Weather: The US is crazy at the moment – temps today through the northern corn/bean belt will be just shy of 37°C while the next few days could see over 3 inches of rain. This will help with the wild fires that are raging throughout Minnesota, Arizona and North Carolina.

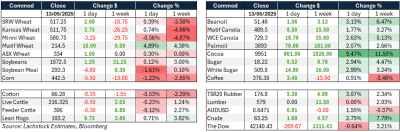

Markets: Wheat markets were pretty boring overnight with most of the volatility coming from the AUD – US inflation keeps printing lower than expected which initially rallied the USD and pushed the AUD lower – the AUD then posted some gains with the price action suggesting the breaks get bought rather than selling rallies.

Australian Day Ahead: There are some small signs of life in the Aussie maps – not the drought breaker we are looking for in the south but at least there is some rainfall forecast.

Offshore

Wheat futures briefly rebounded from new contract lows, with Kansas wheat (KWN) gaining modestly amid rumours of North African and Southeast Asian demand.

Algeria issued a fresh tender, and HRW is now competitive into that market. Despite cheap SRW prices, demand remains lacklustre.

The HRW crop is large, nearing 800 million bushels, with a carryout projected to exceed 450 million, requiring significant demand recovery—potentially from China—to alter the balance.

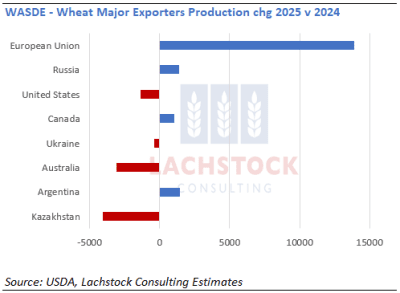

The Wheat Quality Council tour found sharply improved yields in Kansas, with preliminary Day-1 estimates averaging 69.7 bu/acre versus 48 bu/acre last year on the same route. However, some fields showed signs of moisture stress and wheat streak mosaic virus.

In Europe, French farmers planted 4.6 million hectares of soft wheat, up 9.1 percent year-on-year but lower than the April estimate of 4.63m/ha, while durum wheat area fell to a 30-year low.

Other Grains and Oilseeds

Corn prices hit fresh lows near US$4.42/bu amid record US production forecasts of 15.8 billion bushels and strong planting progress (62pc complete vs. 56pc five-year average). Spring wheat and soybeans are also ahead of schedule.

Brazilian corn production was revised up by both the USDA and analysts like Michael Cordonnier, who now sees 130 million tonnes (Mt), while Argentina is pegged at 50Mt.

The focus now turns to summer weather and Chinese demand, which remains subdued.

In soybeans, futures reversed from intraday lows supported by gains in soyoil, which surged on expectations that the 45Z biofuel tax credit will be extended to 2031. This would reduce the attractiveness of imported feedstocks like used cooking oil.

Rapeseed area in France was steady, while barley and corn plantings declined.

Malaysian palm oil stocks hit a six-month high, pressuring prices despite a short-term bounce.

Macro

US inflation data showed headline and core CPI rising less than expected in April, marking the third consecutive month of downside surprises.

Shelter and services inflation are moderating, with the three-month annualized core CPI rate now at 2.0pc. While inflation uncertainty remains elevated—particularly around delayed tariff impacts—markets are scaling back expectations for near-term Fed rate cuts.

The AUD held steady around 0.6471 after a 1.6pc rise, as the USD weakened on the inflation print.

Meanwhile, easing trade tensions between the US and China—marked by tariff reductions and resumed Boeing deliveries—have improved financial market sentiment. The broader expectation is that tariff impacts on price levels will be transitory. Nonetheless, elevated US tariffs and potential new trade agreements (including those discussed at the upcoming APEC meeting) remain in focus.

The UK ethanol industry warned of collapse due to cheap US imports.

Argentina’s land prices are rising amid FX liberalisation and improving rural sentiment.

Australia

New crop bids were slightly stronger across the board yesterday in the west, with canola +A$7 to $845 and GM $782. Wheat was $364 and $336. Current season malt bids improved, reaching $360 FIS.

In the east, bids were firmer with new crop canola at $808 and current crop $775. Wheat was $352 and barley $346, with solid demand for feed driving the lower grades.

Delivered markets in the south have improved $5–$10 over the last week, with the GV now $360–$365 for both wheat and barley, Western Districts bid $370 for both, and Murray Bridge making it back to $390.

Corn bids have improved as consumers look for alternatives to wheat and barley, with bids around $370–$380 FOT through the GV region.

Darling Downs delivered bids have been largely immune to rises in the south, highlighting the good outlook through SQLD and NNSW and last year’s large crop. Wheat is bid $355 and barley $335.

HAVE YOUR SAY