THIS MONTH’S rain has not weakened generally strong prices for current and new-crop grain sales.

Its impact appears to be limited to taking the peak off some feed markets, with one trader saying the Newcastle track market for sorghum had peaked March 10 at $250 per tonne.

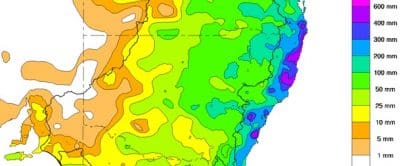

Map showing rain between 1st and 22nd March 2017 in New South Wales and southern Queensland; a major turnaround from the drier-than-average summer. Source BOM

Growers had sold a lot of harvest-time grain and today’s stock-holders feel like they are in a strong position when it comes to marketing balances of current-crop grain.

Lachstock Consulting’s Lachlan Hume said growers have largely sold their warehoused stock.

“It’s estimated that the grower is 75 per cent sold of warehouse stock in Eastern Australia,” he said.

“The slowdown in sales is leading to buyers having to pay better money to draw out stock in good sites to utilise their fixed rail and port assets.”

One trader in southern NSW said ideally placed sites which suited a particular consumer, packer or exporter, were attracting wheat bids which were up about A$30/t since harvest time.

The APW1/ASW1 spreads caused by the high-grain-yield-low-N harvest across Australia presented particular trading opportunity this year.

A number of factors had encouraged growers not to quit on-farm stocks at prices that were still below their targets.

That included a healthy cashflow situation for growers in the wake of a big-yielding winter-crop harvest, a feeling of extreme uncertainty about the seasonal outlook, and buoyant export and domestic demand.

Feed barley prices had increased by as much as A$40/t since harvest, and demand from local feedlots helped to keep barley values trending up.

Views from the north

Traders in northern NSW said on-farm sellers were typically letting small parcels on to the market.

This limited release confirmed that rises in prices for feedgrains and milling grades of wheat, though significant, were still not sufficiently attractive to growers to cash their entire balances of farm stock, instead chipping away as determined by finance, storage, logistics and quality.

Chickpeas bids from northern NSW packers had been strong — A$850/t delivered Narrabri, clean basis — but supplies with a noticeable presence of impurities such as weed seeds may were attracting a grading discount.

Prime Hard (APH2) wheat bids ex farm had been holding strong into the export container and domestic markets.

Values into southern Queensland feedlots had risen around $25/t after the winter-crop harvest on the back of failing prospects for sorghum; prices in NSW took longer to react, but had now risen by a similar amount.

HAVE YOUR SAY