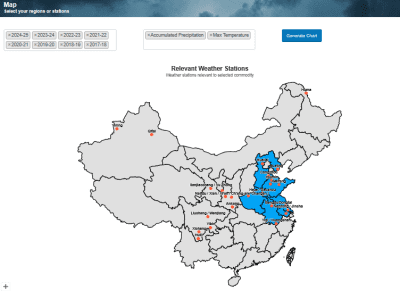

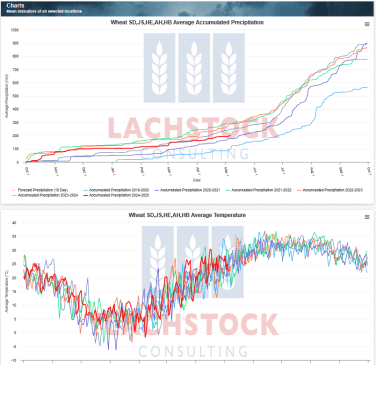

Weather: Little fires everywhere. China temps hitting the wires with official govt warnings issued over the heat. In-season rainfall has been okay but there has been record high after record high throughout the wheat growing regions – always hard to extrapolate to actual impact in China. Russia has a decent forecast but it needs to land. Something… Anything would be welcomed across the southern belt in Australia.

Markets: Donald is never far away. The stability the market showed when many thought some of these trade deals were close to being done seemed to have evaporated along with Japans proposal. However, this is all about China and confidence that a deal will be done or not is the main leading indicator right now.

Australian Day Ahead: AUD trading above 0.6500 for a moment will not help the appetite of the Aussie exporter, regardless of a fundamental balance sheet view.

.

Offshore

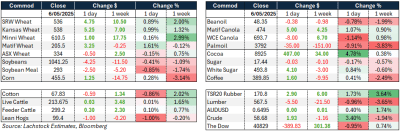

- Wheat markets rebounded slightly after a weak start to the week, with WN up 6.5c and KWN gaining 5c.

- A large speculative short appears to be running out of room, though physical demand remains limited.

- Global weather concerns persist: China’s Henan province issued a crop risk warning due to extreme heat and drought; Northern EU is dry; Russian rains are needed but not yet confirmed; Ukraine had weather challenges in April; and Australia remains painfully dry to start the crop year.

- IKAR raised its Russian wheat production forecast to 83.8 million tonnes (Mt) and exports to 40Mt.

- Egypt has procured 1.3Mt of local wheat. Despite the bounce, trade still lacks a bullish catalyst outside potential trade deals or worsening new crop conditions.

Other Grains and Oilseeds

- Corn markets were split with old crop showing strength and new crop under pressure from ideal US weather and expectations of large acreage.

- Brazilian corn forecasts rose 1Mt to 126Mt due to strong safrinha crop conditions, but corn ethanol demand is climbing—its National Corn Ethanol Union, UNEM, expects 2025–26 ethanol output to rise 20pc y/y, reducing exportable supply.

- Argentina held corn and soybean estimates steady with a slightly bullish bias. Bean markets remain stagnant on weak Chinese demand, lack of export activity, and uncertainty around US biofuel policy, though the EPA is expected to announce new mandates within two weeks.

- South Korean buying helped old crop corn, but new crop lacks support. ADM reported weaker earnings, citing tough trading and unclear biofuel policy signals.

Macro

- Trade tensions dominate global markets.

- Trump’s tariffs continue to disrupt flows: Canada’s exports to the US fell 6.6pc in March, while exports to other nations surged 24.8pc. The EU is preparing retaliatory tariffs worth €100 billion on US goods if trade talks fail, adding to existing measures. The US denied Japan’s request for full tariff exemptions, offering only temporary reductions.

- Meanwhile, optimism over US-China negotiations remains low despite public reassurances.

- Domestically, US imports hit a record $419 billion, widening the trade deficit to $140.5 billion.

- In Australia, Q1 consumer spending was flat, and April housing data shows weakening momentum, reflecting global uncertainty’s spillover into household sentiment.

Australia

- Unchanged in the west of the country yesterday, with canola bid at $785 for current crop and $825 for new crop. Wheat was $353 and $362, with barley at $345 and $332.

- In the east of the country, canola was slightly softer at $766, with new crop bids at $790. Wheat was slightly softer at $344, with barley at $335.

- Delivered wheat spreads are tight, with little appetite for higher grades and strong demand for ASW and below. This will have seen a lot of protein wheat fed through SNSW and SA this year, with these feed markets paying a premium to the exporter for it. Delivered Melbourne/Geelong bids are: H2 at $380, APW at $376, and ASW at $375.

- Barley delivered into major homes across SA is being bid around $360 for Murray Bridge, Sedan, Tintinara, and the Mid North.

- Downs wheat is being bid between $345–$350, with new crop bids at $355. Barley is around $330.

HAVE YOUR SAY