THE FIRST full set of grain supply and demand projections for the 2019/20 crop year sees a further closing-stock drawdown at the end of 2019/20 entirely attributed to three consecutive years of maize production falling and consumption increasing, according to International Grains Council (IGC) estimates published today.

IGC said the anticipated rise in total grains production in 2019/20 would only just compensate for smaller beginning stocks and assumed a solid increase in global consumption would leave total grains ending stocks reduced to 575 million tonnes (Mt) from 604Mt current year, 648Mt ending 2017/18 and 659Mt year ending 2016/17.

Wheat area higher Australia, EU and Black Sea region

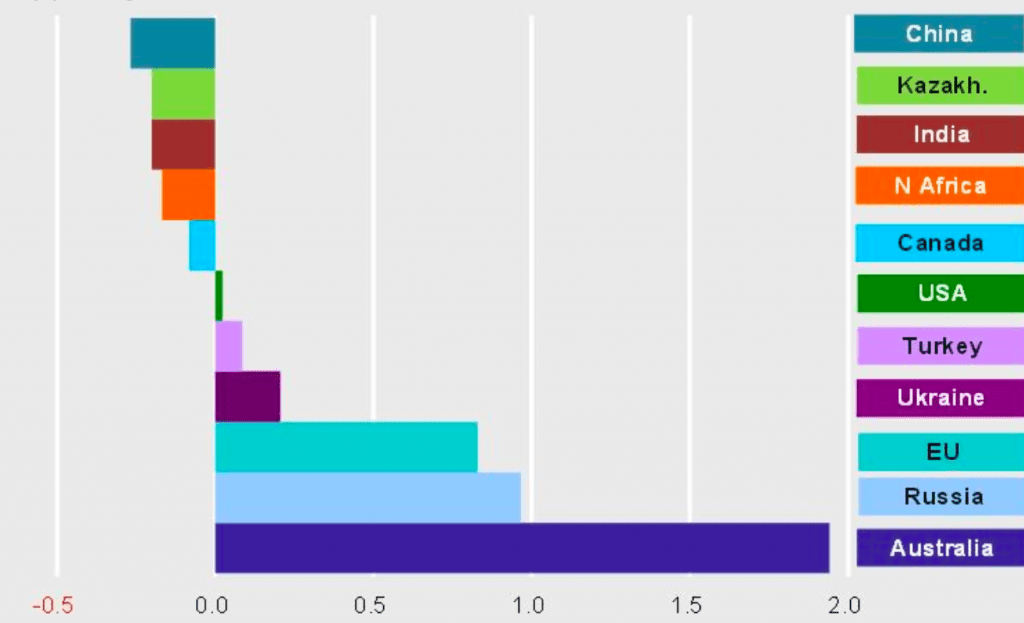

Australia is expected to lead this year’s recovery in wheat harvested area (Chart 1) followed by Russia, Eurpoean Union, Ukraine, Turkey and the United States, the world total harvest wheat area predicted the highest in three years reaching 220 million hectares.

Combined with a small lift in yields, 2019/20 world wheat production is forecast 759Mt, compared with 735Mt current year, 763Mt in the 2017/18 and 757Mt in the 2016/7 crop years.

Wheat ending stocks in 2019/20 are forecast to rise to 270Mt from 264Mt current year.

Chart 1: Change in harvested wheat area 2019/20 compared with 2018/19, million hectares. Source: IGC

Feed barley consumption to rebound

Barley in 2018/19 suffered lower-than-average planted area and yield, which cut production and further tightened world stock to a 23-year low at end 2018/19.

Tight supplies and comparatively high prices could underpin a turnaround in plantings, the world barley crop in 2019/20 projected to rise 5pc to 148.8Mt.

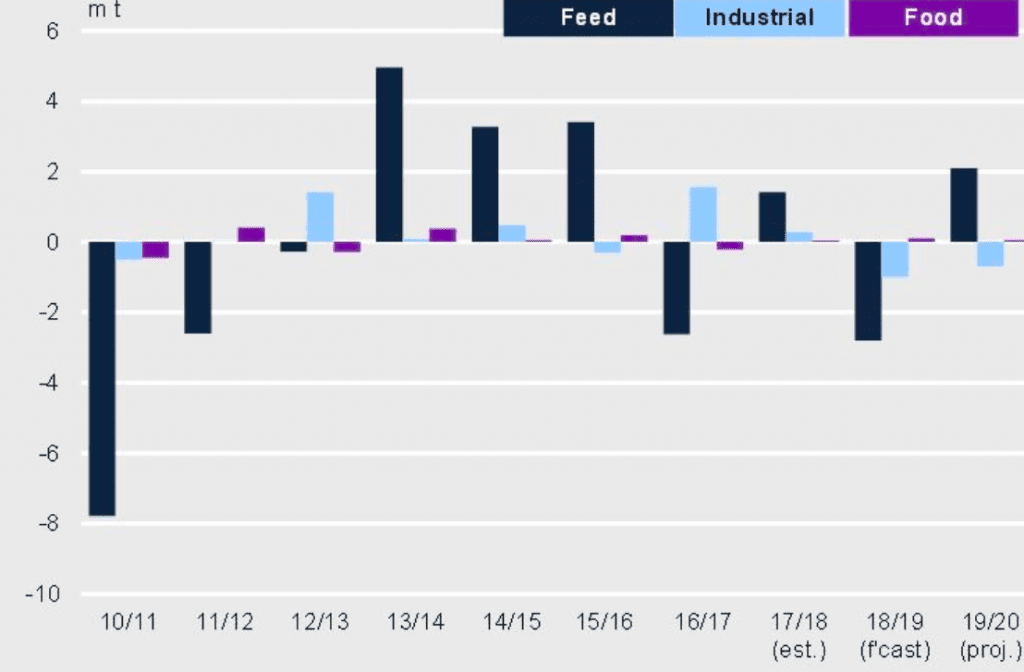

The expanded production of barley is projected to encourage an uptick in feed use (Chart 2)

World barley stock was projected to recover slightly to 24.6Mt at the end of 2019/20, compared with 22.9Mt current year. Note, the 22.9Mt current year closing stock in the March report was raised from 21.2Mt in the February report. Current year barley stocks are at a 23-year low.

Chart 2: Showing feed barley usage (dark blue) is projected to increase in 2019/20 in this graphic of annual changes in world barley consumption, million tonnes. Source: IGC

Maize stock drawdown most significant in China

Easily the greatest influence on global grains supply/demand is maize. Production and consumption have been trending up globally though the figures in China have been diverging. China’s consumption has been rising apparently steadily, while production in the past few years has flat-lined, leading to lower stocks.

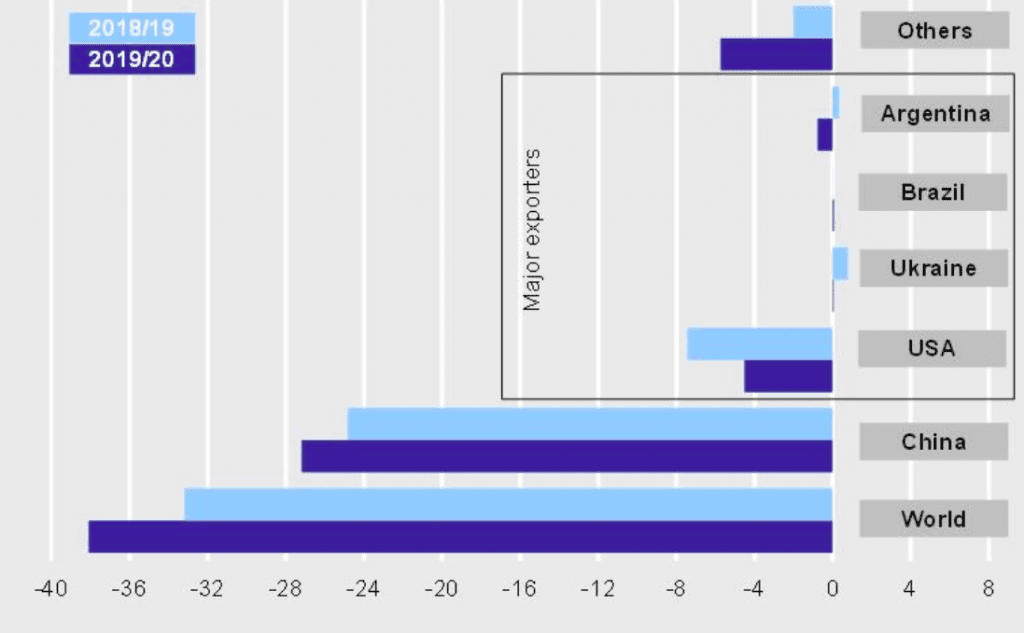

It is expected to contribute more than two-thirds to 2019/20 global maize stock falling 13pc year-on-year to 266Mt, potentially a seven-year low. Stock changes among major exporters, though locally significant, are dwarfed (Chart 3).

Chart 3: Change in maize ending stocks. For the second year China, and world, ending stock has fallen. Million tonnes Source: IGC

Current year balance sheets improved and prices fell

As the 2018/19 year draws to a close, IGC March report noted price indices mostly had fallen a few percent from the previous month and end-of-year bookkeeping on key parameters, production (up from previous month), consumption (down from previous month) had left global grains balance sheets in a more comfortable transition to the new crop year 2019/20.

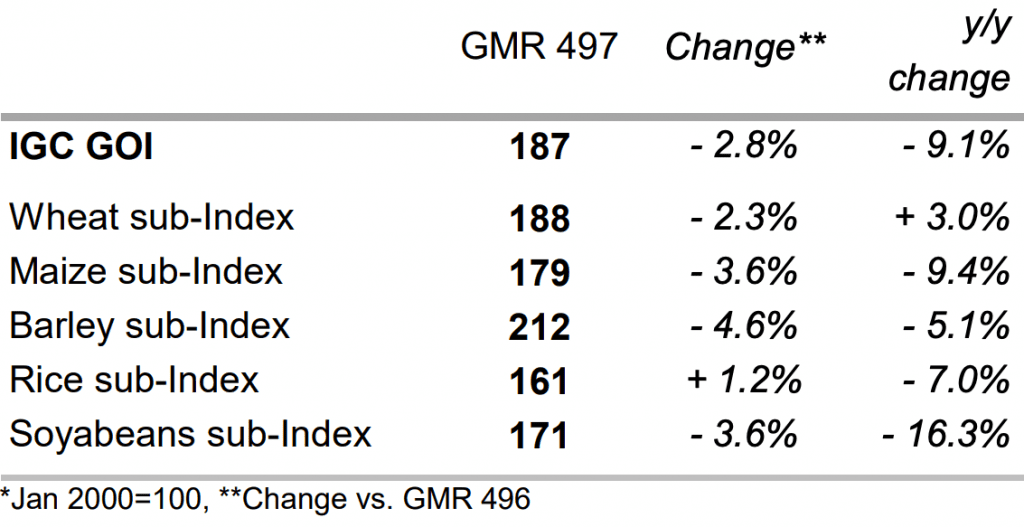

Consequently, IGC price indices for wheat, maize, barley, rice and soybeans were mostly lower, led by declines for maize, barley and soybeans. Rice was the only price index to rise month-on-month, so with average wheat prices also a little lower, the IGC grains and oilseeds (GOI) price index fell by 3pc this month, and was 9pc lower year-on-year (Chart 4).

Source: IGC

Read the precis report here, or purchase the full report here

HAVE YOUR SAY