Trials inlcude safflower, carinata and Indian mustard. Photo: Nick Hill

A THREE-YEAR project has shown that several oilseed crops produce the same or better yields in tropical Queensland compared to trials in temperate climates, de-bunking decades of industry assumptions.

Cooperative Research Centre for Developing Northern Australia (CRCNA) and Grains Research and Development Corporation (GRDC) sponsored the research which was undertaken by Farmacist and Savannah Ag Consulting agronomists.

The trials were conducted from Emerald in Central Queensland to as far north as Laura in Far North Queensland.

They featured oilseed crops including canola, Indian mustard, carinata, soybeans, linseed, nigella, sunflower, camelina, safflower and black sesame.

Other than soybeans, none of the crops trialed are currently widely grown in northern Queensland.

Farmacist agronomist Nick Hill told the Developing Northern Australia (DNA) Conference this month that this project showed a clear path forward for oilseeds in the north.

“Overall from the crops that we have seen, the majority of them do have a good fit for northern Australia,” Mr Hill said.

“It is opening it up to a diversity of crops that can be grown here and grown here successfully, and with better outcomes than what are perceived by some.”

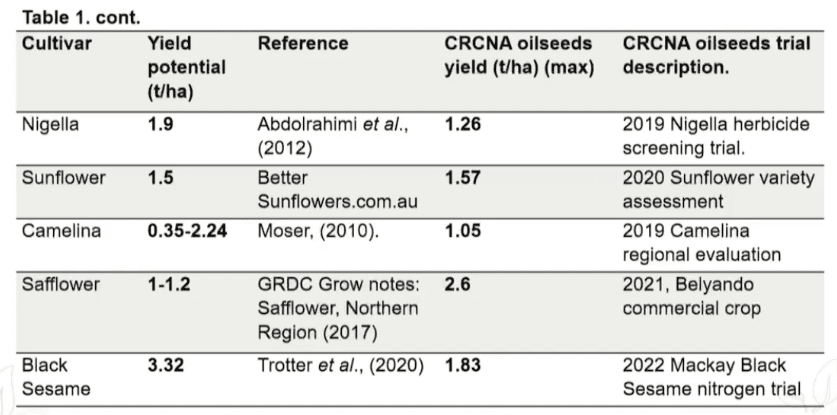

Table 1. Comparing the yields from reference trials to the CRCNA sponsored trials in northern Queensland. Photo: Nick Hill

Table 1 continued: Comparing the yields from reference trials to the CRCNA sponsored trials in northern Queensland. Photo: Nick Hill

The clear standouts were canola which produced a 2.85 tonnes per hectare (t/ha) yield, higher than the 2.54t/ha outcome from the GRDC NVT Round up Ready trials, and safflower that had a 2.6t/ha yield and was over double the 1-1.2t/ha referenced by GRDC in 2017.

Sunflowers also demonstrated a yield improvement, with 1.57t/ha in the northern Queensland trials compared to the Sunflower Association of Australia’s 1.5t/ha reference; as did carinata which produced a 0.11t/ha yield increase.

Other crops, such as, Indian mustard, soybeans, camelina, linseed and nigella were either within the yield potential range of the reference material or were slightly below.

Only black sesame showed a significantly lower yield, producing 1.83t/ha in the trials compared with 3.32t/ha identified in the reference research.

Mr Hill said he believed it was the existing incompatible farming systems and the lack of harvest equipment that held back the black sesame results rather than the potential of Northern Queensland’s soils and conditions to accommodate the crop.

Creating a NQ market

Savannah Ag Consulting’s Tony Matchett told the DNA Conference that he was not surprised by the results.

Mr Matchett said for the past 15 years he has conducted crop research in northern Australia and is well aware of the potential of oilseeds to grow and prosper in these regions.

However, he said proving the viability of the crops was not enough to get growers to change their farming systems and to invest in new equipment.

“The last field day we had in August 2020 showing some of the work we’re doing in the oilseeds was really successful but the takeaway message from growers was: ‘Tony that’s fantastic with all the oilseeds we can grow, but where is the market?’” Mr Matchett said.

“That was our lightbulb moment and pivot to say unless the infrastructure and path to market is developed, growers won’t be adopting anything that there is no infrastructure to support.”

Mr Matchett said this realisation prompted him to found Savannah Sun Foods, to creating a path to market for these oilseeds.

He said the company is a full farm-to-market operation, which sells the seeds to growers, buys the crops, and manufactures value-added products for consumers.

“We do that through a guaranteed path to market with 100-per-cent buy-back so they have the confidence to know that what they grow they will be able to get paid for.

Northern Queensland growers inspect a sesame crop. Photo: Nick Hill

“We started that with an oil press to turn some of the oilseed crops identified in the CRC-enabled project into high-value premium cold-pressed vegetable oils.

“Through this, that has created new industries and opportunities for Australian growers but also Australian consumers.”

Currently Savannah Sun Foods produces a range of oils from northern Queensland crops, such as, sesame, sunflower, camelina, soy, and mustard.

Mr Matchett said the company also focused on reducing or eliminating food waste by transforming it into new products.

He said sesames has been “a target crop” not only for its adaptability to Northern Queensland, but its ability to turn the waste product into something valuable.

“When we now grow Australian sesame and press…the meal that is left over from the sesame is the perfect substitute for almond meal; put a bit of baking soda into it and you have a flour replacement.

“Currently we import roughly $100M worth of sesame every year from India, Mexico and Guatemala and that is in the form of whole seed for baking…, oil, tahini and as an ingredient in packaged foods.

“The consumer feedback in the restaurant trade is telling us, if they can get their hands on reliable supplies of Australian grown and processed sesame, they will shout from the rooftops that they no longer have to worry about imported product.”

Mr Matchett said mustard, which also performed well in the trials, was also a key focal point for the company.

“After two years of really bad drought in Canada, there is a global shortage of mustard in the world.

“With Canada off the scene with supplying mustard to Australian food ingredient companies like Masterfoods and McCormicks, the next person you would ring is the Ukraine and Russia and they are distracted at the moment.

“So, there are companies in Australia…that need to and are willing to diversify what was a reliable supply chain until COVID and war disrupted things.”

Mr Matchett said he has been in discussions with companies, such as Masterfoods, to work out what varieties and supply chains need to be developed in the north to make it a viable provider of mustard to the business.

Savannah Sun Foods uses northern Australian-grown crops to manufacture cooking oils. Photo: Savannah Sun Foods

He said the overall goal of the company and the work undertaken by Mr Hill and CRNCA is to reduce Australia’s reliance on imported seeds and grains.

“We know now that import costs, disruptions and delays of getting things into Australia has been a real challenge over the last two and a half years.

“With food in particular the safety and reliability and the quality of supply has been challenged, and that is not just because of the disruptions in supply chain but also global issues around drought or war.

“We know that the ag sector has a target of achieving $100 billion of net value at the farm gate and we are on our way, but our business model in that circular economy is flip part of the $20B worth of imported food and agriculture that comes into Australia every year and $20B of food and agriculture that is waste.

“If we can do this, it will go a long way to achieve our target.”

The DNA Conference was held in Mackay from July 6-8.

Grain Central: Get our free cropping news straight to your inbox – Click here

HAVE YOUR SAY