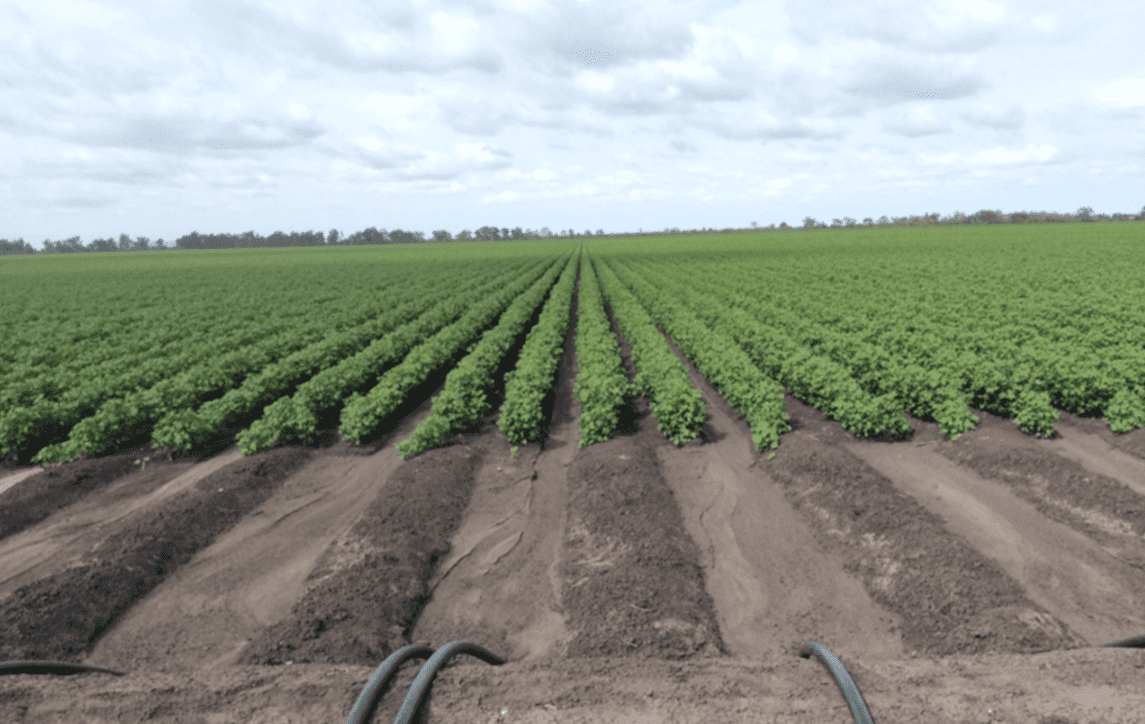

Gardner Farms – North Hub offers an incoming lessee strong production potential. Photo: Westchester Group of Australia

INVESTMENT firm, Westchester Group of Australia, has listed four productive cropping properties for lease, in a rare move for the US-owned investment fund.

Usually transacted off-market, the public listing opens up the opportunity for a wider variety of prospective lessees from small family operations to corporate entities.

Two properties, Gardner Farms – North Hub (2461 hectares) and Gardner Farms – West Hub (806ha) are irrigated cropping operations located just east of Cecil Plains on the Darling Downs.

Westchester purchased the properties from Toowoomba’s FKG Group in 2017.

Grain Central understands FKG Group leased the properties back from Westchester.

Located at Yallaroi, about 20km east of North Star, Hibernia Aggregation (7420ha) is a dryland cropping operation which features several infrastructure sites and substantial grain storage.

Purchased by Westchester in 2019, the aggregation is being offered for lease as a whole or in three separate parcels ranging from 1439-3878ha.

Abilene North (841ha) is a mixed irrigated and dryland cropping property located east of Gunnedah.

Bartholomew Bowen

Westchester acquired the holding in 2017.

Leases for all four properties are open via an expressions of interest process closing on March 31.

Westchester leases its farming assets and currently has 68 properties in Australia across Western Australia, Queensland, New South Wales and Victoria.

Grain Central understands these leases are for typically three-five years.

Suited to family farmers

The Cecil Plains holdings are two rare and high value leasing opportunities for the tightly held Inner Downs, thanks to water availability, infrastructure and production capacity.

Herron Todd White Darling Downs director, Bartholomew Bowen, said the Gardner Farms, especially the larger holding should draw strong interest, but would be out of reach for most family farming operations.

“It’s a big asset that is going to have a pretty substantial lease or agistment payment associated with it,” Mr Bowen said.

“A potential lessee is likely to be a large family operation who can tack that on to an existing large operation that they might have in the district.

“It could be very advantageous for them building additional scale into an operation that they’ve already got.”

Mr Bowen said a potential locally-based lessee could transfer existing machinery and staff to the leased holding and increase production without additional costs.

“[T]hey’ll get a significant economy of scale when they can add such a large holding on.”

Nutrien Harcourts Narrabri agent James Thomas said Hibernia, if broken into several parcels, would become accessible to more local growers.

He said farms in that area are blessed with “beautiful dirt” and have great production capacity.

He said investment firms which offer aggregations in parcels or smaller holdings for lease provide more opportunities for growers to buy-in or expand.

“We need them in the market because they pay valuation rates in tough seasonal conditions and they provide an opportunity for people to expand or get into farming by leasing them,” Mr Thomas said.

“It is a symbiotic relationship having them in the market.”

Hibernia Aggregation is located in the heart of the Golden Triangle farming region. Photo: Westchester Group of Australia

Rural leasing on rise

Mr Thomas said leasing was becoming a greater portion of his workload, with most agreements completed without the need to advertise.

“I think it’s going to become a bigger part of our business moving forward.

“Farmers are now looking at their farms as assets and looking at it from an investors’ perspective, not just from an operational view.”

He said the supply of properties and demand were both increasing as economic conditions shift.

“What is driving it, I think, is you have an aging farming population, and people are getting a grasp on the capital growth rates and how good of an asset the land is.

“They are not wanting to sell it and they’re probably quite happy to accept a quite nominal rent but still retain that core asset.”

He said the struggle to get staff had also prompted some large-scale operations to lease portions of their holdings to maintain some cash flow.

“[They] will take a risk for the return on that portion and retain the asset to potentially take I over later down the track.”

Mr Thomas said neighbouring or nearby farmers were generally taking on leases.

“It is creating opportunities for younger farmers to come in or contractors to come in and lease to gear up and expand.

“The people who are leasing are neighbours or people nearby who are looking to just…buy a new planter or header and spread the cost of that machinery or just get more efficiency.

“They might be boxed in, where there might not be opportunities to purchase, so leasing nearby might work for them.

“The other ones who are leasing on a standalone basis, they’re ones who don’t have the equity to buy in, because if you have the equity you are better off buying which I think generally people have done.”

Interest rates impact

Colliers Agribusiness Brisbane agent Phillip Kelly said he also expected leasing to become a more attractive option for growers in southern Queensland.

He said this was largely driven by “pure economics, capacity and cost of funding” centred around interest rate movements.

Mr Kelly said when interest rates were low it was hard to find possible tenants.

He said this was especially the case when leasing rates were higher than interest rates.

“What we found was when interest rates were very low, it was very difficult to lease country,” Mr Kelly said.

“In one case…the vendors were seeking 4.5-5pc of agreed value and at that time interest rates were 3.5pc.

“So, anyone who had the capacity to pay the yearly lease fee, would have had the capacity to go and borrow money at a far lesser rate than leasing.”

Strong property prices

In northern NSW, Mr Thomas said leasing rates have dropped to reflect the strong property prices in many cropping regions.

“In the last say seven years, where interest rates have been 2-3pc but people were wanting 5-6pc as a lease return, they were struggling to get people.

“Now…because land values have lifted so significantly in such a short amount of time, most of the leases we have structured have reflected 2.5-3.5pc on the current values.

“Anything above that, there is not much margin in it.

“If you go west, the lower the land value they may be able to get a higher return and with interest rates at 6-7pc it might be a more attractive proposition to lease a property than purchase or debt fund it.”

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY