CHINA has been an outlier when it comes to how it reports its cotton supply and import volumes, according to the United States Department of Agriculture’s (USDA) latest cotton market outlook.

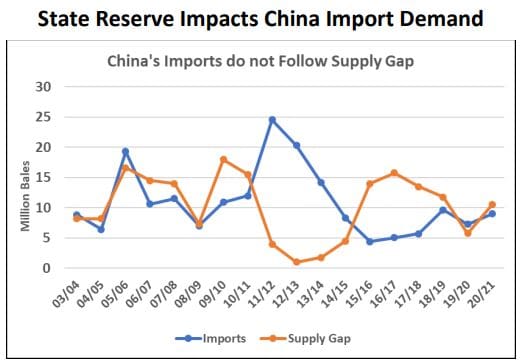

For most cotton spinning countries, import demand is largely driven by the supply gap between production and consumption.

But, the USDA says China’s trade has shown little correlation between its imports and its supply gap over the last decade; for example, 2011/12 imports doubled and reached nearly 25 million bales (Mb) while the supply gap fell by 75 per cent to 4Mb.

But, the USDA says China’s trade has shown little correlation between its imports and its supply gap over the last decade; for example, 2011/12 imports doubled and reached nearly 25 million bales (Mb) while the supply gap fell by 75 per cent to 4Mb.

The disconnect between the supply gap and import volume was due to the fluctuations the level of China’s State Reserve (SR) – the SR absorbs surplus domestic cotton to keep internal prices from falling too low, and also purchases foreign cotton at times.

The SR also supplies the domestic market if prices and supplies outside of China are such that internal prices rise too high relative to world prices.

Since China’s accession to the WTO in 2001, the SR has bought or sold nearly 200Mb of cotton; SR holdings have changed by up to nearly 20Mb in a single year.

The USDA says the reasons for SR activity have been both external and internal – external being the global price shocks of 2008 and 2010, while the policy of shifting production to Xinjiang served internal purposes.

Year-to-year SR activity has had a major impact on China’s imports, as some years cotton released from the reserve reduced demand for imported cotton and in other years purchases bolstered import demand.

Anticipating the level of SR activity is important in predicting China’s import demand.

Rotation strategy

Following annual auctions of the world’s largest cotton reserves in the years starting after 2013/14, the USDA now estimates that China’s State Reserve has reached the government’s preferred level.

Nearly 10Mb are estimated to remain – a level consistent with the government’s objectives and down from nearly 60Mb in March 2014.

The USDA predicts a strategy of rotation going forward and minimal net changes in stock levels, with the State Reserve auctioning old-crop and replacing with both new-crop domestic cotton and imports.

This would imply that for the first time in over a decade that import demand in China will largely be based on the supply gap.

COVID-19 has sharply reduced China’s spinning activity and therefore import demand in 2019/20 and to some extent into 2020/21.

Recovery from COVID-19 impacts

Looking ahead, the USDA expects demand to recover from the COVID-19 impacts. Production in China’s inland areas is likely to continue its decline, while area expansion in Xinjiang is limited and the USDA Baseline forecasts total production to grow modestly.

If China’s consumption increases at or near the expected global rate of growth, then import demand will still witness steady growth, albeit somewhat limited.

Global overview

For world cotton production in 2020/21, the USDA’s July forecast shows lower production and ending stocks.

Production is lowered for the United States, Turkey, and Tanzania, more than offsetting a small rise in Pakistan.

Consumption is lowered only 100,000 bales, and global trade is mostly unchanged.

For 2019/20, the July forecast shows slightly higher ending stocks due to lower consumption. The US forecast shows higher exports and the US season-average farm price is unchanged at 59 cents per pound.

Source: USDA

HAVE YOUR SAY