A DISTINCT divide has emerged in confidence levels among Australia’s farmers, with those in the west and south of the country increasingly upbeat, while sentiment has waned considerably in the drought-affected eastern states, according to the latest Rabobank Rural Confidence Survey.

And the divide was particularly evident in the country’s grains sector, the survey showed, with some of Victoria’s grain-growing regions – including the Wimmera – having the potential for one of their best seasons on record, while confidence among Western Australian growers also found higher ground following good June rains.

However, sentiment was down sharply among grain growers in New South Wales and Queensland, where prospects for the summer crop ahead are also poor.

It was the dairy sector, however, which saw the most dramatic turnaround in confidence this quarter to now outstrip the other surveyed commodity sectors.

This uplift was largely driven by dairy producers in southern Victoria and Tasmania, who also reported overall strong profit projections and investment plans for the year ahead.

Rabobank Australia chief executive officer, Peter Knoblanche, said the latest farmer confidence survey revealed just how contrasting seasonal conditions were across the country, as the drought tightened its grip in New South Wales and southern Queensland, while conditions were comparatively favourable across much of Victoria, Tasmania and Western Australia.

“With no alleviation to drought conditions over winter in eastern Australia, it remains extremely challenging as farmers continue to feed stock at a high cost and prospects for the summer grain crop and cotton are looking bleak, unless good rains fall in the coming weeks,” he said.

Mr Knoblanche said while farmers knew the rains would come, it would take time to rebuild from this drought – particularly in those regions affected for such a long period.

“While the strength of commodity markets, low interest rates and the weaker Australian dollar will aid with that recovery, it is only rain that can materially change the outlook,” he said.

“And we saw this in WA, with good June rains driving a turnaround in farmer sentiment as it effectively put to an end the exceedingly dry conditions prevailing earlier in the year.”

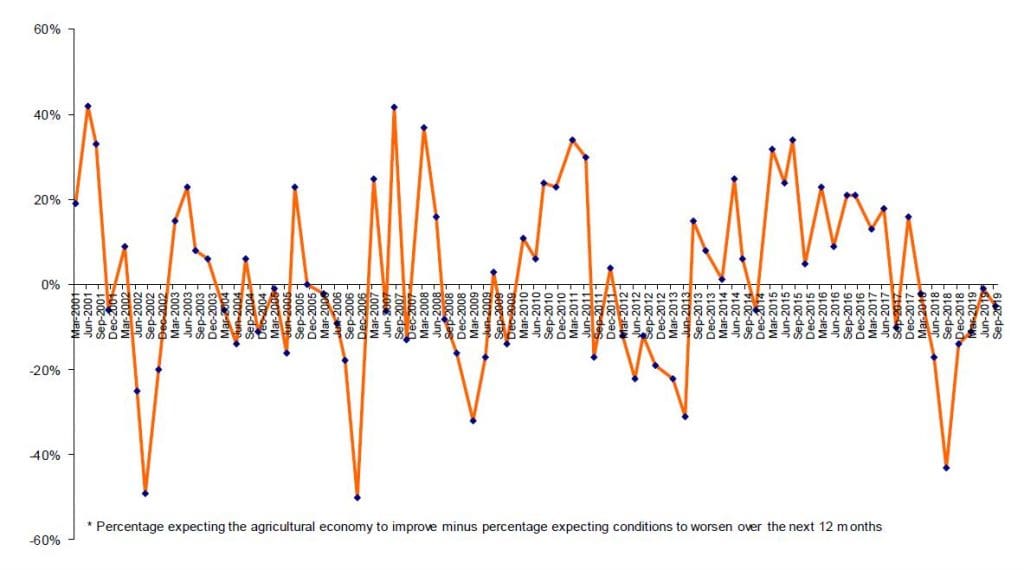

Despite the marked variance in sentiment across geographical regions and commodity sectors, the overall Rural Confidence Index remained relatively steady at a net -5 per cent, from -1pc in the June survey.

Nationally, the percentage of Australian farmers feeling positive about the outlook for the agricultural economy in the coming 12 months eased back slightly to 25pc, from 27pc in the previous quarter.

The number of farmers with a pessimistic outlook rose slightly to 30pc, from 28pc previously. And those expecting little change in current conditions stood at 35pc.

Drought remained the key driver of negative sentiment, cited by 86pc (up from 73pc) as the main reason conditions were likely to worsen. It was a particular concern in New South Wales, with almost all (97pc) of those with a pessimistic outlook blaming the season.

On the flipside, the season was considered a positive driver for 58pc of those Australian farmers with an optimistic outlook on the coming 12 months.

Commodity prices were also deemed a positive factor by 50pc expecting conditions to improve, up from 38pc previously.

State by state

With the season front of mind, confidence lifted strongly in WA, Victoria, South Australia and Tasmania, but it was NSW that took the biggest knock – with two-in-five farmers expecting conditions to worsen further. Sentiment also waned in Queensland, from already subdued levels.

Mr Knoblanche said with 95pc of NSW and 65pc of Queensland remaining drought declared, the season was weighing significantly on the rural outlook.

In contrast, Mr Knoblanche said, sentiment was found to be particularly strong in Victoria and Tasmania, with the state’s dairy producers behind much of the upswing.

“Victoria’s grain growers also retained their upbeat outlook on the year ahead, as their crops shape up to be the best in the nation,” he said.

In WA, the June rains had gone a long way in turning around the outlook, but a soft spring finish would be needed to shore up yields, with concerns now focussed on an unseasonably hot start to spring in the state.

“This is also the case in SA, as subsoil moisture levels haven’t recovered from the significantly dry start to the season,” he said.

“But that said, rain received in June and early July has alleviated some of the uncertainty growers were feeling as they entered the season.”

Sector by sector

Across commodity sectors, dairy staged the biggest turnaround in sentiment, with net confidence lifting to 22pc, from just -1pc in the June quarter.

Confidence in dairy is now outstripping the other sectors, Mr Knoblanche said, with sentiment remaining relatively stable in beef, and easing in grain and sheep – albeit to remain at much higher levels than cotton and sugar.

“While confidence picked up strongly in dairy, it is a tale of two halves, with those in the southern dairy regions much more positive than those relying on bought-in water and feed, the cost of which is outweighing the improvement in milk prices,” he said.

This was evident in the survey results, he said, with close to two thirds of dairy farmers in Victoria and Tasmania expecting to generate a higher gross farm income from their farm business in the 2019/20 financial year.

In the grains sector, Mr Knoblanche said, confidence was also disparate, with grain growers in Victoria much more positive than their counterparts in other parts of the country.

“Despite good prospects for much of the Victorian crop, the poor start to the season – across most of the country – has curtailed the potential of the nation’s wheat crop to around 18 million tonnes,” he said.

“Even WA, which received a reprieve with the June rains, is looking at a wheat crop that could be down by more than 26pc, according to recent forecasts released by the Grains Industry of WA.”

Mr Knoblanche said sentiment remained low in the cotton sector, with 60pc of surveyed producers expecting conditions to further deteriorate.

“As the prospect of low-to-zero water allocations looms large, many growers will be hard pushed to plant a 2019/20 crop, with talk of next year’s crop being below one million bales,” he said.

In contrast to other commodity sectors, where seasonal conditions were the main driver of confidence, Mr Knoblanche said it was the market outlook that was supressing confidence in the sugar sector.

“Sugar prices have been fairly stubborn at $375/tonne as they remain under pressure from Thai and Indian sugar oversupply,” he said.

“However, some of these pressures are expected to ease in the coming months, with prices forecast to edge up close to $430/tonne in the first quarter of 2020.”

In the beef and sheep sectors, Mr Knoblanche said, confidence was divided across the country with graziers comparatively upbeat in WA, SA and Tasmania – while it fell back in NSW and Queensland.

“From a market perspective, young cattle and cow prices – while dipping in recent weeks – continue to be supported by limited supplies on the market,” he said. “And sheep and lamb prices are at strong levels for this time of the season.”

Mr Knoblanche said there was some real concern emerging among sheep producers, however, with the sharp drop off in wool prices.

“While many didn’t expect wool prices to remain at historical highs, it is how sharply the market has fallen, and how the market will continue to react to developments in the US-China trade war, that has graziers worried,” he said.

Farm business performance and investment

This quarter, the survey found overall the nation’s farmers retained relatively strong on-farm investment intentions, with two-thirds of those surveyed (66pc) looking to maintain their current level of farm business investment throughout the coming 12 months, while a further 17pc were intending to up their investment.

Farmers in Tasmania and Western Australia had a particularly strong investment appetite, with 26pc and 22pc of farmers respectively looking to increase their investment over the coming year. Meanwhile investment activity looks to be winding back in New South Wales, with 24pc planning to reduce their investment over the next 12 months.

In line with overall confidence levels, there was little change in farmers’ expectations for their gross farm incomes in the 2019/20 financial year.

A total of 24pc of surveyed farmers are expecting an improvement in gross farm incomes (same reading as last quarter), while the percentage expecting a weaker financial result increased slightly to 34pc (from 32pc).

A total of 38pc expect a similar income to that generated in the 2018/19 financial year.

Income projections varied across commodity sectors however, with 53pc of dairy farmers expecting a better financial performance for their business in the coming 12 months (up from 39pc), while 64pc of those in the cotton sector expected a decline (up from 59pc).

Source: Rabobank

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY