Weather: I almost don’t want to talk about Australia given how devoid of moisture the maps are. Global spot fires remain just that, small, non-threatening isolated events. IKAR upped its Russian production number – nothing to see there. Northern EU looks dry still but they are still fine according to every production estimate. Basically, nothing in global weather that would make you hit the buy button.

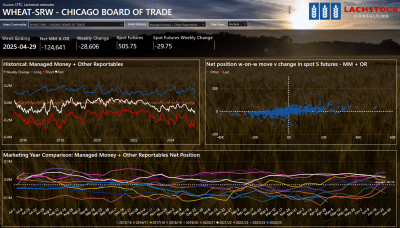

Markets: Dead cat. All of Friday’s stolen money was given back. We have a USDA report in our future which might provide some numbers to get excited about. SRW is cheap, dirt cheap. The demand response is not knocking anyone over just yet however and we can bang on about the Black Sea vs US FOB spread all we like, until the global end user forces convergence, trade flows remain unchallenged.

Australian Day Ahead: An extremely complex environment is a massive understatement. From 2000 feet, the market looks like it is doing what it needs. Basis levels vs Chicago are historically reflective of a market trying to ration stocks. However, if you are an enduser and you want grain, you can find it. The east coast has produced decent crops with late breaks so its too early to hit a panic button just yet. AUD looks technically strong with a close above the 200 day moving average but, there was also increased talk about the US market pumping the brakes on a rate cut expectations.

Offshore

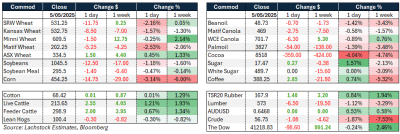

Wheat – Wheat futures dropped sharply to start the week, with WN off 11.75c, KWN down 8.5c, and MWN marginally lower.

US inspection data disappointed at 310.3k, though total shipments are up 14.4pc year-on-year.

Winter wheat conditions improved to 51pc, with HRW states like MT and CO showing gains. Despite short covering early in the session, wheat lacked a catalyst and fell under pressure.

Russian cash markets remain steady at $250, while IKAR lifted its Russian production forecast to 83.8Mt.

Ukrainian drone attacks damaged Novorossiysk’s KSK grain terminal, though Russian exports aren’t meaningful until new crop.

European forecasts remain mixed, with dryness in the north and better moisture in the southeast.

A Taiwan wheat tender for up to 99,200t and Egypt’s domestic procurement of 645,000t also featured in the news.

Other Grains and Oilseeds

Corn futures dropped sharply, with CN off 14.75c and CZ down 7.25c as planting conditions remain highly favorable.

Corn planting progress hit 40pc vs 41pc expected, while export inspections of 1.6Mt were strong, pushing pace 28.8pc above last year.

U.S. corn remains the cheapest globally for now, but Brazil is expected to dominate world demand by August.

South Korea’s MFG purchased ~70,000t of feed corn at ~$248/t C&F for August arrival.

Soybeans are rangebound (July: 10.40–10.65) amid steady U.S. planting progress (30pc vs 31pc expected) and Brazil completing a record harvest (~170Mt).

Argentine harvest is delayed but yielding better than expected. Exports are currently light as China waits for new crop.

Soybean oil remains the volatile leg of the complex, pressuring margins, while meal prices have been used as a balancing lever.

Malaysian palm oil fell for a fifth straight session on currency strength and weaker Chicago soyoil.

Macro

Markets no longer expect a US Fed rate cut this week, with pricing showing zero probability of easing compared to over 50pc in early April.

The US labor market remains stable, allowing the Fed to focus on inflation risks, particularly from tariffs. Cuts are now more likely from Q3, with ANZ forecasting a modest cycle toward 3.75pc.

OPEC+ is preparing to ramp up output, potentially adding 2.2 mbpd by November.

Trump has promised upcoming trade deals and reaffirmed control over the process, while tensions with Mexico and India are emerging amid separate bilateral negotiations.

Australia’s economy is seen as resilient to U.S. trade shocks, supported by flexible monetary policy, a weaker AUD, and incoming capital, according to Macquarie CEO Shemara Wikramanayake.

PM Albanese’s recent election win is seen as reinforcing policy stability.

Australia

The week started slightly firmer for canola in the west, buoyed by global futures, with the current crop priced at $785 and the new crop at $825. Wheat was unchanged to start the week, with bids at $355 and new crop at $368. Barley was slightly softer, with bids around $345, but is still pricing at around export parity.

In the east of the country, it was steady to firmer across the board, with conventional canola at $770 and GM at $725, and new crop at $792. Wheat was slightly higher at $346, and barley was priced at $337

Victorian barley continues to trade above export parity, elevated by strong domestic demand that doesn’t seem to be easing in the short term. This is coupled with an export program that has been too active in the front end of the marketing year, meaning higher prices are needed to reduce export activity

New crop delivered canola markets continue to be bid around $820 for Footscray and Newcastle.

The mutton indicator has spent the week above 600c/kg, which is 342c higher than the same time last year, as processors seek to fill space while lamb supply slows. This rise in price will continue to impact surplus breeding stock numbers through South Australia and Victoria, as producers offload to conserve feed. This will make for an interesting spring, especially if “normal” rainfall occurs, as models are suggesting for southern Australia.

HAVE YOUR SAY