Weather: Small areas of concern are widespread. It remains very dry in the north of Europe, hot and dry in China, and signs of some frost damage exist in the Russia crop, there is flooding in Argentina, and it remains dry in parts of the Australian grainbelt.

Markets: The Saudi wheat tender was really cheap. Australian wheat would only work into Dammam due to freight, but even those values looked around US$10/t under current Aussie values. Remember, however, this should be Northern Hemisphere new crop.

Australian day ahead: Whether or not the Reserve Bank of Australia cuts interest rates today, the AUD reaction, and the weather map: that’s probably all we need to look at today. Some confidence in the southern NSW forecast is growing, and there are signs that Western Australia’s Geraldton port zone will get a drink too.

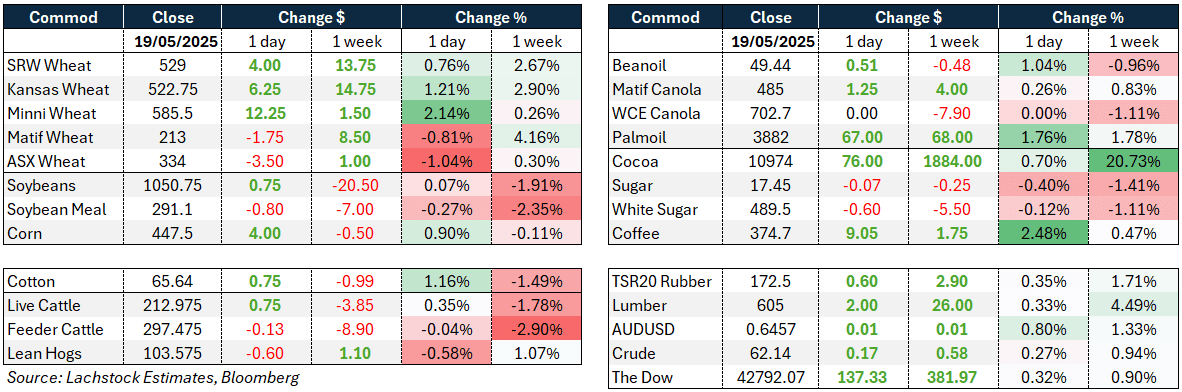

Offshore

Wheat futures surged on short covering, with traders unwinding record-large net short positions, particularly in HRW and SRW, due to renewed weather risks in the US, namely Kansas frost and virus concerns, and dryness in key Chinese growing regions.

The Minneapolis July contract led gains amid frost worries in the northern plains. Dryness in Australia and north-west Europe is also attracting attention, while Russia’s Rostov region declared an emergency due to cold-induced crop damage.

German winter wheat area for the 2025 harvest rose 12.2 percent on improved autumn sowing conditions.

On the demand side, Saudi Arabia purchased 621,000 tonnes of 12.5pc protein hard wheat for Aug-Oct, likely sourced from the Black Sea. Offers came from the EU, the Americas, Australia, and Russia. Prices were around $255-$256/t.

US wheat inspections were solid at 424,000t, up 15.7pc year on year, and US winter wheat conditions are rated 52pc good to excellent, below expectations, with HRW down 2pc. Kansas and Illinois improved, while Texas, Colorado, and Montana declined.

Other grains and oilseeds

Corn futures posted moderate gains, supported by grower reluctance to sell below the insurance price, planting delays from wet and cool forecasts, and strong weekly inspections at 1.72 million tonnes, up 29.2pc year on year. US corn planting reached 78pc, slightly below expectations. Brazilian crop estimates continue to rise, but internal demand from ethanol use is also climbing. Flooding in Argentina’s Buenos Aires province is being monitored.

Soybeans saw modest support, with the July and November contracts posting small gains, while soybean meal dipped and bean oil firmed. Weekly inspections were below expectations but still up 11.1pc year on year, and planting progress reached 66pc. China will auction soybeans tomorrow, and has purchased Argentine reserves. The Philippines bought 145,000t of US soybean meal.

German farmers expanded 2025 winter rapeseed area by 1.5pc to 1.1Mha.

Macro

Moody’s downgrade of US debt renewed concerns about the fiscal outlook, pushing down long-dated Treasury prices.

Meanwhile, Japan is softening its tariff stance in trade talks with the US, eyeing reduced, not eliminated, tariff agreements. US-India talks continue, with the US pushing for ethanol fuel exports and broader tariff concessions.

Australia

Little change to begin the week in the west with canola at A$850/t for new crop and $735/t current, wheat was $363/t and $355/t, with barley at $352/t and $332/t.

In the east of the country, new-crop canola started at $818/t and is currently $784. Wheat was unchanged at $348/t for current-crop and new-crop at $370/t, and barley was $342/t.

Markets have shown little interest in global wheat/barley/corn values, driven by domestic dryness and feed tightness with strong basis levels, with global values back in recent weeks.

Rainfall models are now showing widespread rainfall for most of the country in early June, which willl put some pressure on domestic values with more grain likely to come to market.

March barley exports totalled 839,000t, with 715,000t shipped to China. Around 80pc of the export program has been completed to the end of May, with a significant portion of the remaining crop already sold.

HAVE YOUR SAY