HOTTER and drier-than-average weather led to reduced water availability and higher prices for tradeable water products in 2017–18, placing pressure on water users in the Murray–Darling Basin, according to the Australian Competition and Consumer Commission’s (ACCC) ninth annual Water Monitoring Report.

Despite this, the ACCC found that 2017–18 was a relatively stable year for major water infrastructure operators, with relatively minor changes in hypothetical (or average) bills for irrigators in the majority of networks.

Despite this, the ACCC found that 2017–18 was a relatively stable year for major water infrastructure operators, with relatively minor changes in hypothetical (or average) bills for irrigators in the majority of networks.

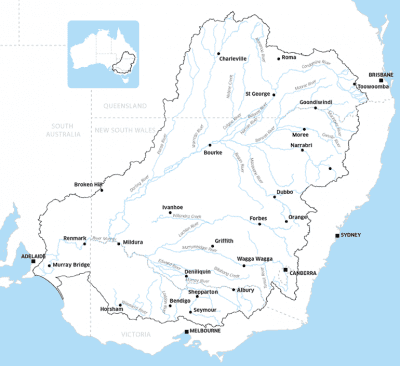

The ACCC is required under the Water Act 2007 to monitor regulated water charges, transformations and terminations, and compliance with the water charge and water market rules by monopoly water infrastructure operators that service water users including irrigators in the Murray–Darling Basin (MDB).

Most hypothetical bills calculated by the ACCC for Basin water infrastructure operators did not change much from 2016–17. Overall, on-river hypothetical bills rose slightly above the rate of inflation, while off-river bills rose by an average of about 5 per cent in pressurised networks and 1pc in gravity fed networks (both in nominal terms).

The report found that, within water infrastructure operators’ networks, the volume of water delivery rights traded increased by 10pc during the year, partly due to large trades within the Murrumbidgee Irrigation and Jemalong networks, while trade of temporary allocations of water rights declined by 20pc.

“Water markets in the Murray–Darling Basin have developed significantly since 2007, and despite variation in trade volumes between years, we are seeing water users access markets to manage risk in a variety of ways,” ACCC deputy chair Mick Keogh said.

Irrigators and other water holders used water ‘carried over’ from previous years, helping to offset lower water allocations during 2017-18.

As a result, water infrastructure operators increased the total water delivered to water users during the financial year, by 18pc for off-river infrastructure operators, and by 9pc for on-river infrastructure operators.

“Carryover and water markets more generally are aimed at helping water market participants to manage water risk year-to-year, and this is what we saw happening during 2017–18,” Mr Keogh said.

Prices for tradeable water products rose significantly, with the southern connected MDB experiencing record prices for most water entitlement types in 2017–18, underpinned by strong commodity prices and expanded growing area for crops in the Murrumbidgee and Murray regions.

“However, the ACCC continues to have some broad concerns over the reliability of publicly available water trading data,” Mr Keogh said.

The report found that while the number of applications for ‘transformation’ of irrigation rights into water access entitlements increased from 2016–17 (up 32pc), the total volume of transformations and ‘terminations’ both dropped to record lows in 2017–18.

The report found that while the number of applications for ‘transformation’ of irrigation rights into water access entitlements increased from 2016–17 (up 32pc), the total volume of transformations and ‘terminations’ both dropped to record lows in 2017–18.

‘Transformation’ is the process whereby a customer transforms their irrigation right held against a water infrastructure operator into a water access entitlement that they can individually manage or trade.

“A significant proportion of irrigation rights remain untransformed. This may indicate that water users are hesitant to incur transformation and trade approval fees, or commit the additional time required to manage their own water access entitlements,” Mr Keogh said.

“Given the cumulative volume of transformations is much greater than that of terminations, we know that some irrigators have transformed their irrigation rights but not terminated their water delivery rights to the same extent. These irrigators may have planned to continue irrigating while participating in water trading.”

Compliance with the water charge rules and water market rules by water infrastructure operators was generally good in 2017–18. There was a rise in complaints year-on-year, from 10 to 14, but the number of complaints remained significantly lower than its peak of more than 70 in 2011–12.

“In 2017–18, MDB policy and its governance framework were subject to multiple reviews and public debate. Further policy and governance changes have been foreshadowed,” Mr Keogh said.

“Following the Minister’s announcement amending the water charge rules, we have been developing guidance materials to help stakeholders understand the changes and the transitional arrangements. We will work with interested stakeholders and publish guidance materials before the rule changes come into effect on 1 July 2020.”

Source: ACCC

The report can be viewed at ACCC water monitoring report 2017-18.

HAVE YOUR SAY