Overview

- National production estimates of wheat (32.1 million tonnes), barley (11.4Mt) and canola (4.2Mt) are the second highest on record.

- Australian wheat, barley and canola exporters are taking advantage of strong export demand, with bulk grain export stems mostly booked out to April.

- Local prices are being supported by international supply and demand factors but are expected to remain.

THE completion of the 2020-21 harvest has resulted in the second highest level of production on record for Australian wheat, barley and canola, corresponding with a period of heightened demand.

National wheat production of 32.1 million tonnes (Mt) is 44 per cent above average and the second highest total on record behind the 2016/17 season. Similarly, national barley production of 11.4Mt is the second highest total on record, an 18pc increase on average.

In its ‘Insights February 2021’ report released today, Rural Bank says exporters are being booked out until April as Australian grain prices become increasingly attractive to international buyers.

The single largest destination for Australian wheat in 2021 is currently China, driven by an appetite for stockpiling and a resurgence in the country’s pig herd.

Whilst the New South Wales crop produced 12.8Mt of wheat, or 84pc of last season’s national wheat production, it has overshadowed Western Australian production where despite below average soil moisture and growing season rainfall, and less rainfall than last year, wheat production increased 48pc year-on-year and was 3pc above average.

Global picture

The Rural Bank report says whilst the United States Department of Agriculture (USDA) World Agricultural Supply and Demand Estimates (WASDE) report has 2020/21 marketing year wheat production at record high levels, it doesn’t paint the whole picture.

Of the three largest wheat producers, European Union, China and India, only the EU is a net exporter and production there was 9pc below average due to poor crops in some areas.

Whereas global import demand increased 2pc year-on-year, the combined production of the top five wheat exporting nations declined 1pc.

Australian wheat is in high demand with the squeeze in production in major exporting nations causing a shift in global supply chains.

Russian wheat is in demand in markets normally serviced by the EU and Ukraine, which has re-opened markets in which Australia has lost market share in recent drought years.

According to Bulk Handling Company (BHC) bulk shipping stems, Australia exported over 1.9Mt of wheat in January, and season-to-date exports of 4.6Mt is 28pc above average.

China, Saudi demand

However, the single largest destination for Aussie wheat to date is China, with 900,000 tonnes, or 19pc of bulk wheat exports. This includes over 700,000t shipped in January alone, the largest amount of wheat shipped in a month to a single destination.

China’s appetite is attributed to stockpiling activity after floods last year are understood to have damaged China’s grain stores, as well as a resurging pig herd which has also seen China buying large amounts of corn and soybeans from the US.

Despite the loss of the Chinese barley market, bulk barley exports out of BHC grain terminals are running at record export pace, with 2.4Mt 50pc above average for the October to January period, with around 6Mt expected for the full season.

Saudi Arabia, a market lost to Australian barley in recent years due to low production and cheaper Black Sea origin grain, is leading demand with almost 1Mt, or 39pc of season to date bulk barley shipments.

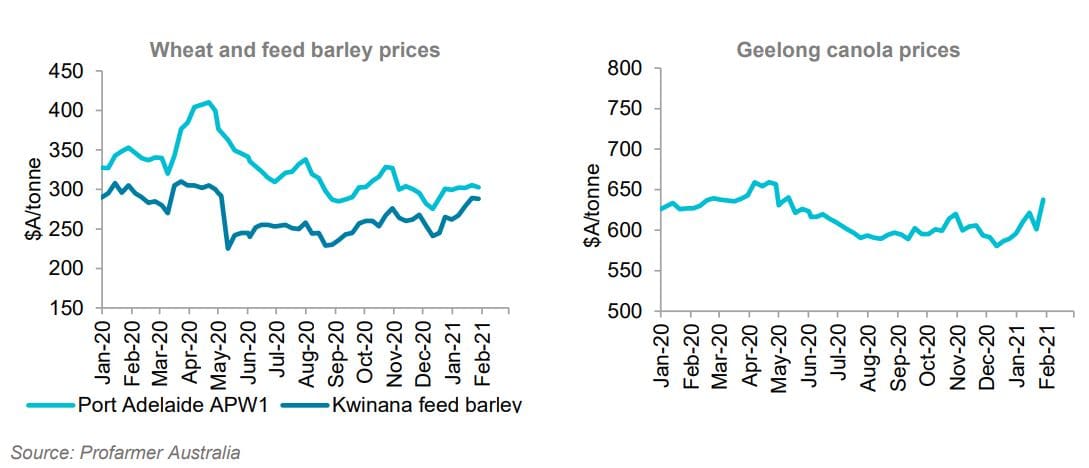

Local prices have remained relatively stable over the past month, though export focussed states have been more volatile being more closely aligned to international demand and receiving some support from the announcement of Russia’s increased export duty coming into effect on the 15th of February.

Looking ahead, growers seem to have filled their appetite to sell, exporters have mostly purchased stock to fill near term shipping demand, and international influences have been factored into global pricing, so prices are expected to remain supported, but relatively flat in coming weeks.

Source: Rural Bank

Download the full report here.

HAVE YOUR SAY