Panel chair and InterGrain CEO Tress Walmsley, Grains and Legumes Nutrition Council general manager Kathy La Macchia, Essantis co-CEO Andrew May, and Brownes Dairy CEO and managing director Natalie Sarich-Dayton at the 9 October 2024 GIWA forum. Photo: GIWA

THE GRAIN Industry Association of Western Australia served up some pointers for Australia’s biggest grain-growing and exporting state at its annual forum in Perth last week.

Under the topic of Farming for the future: Adapting to changing diets, it highlighted the suitability of oats and lupins, where WA is already a global leader in production and exporting, as ideal ingredients for modernising food and beverage markets.

Kicking off with an address from WA Minister for Agriculture and Food Jackie Jarvis, the forum got a rundown on the evolution and nature of the modern diet from Grains and Legumes Nutrition Council general manager Kathy La Macchia.

Insights into the world of food and beverage came from Essantis, formerly Unigrain, co-chief executive officer Andrew May, and Brownes Dairy CEO and managing director Natalie Sarich-Dayton.

At its Wagin facility, Essantis is a major processor of WA oat cereal, as well as oat-milk base and pulses at its Victorian site, while Brownes is WA’s biggest dairy processor.

Oat opportunities abound

In her address, Ms Jarvis said Australian and international consumers increasingly wanted healthier and sustainably produced food, while WA consumers were looking to buy locally made food.

“This trend isn’t new, but it’s accelerating and it creates opportunities for innovation across our industry,” Ms Jarvis said.

“The WA grain sector has responded swiftly; we are value-adding here at home whilst making sure that we’re still meeting our international markets.

“Oats obviously has become a clear beneficiary of this shift.”

Ms Jarvis said six years ago, her daughter was living and working in Scotland and introduced her to the concept of oat milk, which has since become a staple in cafes and homes.

GIWA estimates WA will harvest 555,000 tonnes of oats in coming months, and international data says that will make WA the world’s second-biggest exporter of oats, behind only Canada.

Ms Jarvis said the WA Government’s $10.2-million investment in the Processed Oat Partnership was already helping WA oats sector from plant breeding all the way to further processing.

“With their well-known health benefits, oats are finding new markets in Australia and overseas and showing strong potential far beyond the breakfast staples.

The May family’s business started in Victoria in the 1970s as Unigrain, and Andrew May said the food-ingredient manufacturer has been involved in oat cereal production since 2007, and produces stockfeed also at its Wagin operation.

“We’re one of the largest participants in that market alongside CBH in supplying Asia Pacific with our all the oat cereal needs of those markets,” Mr May said.

“Protein is another key trend, reshaping global markets.

“As affluence rises in South-east Asia, so does the demand for high-protein, sustainably produced foods, both for human consumption but also for animal feed.

Ms Jarvis said WA already supplies 80 percent of the world’s sweet lupins, and potential to value-add them existed.

“There is absolutely room to grow high-protein lupin products such as lupin flour.

Ms Jarvis spoke about Wide Open Agriculture’s development with Curtin University of the Buntine protein powder, the world’s first globally patented lupin-based protein, already in use in plant-based milk and cheese products in domestic and export markets.

“Last year, Wide Open Agriculture expanded to acquiring a German facility to produce the Buntine protein for European markets, and that is turning a WA innovation into a global success story,” Ms Jarvis said.

“We know that the global alternative-protein market is set to grow by more than 20pc annually, and I think WA is in a prime position to capitalise on momentum and continue leading the way on plant-based innovation.”

Behind wheat, barley, canola, and oats, lupins is WA’s fourth-biggest crop, and GIWA estimates this harvest will produce 440,000t, most of which will be exported for stockfeed.

Goal to supplant imports

On the domestic front, Essantis is keen to reduce Australia’s reliance on imports for its alternative-protein products, adding that with Ms Sarich-Dayton also on the program, milk in general was the “topic of the day”.

“This is not about choosing one protein over another; this is about complementary proteins that all need to go into the mix to feed the demand that is out there.”

Andrew May, Natalie Sarich-Dayton, Jackie Jarvis, and Kathy La Macchia all presented at GIWA’s forum held last week. Photo: GIWA

Mr May said Essantis has built an enzymatic oat-based production facility at its site in Smeaton, Vic.

“We have done that to be able to support the industry and wean itself off imported oat products.”

Beyond companies like Sanitarium and Vitasoy with “main-player” status and their own facilities, Mr May said other manufacturers supplying supermarkets have come to rely on ingredients imported from countries including Spain, Sweden, and China.

“We’ve sought to solve that supply chain in the market.”

“The production facility can support the production of over 50 million litres of oat milk per year, and we’ve partnered with other sites in Victoria to finish off the formulation and aseptic packing of those products.”

As with some pulses, Mr May said Australia has a natural advantage as a volume and quality producer of oats.

“We think we can build scale in that market and we think in this particular industry, it makes no sense that Australia is buying a product that’s come from Sweden or from Spain given the scale of our industry.”

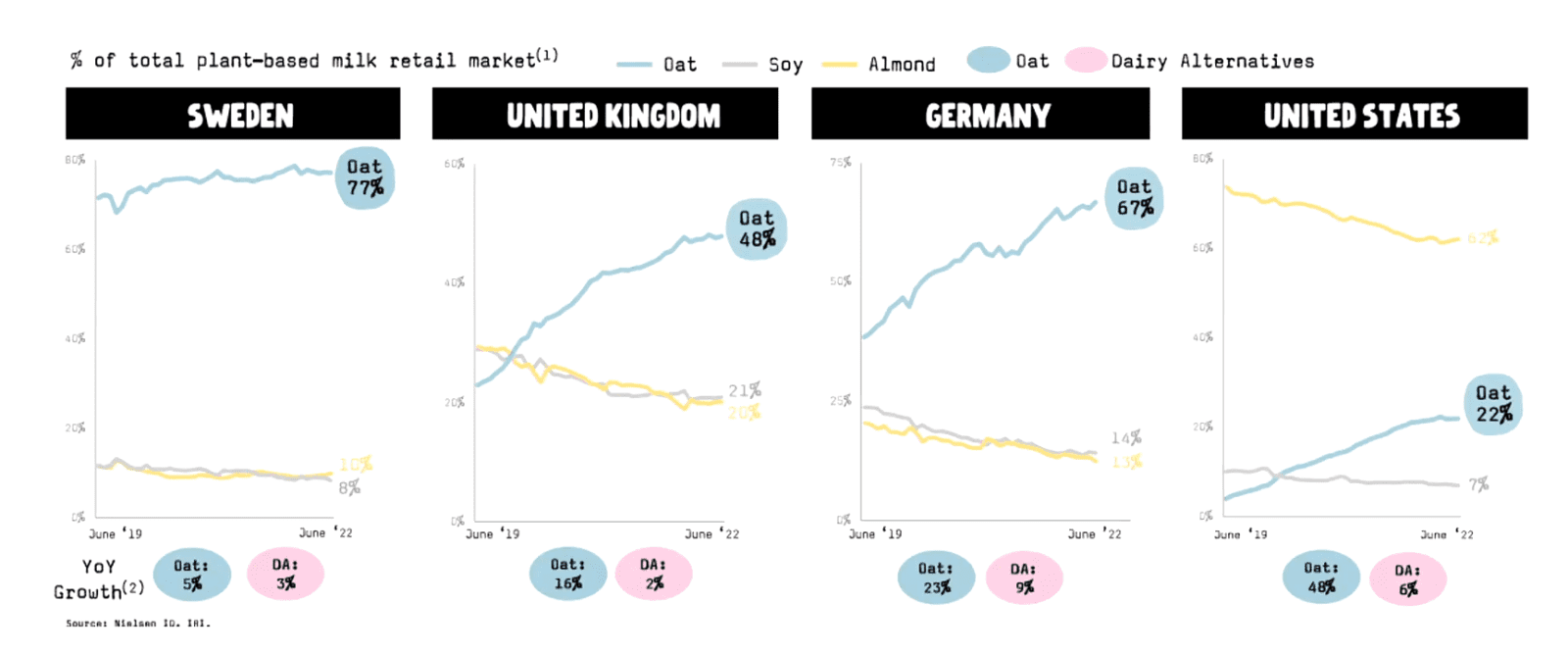

“There is no doubt the plant-based category is growing and oat is destroying almond and soy in many countries.”

Figure 1: As shown in this slide presented by Essantis co-CEO Andrew May at the 9 October 2024 GIWA forum, oat milk’s popularity is on the rise in Europe and the US.

Mr May said the shift into oat milk is being driven by Europe and the US.

“The Asian market clearly is still much more of a soy market initially, but more broadly I’d say…do not dismiss what the oat-milk industry can do for the oat industry in general.

“The oat content in a carton of oat milk is 10pc, but if (up to) 500 million litres of it is being produced and sold, that is really material.

“We’re taking a breakfast category and creating an entire new segment of demand for that product.

“We are really big believers in terms of what that can mean for the oat industry in general, and we’re really big believers in what that can do to continue to underpin demand for oats and underpin the WA oat industry more broadly.”

In 2022, Unigrain (now Essantis) received $3M from the WA Government’s Investment Attraction Fund for a new development at its Wagin facility.

“We are building what will be the largest oat-flour production line in Asia-Pacific and that is being built solely to support our customers in Asia to fulfil the demand they have at their oatmeal facilities.”

“The WA government or the…ecosystem here I think is doing a great job in terms of understanding the importance of the oat industry.”

Mr May said while Essantis believed that changing consumer preferences would create further opportunities for plant-based ingredients, food, and beverage, but investment decisions needed to be made wisely.

“We’ve got to think about how we can find parts of the market where we have crops that we can scale up, where we’ve got crops we have competitive advantages in, and where we can produce products at a unit cost that can make money.

“As we know in the Australian market, both in protein and in plant-based, there is plenty of press around both the success and the failures in the market, and that just says that it is really hard.”

Dairy milk on own journey

The irony of putting a representative of a cows’ milk company, namely Ms Sarich-Dayton of Brownes Dairy, on the bill following a major producer of ingredient for plant-based milk, namely Mr May, was not lost on the speakers or the audience.

However, the mood was entirely collegiate.

As GIWA forum attendee Mark Narustrang told Ms Sarich-Dayton in the panel session: “We, the grains industry, love the dairy industry because cows eat grain and probably over half of the crop ends up in an animal.”

Ms Sarich-Dayton also spoke about the common ground.

“The dairy and grain industries in Australia might seem like two different worlds, but we’re more alike than you think; both of us are at the mercy of nature.

“Whether it’s too much rain, not enough rain, or everything in between, it’s clear that Mother Nature has a wicked sense of humour we both face.”

She said export challenges, sustainability pressures, labour shortages and changing consumer tastes were all being felt by the dairy sector, including Brownes, which was founded in 1886 and is Australia’s oldest dairy.

“Today we employ over 300 people and we work with 40 farming families in our south-west region which help us produce around 120M litres of milk annually.

“We’re proud to say we’re WA’s largest processor of dairy products, number one in fresh white milk, number two in yogurt, number one in cream, and number two in flavoured milk.”

Ms Sarich Dayton said, like the grain industry, dairy has had to evolve.

“Consumer preferences have shifted; people want more cream, less sugar, and lately they want protein in everything.”

WA’s dairy industry snapshot is 4pc of the national pool with 112 farms producing 338M litres of milk, 88pc of which is consumed in WA.

Since 2000, WA’s milk production has dropped by 68M litres, which roughly mirrors the national trend.

“We have been losing about 5M litres of milk every year, while the state’s population has been growing steadily by more than 3pc annually.

“At Brownes in particular, we’ve been working closely with our farmers to help them adapt their business models and increase production efficiencies.

“Some of our larger farms are even investing in dairy barns to boost production and profitability.”

Supply chain synergies

Brownes dairy supplies 80pc of metropolitan Perth’s coffee shops, and Ms Sarich-Dayton said they have been “demanding more and more alternative dairy”, ideally arriving with their cows’ milk.

“We ended up giving Sanitarium’s alternative dairy company a go and it’s grown significantly over the last two to three years.

“In fact, they have said to us they wish they had a Brownes Dairy in every state.”

Ms Sarich-Dayton said Brownes would rather source the plant-based milks it distributes from WA.

“That was the dream, but it proved impossible.

“With the amount of capital that has now opened up on the eastern states to be able to manufacture these products, it was a no-brainer that we went over there.”

Nonetheless, Brownes is working on making its own alternative milks.

“It’s been very difficult; I’m not going to lie to you.

“Every factory trial will cost you at least $20,000; when you start putting it into tetra cartons, you’re building mountains of hundreds of thousands of dollars of packaging, and if you get it wrong, you’ve got to write it off.

“That’s exactly what we’re looking at right now; our first version isn’t right.

“We created what we think was an absolutely delicious almond alternative.

“However, we created more a roasted almond flavour; people don’t want that in their coffee.

Brownes Dairy’s iced coffee brand is sold across Australia and in Tesco supermarkets in the UK. Photo: Hunt and Brew

“We created an oat dairy-based alternative that had a more oat flavour, and guess what: They don’t want oat to come out in their coffee – they want it to taste like nothing – so we’ve got to go back to the drawing board.

“We’re doing also an incredible amount of research to further understand what we really need to do before we commit to version two.

“We’re committed because we…understand that offering your consumers choice is absolutely pivotal for survival, and for us to be here for the next 100 years, putting our eggs in one basket is probably not the right choice to be making.”

Coffee break

On the value-adding front, Brownes Dairy is behind the award-winning Hunt and Brew ready-to-drink coffee range, made since 2017 from single-origin beans, cut with fresh milk, and with no added sugar.

“We do very much say that we’re a dairy company and we’re very much evolving to be a coffee company as well.”

It’s why Ms Sarich-Dayton says Perth deserves to be Australia’s coffee capital, with the 4.2pc fat content of Brownes Dairy milk having the edge over the Melbourne average of around 3.2pc.

“Anyone who tells you that Melbourne coffee is better is lying because we use our milk.

“This is why our coffees taste much better.”

Hunt and Brew uses coffee made from beans grown in a number of countries, and the label would welcome more Australian beans.

“We are Australia’s number one purchaser of…Australian coffee beans.

“They grow them in Queensland and we’ve cleared them out, so if you want to pull up anything and grow coffee beans, I would love to talk to you.”

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY