Weather: It remains dry in US wheat growing regions, despite some relief in the winter wheat belt of Kansas and Nebraska with a storm bringing snow to some of the dry areas. BSEA still well behind on normal rainfall but recent crop condition reports have it good shape.

Markets: Canola markets are starting to stage a comeback after recent tariff-led sell off, fundamentally prices are still supported if the tariff noise can be dampened. Matif wheat was €4 stronger on back of the news that wheat imports to Turkey were back on.

Australian Day Ahead: Canola bids to improve domestically today expect a rise of A$5-10 with global markets stronger. Expect cereal bids to be firm to slightly stronger to follow Matif.

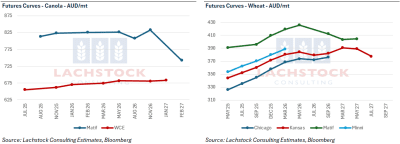

Futures prices, forward curves. Canola rapeseed on the left and US and Matif wheat on the right. Source: Bloomberg via Lachstock. Click expand.

Offshore

Turkey is back. Flour mills can import wheat again provided they turn it into flour, which was the case prior to 21 Jun 2024 when tariffs were introduced.

The overnight ethanol production report from the US was positive, reaching 1.105 million barrels—an increase of 43,000 barrels from the previous week and the highest level in six weeks. This marks a 4.2 percent rise compared to the same period last year.

Iran purchased wheat; up to 500kt for Apr/May shipment, most likely Russian origin.

The USDA rated the health of the winter wheat crop in Kansas, the top producing state in the country, at 48pc being in good and excellent condition. That it down from 52pc the previous week.

Live cattle futures posted strong gains on Wednesday, with feeder cattle reaching another fresh all-time high.

Turkey’s government has announced a 1 million tonne import quota for animal feed corn, the trade ministry said in the Turkish official gazette on Wednesday.

Australia

WA new crop canola was $800 for conventional and $730 for GM. New crop wheat was bid $380, down a little. Current barley was bid $357, and new crop bids $336.

Through the east new crop canola was firmer bid $743 and GM $643. Wheat was bid $367. Current crop cereals were largely unchanged with wheat $347 and barley $321.

Canola looks set to lose some hectares through NSW with growers looking at alternatives. Recent pullback in canola price and tariff noise one of the leading factors in this decision. One of the alternatives is faba bean.

Local canola meal has worked around $20 higher to around $480 ex crush after recent China tariffs on Canadian meal.

HAVE YOUR SAY