THE LATEST monthly World Agricultural Supply and Demand Estimates (WASDE) report from USDA released overnight unsurprisingly made few changes to global, and US, wheat figures.

But corn is the big story in US grain markets, and USDA gave a bearish measure to USDA’s October estimates interpretation of corn supply and demand.

CME corn futures prices reacted with a 3-per-cent drop.

The further confounding factor was last month’s accounting adjustment downwards of previous year stock, now washing through subsequent data.

Rabobank’s commentary on the report said corn has been “continually disappointed” by the USDA’s view on the varied and delayed 2019/20 crop.

“However, the overt focus on supply misses the larger picture of declining demand,” Rabobank said, noting that USDA has cut US 2019/20 demand for a third consecutive month to a level now seen down 3.3pc year-on-year.

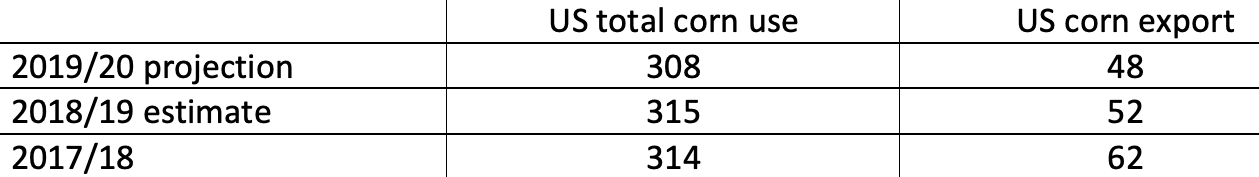

Exports in particular could see further cuts on strong global competitiveness(see table 1).

“Looking ahead, there remain important demand questions for corn: weakened feed demand growth, the US-China trade war, weak ethanol, and record production in major exporting countries of Brazil, Argentina and Ukraine.

“US production declines are helping offset demand-burdened stocks, but unless a trade resolution can address years of overproduction in the US, CBOT will have limited upside and the US Farmer will have few planting options.”

Corn in perspective

US domestic corn consumption is almost 10 times that of US wheat, and its feed use is 100 times that of US feed-wheat use.

The October WASDE report has put US domestic corn use at 308Mt, with the feed component of corn use raised 4Mt to 135Mt, and exports lowered a similar amount to 48Mt.

Table1: US corn exports and total domestic use have been shrinking (million tonnes).

Wheat steady

The WASDE reports wheat numbers held no surprises because, barring pestilence, the northern-hemisphere wheat crop is practically in the bin now, and harvest of the southern-hemisphere crop has started.

USDA lifted its world wheat-stocks projection at the end of the 2019/20 marketing year by less than 0.5pc to around 287Mt.

It left world production unchanged at 765Mt, and cuts this month in Australia and Canada offset an equivalent increase in the EU.

Likewise, all other parameters of world opening stock, trade and usage were practically unchanged this month compared with last month.

The US wheat domestic feed use estimate was cut 800,000t to 3.8Mt, still above the 2.4Mt it estimated last year.

US wheat exports were trimmed 600,000t to 25.9Mt, though not much different from the previous figure of 25.5Mt.

Source: USDA, Rabobank

HAVE YOUR SAY