ha just to make the BAGE number.

However, with a planted area of 6.5Mha, there needs to be a dramatic recovery in yields if final production is going to get remotely close to the BAGE production estimate of 16.8Mt, let alone the USDA’s 18Mt forecast. In fact, the balance of the harvest will need to average almost 3t/ha just to make the BAGE number.

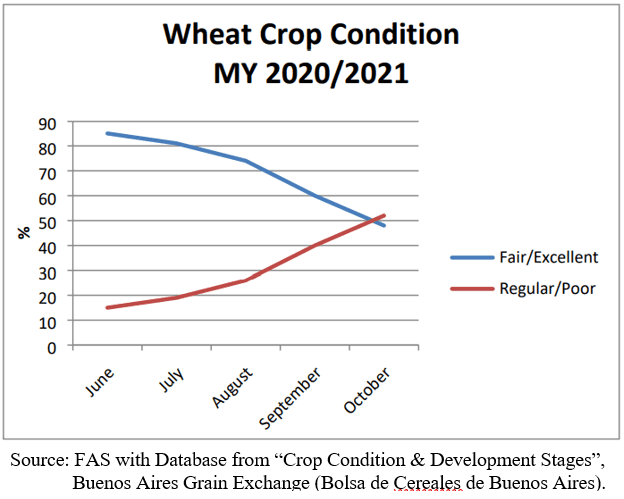

The wheat crop is currently rated at 17pc good to excellent, 40pc fair and 43p poor to very poor. The deteriorating state of the crop throughout the growing season is clearly evident in the ‘Wheat Crop Condition’ graphic (right).

Barley fares better

The Argentine barley crop has largely escaped the effects of the drought as it is mainly planted in Buenos Aires province and the eastern reaches of La Pampa province. Soil-moisture levels have been quite favourable during the season which may well lead to higher-than-average yields if the kind conditions continue through to harvest. Smaller production areas further north in Cordoba and Santa Fe provinces are, like the wheat, in generally poor condition.

The BAGE is calling barley production 3.7Mt, slightly higher than the latest USDA number of 3.5Mt. This is down from 3.8Mt last year, but that output was off a significantly higher planted area.

A smaller wheat crop means export offerings out of Argentina will be vastly reduced in the 2020-21 season, and at current prices, it is hard to see the Republic finding much demand outside the Mercosur region. China is reported to have been purchasing barley of different qualities, including FAQ (fair average quality) which is used for malting. But other than China, barley export sales outside Mercosur block members will also be minimal.

Argentina has been a persistent seller into Asian markets in recent years, in the search for new demand for its burgeoning exportable surpluses. But the smaller crop and higher prices virtually eliminate them as a competitor in the 2020-21 marketing season. That leaves Australia as the sole aggressive seller into Asia at the moment.

Grain Central: Get our free cropping news straight to your inbox – Click here

HAVE YOUR SAY