BRAZIL is banking the windfall of big crops and dramatically depreciating currency to maintain its top ranking among world soybean exporters, according to the United States Department of Agriculture (USDA) Oilseeds World Markets and Trade Report.

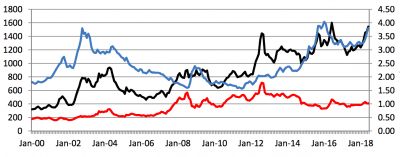

Brazil displaced the US as the world’s biggest soybean exporter in 2013/14, and since then, the value of its exports has leapt from around R$800 per tonne to more then R$1500/t, thanks to the Brazilian real’s devaluation against the US dollar.

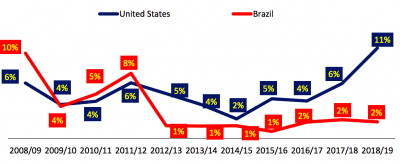

Since 2014/15, when stocks in both Brazil and the US reached minimum levels, Brazilian stocks have remained relatively unchanged, while stocks relative to supply in the US are projected to rise to 11 per cent in the coming year, chart 1.

Chart 1. Soybean opening stock/supply. Since global drawdowns to 2014/15, Brazil (red line) has effectively cleared annual production while US stock (blue line) has built again. Source USDA

While reduced crops and strong global demand in the early part of the decade helped all exporters draw down stocks, large crops of recent years have led to a build-up of stocks, mostly in the US.

The weaker real has given Brazilian producers the ability to undercut US prices, and encouraged continued area expansion, all factors contributing to Brazil’s rising global market share.

The USDA report said as long as US producers continue to battle against a weak real, this trend was likely continue.

Despite the prospect of Brazil clearing out the 2018 crop this year, limited year-on-year growth in Brazil’s soybean production, rising global demand, and smaller supplies in Argentina and Uruguay following this year’s drought should were expected to sharply curtail exportable supplies in the remainder of 2018.

Despite a weak real, this should reduce competition in the global soybean market, boosting US exports in 2018/19.

Another record crop

Another record Brazilian soybean crop, currently estimated at 119 million tonnes (Mt), will provide ample supplies for export in 2018.

Brazil’s political and economic uncertainty have added to the country’s competitive pressure by weakening the real relative to the US dollar to a rate of close to $3.8.

Chart 2. Brazil fob soybean export price, left axis. The returns to farmers have risen strongly expressed in Brazilian reals/tonne (black line) although not so much in US dollar terms (red line). Key to this explanation is significant currency depreciation, right axis, of the Brazilian real to US dollar exchange rate (blue line). Source USDA

This is nearly 20pc below the level of January 2018, and approaching the near-term record low of R4.04 observed in January 2016.

With elections in Brazil scheduled for October, the same forces which pushed the real lower are seen as likely to persist through the US harvest, and possibly into late 2018.

Weak currencies generally augment pricing power in the market, providing producers more flexibility to undercut competitor prices, and increase sales.

In Brazil, this has helped growers and exporters sell out most of each year’s crop over the past five years.

Source: USDA

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY