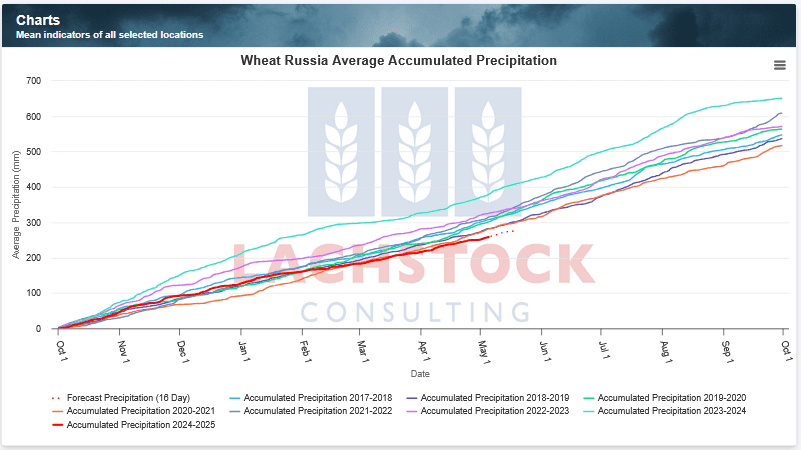

Weather: Disturbingly the Aussie outlook remains painfully dry. Forecasts now give us estimates through to mid May with little to no rainfall forecast. Meanwhile, and i acknowledge i sound like a broken record, but rainfall deficits are growing in a bunch of key winter wheat growing regions. There is some decent rainfall forecast for the higher production areas of Russia – the ECM model building in over 40mm over the next 2 weeks.

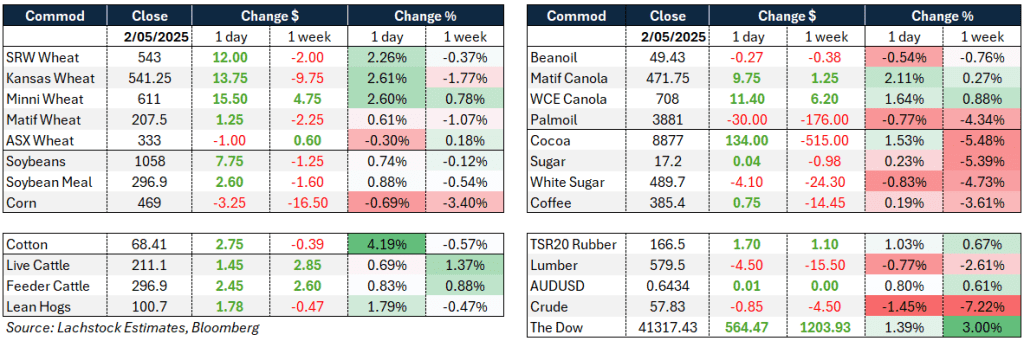

Markets: Signs of life. The set up is pretty compelling. Record spec shorts, lower pricing triggering demand and some spot fires on the weather front. The swing and the roundabout for the Aussie market will be the AUD. Macquarie calling for 0.6700 by Jan-27, not an aggressive forecast but indicates that analysts are becoming unified in the view that the USD continues to fall under a series of rate cuts. The AUD seems comfortable with another Albo go-round, pushing it back to the all important 200 day moving average.

Australian Day Ahead: The forecast, or lack of will hold the key for price direction this week. Old crop has largely been grinding higher but, walking in today feels a little more urgent. For new crop, there is plenty of time – crops have been made with later breaks – it would be nice to see something on the forecast.

Offshore

Wheat – Wheat futures posted their strongest daily gain in three weeks, driven by a combination of short covering and mounting global weather risks.

Prices rose 2.3% in Chicago as traders reacted to persistent dryness across northern and southeastern Europe, southeastern Ukraine, Russia’s North Caucasus, and key regions of China. These developments are exacerbating concerns about winter wheat yield potential.

Concurrently, speculators are holding historically large net short positions across global wheat markets (Chicago, KC, Minneapolis, and Matif), which adds to the upside risk if weather issues persist.

On the demand side, HRW found buyers in Morocco, and China took Canadian and Australian wheat.

France’s crop condition held steady, while Rouen port loadings improved.

Canadian grain production is forecast to rise 2% next season.

UN projections trimmed global grain stocks to a three-season low, with the wheat stock-to-use ratio still considered “comfortable” for now.

Other Grains and Oilseeds – Corn was mostly flat, weighed down by ideal U.S. planting weather and increasing South American production estimates, despite some strength in deferred contracts and an active feed demand narrative.

Old crop is losing its premium, as traders rotate out of inverses.

French corn planting was ahead of schedule.

Soybeans posted modest gains amid hopes of resumed China trade dialogue, although little real progress has occurred. U.S. soybean planting is running at a record pace.

In South America, Argentine farmer selling increased slightly, while Brazilian soybean premiums fell.

Soymeal and soybeans strengthened, while bean oil slipped and July crush margins narrowed.

Indian palm oil imports dropped for the fifth straight month due to its premium over soyoil, and Malaysian production rebounded.

Biofuel markets remain on hold pending clearer U.S. policy guidance on mandates or tax credits.

Energy is under pressure again with OPEC set to increase production.

Macro – The U.S. labor market showed resilience in April, with payrolls up 177k and the unemployment rate steady at 4.2%. Wage growth remained moderate at 0.2% m/m and 3.8% y/y, suggesting tariff-driven inflation pressures may be transitory.

Meanwhile, political developments in Australia saw Labor securing at least 86 seats, giving it control of the Senate with the Greens.

Globally, the EU is preparing a trade offer to the U.S. to ease tariff tensions, while the U.S. is seeking talks over Trump’s 145% China tariffs.

The Bunge-Viterra merger is reportedly stalled due to these ongoing U.S.-China tensions.

The UN food price index rose 1% in April, hinting at a potential return of food inflation.

Additionally, the re-emergence of the New World Screwworm in the southern U.S. threatens cattle supplies and could further raise beef prices during an already tight market, adding another layer of risk to the inflation outlook.

Australia – The week ended largely unchanged across the board, with canola bids in the west of the country around $785 for current crop and $825 for new crop. Wheat was $357 and $368, with barley at $348 and $333.

In the east, canola was $760 for current crop and $789 for new. Wheat was steady at $342, with new crop at $370, and barley at $333.

No significant rainfall is forecast for any southern cropping regions. Combined with warm, windy conditions, this will have those with early germination in Victoria, New South Wales, and small parts of South Australia hoping it holds on until follow-up rain arrives.

Poor conditions will likely see end users and consumers in Victoria and South Australia looking to stay ahead of demand, with feed grain values expected to firm.

Sorghum bids remain strong, with Brisbane and Newcastle around $385 and the Downs at $355. With a $5–10/t premium to wheat through the Downs, sorghum may have lost its place in some feed rations, instead finding its way into export channels.

HAVE YOUR SAY