Weather: China heat is hitting the wires everywhere – yes, its hot, really hot with +40°C across the main growing region. However, we can’t forget that a bunch of the crop is irrigated. Additionally, there may be damage but we won’t really see that in the markets for a while. Not unlike Australia, Russia is a tale of two halves. The North Caucuses through to Stavropol is looking really good while Rostov is still lagging.

Markets: With the Fed decision behind us the market has returned focus to the trade negotiations, particularly with China. The all important sit down in Geneva will set the tone but, if you are only listening to Donalds sound bites – it’s hard to see a short term resolution. The China stimulus package was largely viewed as more of the same – they have been throwing the kitchen sink at their economy with little reward to date. Wheat markets are doing what they should do – find a point where demand truly turns on.

Australian Day Ahead: Ground hog day – every day the forecast remains dry across the whole country is another day of uncertainty. Way too early to blindly buy Aussie wheat, not that you could with liquidity and its a brave trader to short the domestic basis. So, net result is do nothing. Planting pace continues to chip away however so, when it rains (and it will) it needs to keep raining… thanks Hughie...

Offshore

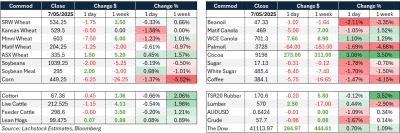

Wheat markets softened despite early optimism. Chicago (WN -1.75c), Kansas (-8.5c), and Minneapolis (-7.5c) futures all fell, with Paris Matif and Russian cash also weaker. Spreads were soft and implied volatility in WN ended at 27.65 percent.

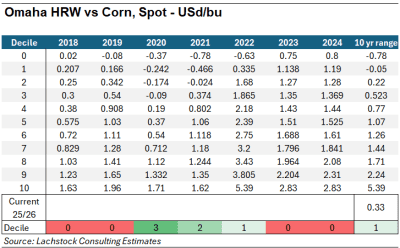

US HRW production prospects are reportedly strong, capping rallies.

Market focus is on upcoming export sales, with whispers of 500k tonnes of old crop wheat, above the 325kt estimate.

StatsCan wheat stocks are due, expected at 13.2 million tonnes (Mt).

Global supply developments are mixed: Russian consultancy IKAR raised its 2025 wheat crop estimate to 83.8Mt and exports to 41.3Mt, while China is dealing with hot, dry weather in Henan just before harvest. Low soil moisture, after previous flood damage, may prompt further imports despite Beijing’s preference for domestic support.

WASDE pre-report expectations suggest 2025 US wheat production will fall slightly to 1.9 billion bushels.

Other Grains and Oilseeds

Corn markets were split with old crop showing strength and new crop under pressure from ideal US weather and expectations of large acreage.

Brazilian corn forecasts rose 1Mt to 126Mt due to strong safrinha crop conditions, but corn ethanol demand is climbing—its National Corn Ethanol Union, UNEM, expects 2025–26 ethanol output to rise 20pc y/y, reducing exportable supply.

Argentina held corn and soybean estimates steady with a slightly bullish bias. Bean markets remain stagnant on weak Chinese demand, lack of export activity, and uncertainty around US biofuel policy, though the EPA is expected to announce new mandates within two weeks.

South Korean buying helped old crop corn, but new crop lacks support. ADM reported weaker earnings, citing tough trading and unclear biofuel policy signals.

Macro

Trade negotiations between the US and China are back in focus.

Treasury Secretary Bessent and USTR Greer are headed to Geneva for talks, sparking temporary optimism in futures markets. However, that faded after President Trump insisted that he would not pre-emptively lower tariffs, with rhetoric suggesting a prolonged and ego-driven negotiation.

Chinese President Xi responded with sweeping domestic stimulus—interest rate cuts and policies injecting up to 2.1 trillion Yuan (~US$291 billion)—to stabilise the economy ahead of talks. A temporary pause or partial rollback of US tariffs is possible, but high duties are likely to persist for 6–12 months.

Meanwhile, the Federal Reserve held interest rates steady at 4.25–4.5pc. Chair Powell reiterated a wait-and-see stance, citing uncertainty from tariff-induced inflation and economic drag. Markets reacted positively to the Fed’s patience, with gains in stocks and US Treasuries.

Australia

Slightly firmer in WA yesterday with canola bids +A$5 with current crop $790 and NC $830. Wheat was $355 which this time last month was +$30 dragged down by cheaper US wheat and an improve Aussie dollar, barley was bid $340 with solid demand still.

Through the east it was sideways to slightly stronger yesterday with canola $771 for current season and $795 for new, wheat was $348 and barley $338.

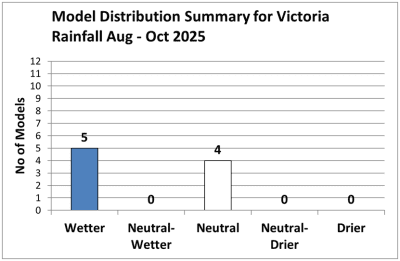

It certainly doesn’t feel like it for southern Australia now but long-range rainfall models from 9 global forecasts for Victoria are suggesting neutral rainfall for May-June and neutral to wetter Aug-Oct, fingers crossed.

New crop delivered Jan+ wheat bids continue to be published with ASW into Geelong/Melbourne $388, Bendigo $370 and SFW Darling Downs $355.

New crop chickpeas are slightly softer with delivered Brisbane now bid $850, with a strong planted area and improving Aussie dollar pulling bids down.

GM canola demand is strong through Vic and SA with packers filling boxes for the subcontinent, this has seen bids make their way to $760 delivered with the grower close to 100pc sold.

HAVE YOUR SAY