Weather: The next 10 days look set to bring some decent falls through southern Australia with at least 25mm set to fall through Victoria, southern New South Wales and South Australia’s South East. Recent rain in the Black Sea region was welcome but more is needed, with Rostov most in need, and northern Europe is a similar story.

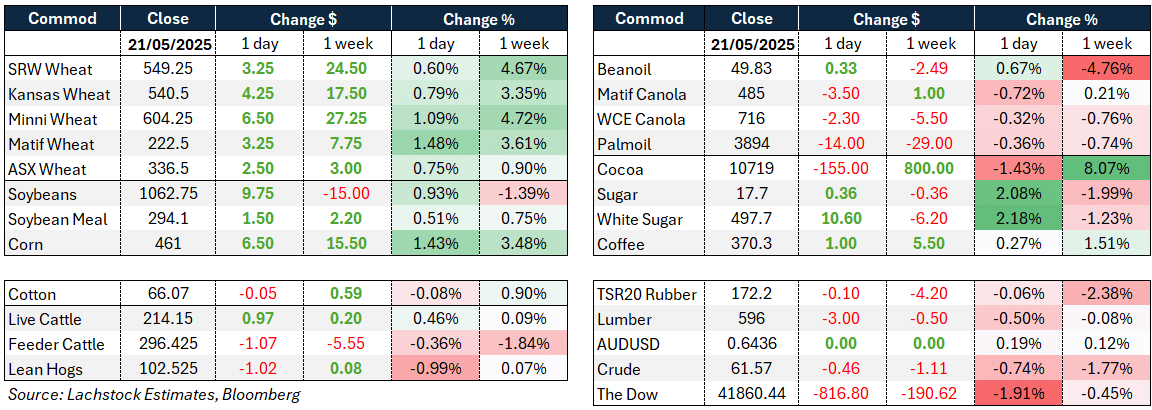

Markets: Wheat continued this week’s gains fuelled by weather concerns through parts of the Black Sea region, Europe and China, coupled with a softer US dollar which saw funds cover some short positions. Corn and soybeans followed suit, with canola slightly softer.

Australian day ahead: Markets are expected to trade unchanged to slightly higher. Domestic buyers will be happy to sit on the sidelines for the next week or so to determine how widespread this forecast break looks to be; if it is a fizzer, feed markets could climb $10. Domestic buyers have been pushing the east coast values, with a narrow spread now between west and east.

Offshore

Chicago futures extended gains to a one-month high, with July up 0.5 percent after rallying 3.2pc the previous day on short-covering and weather concerns, and hitting US551c, its highest since April 2023. The weaker US dollar added support as funds covered large short positions after prices hit five-year lows last week.

Heat in China’s major wheat-producing region Henan touched 40 degrees Celsius, but was short-lived, limiting crop damage. Russian frosts caused limited harm, though dryness in Rostov, Russia’s largest wheat-growing region, is expected to cut yields, prompting a state of emergency and compensation measures. Northern Europe and Australia also need more rain as crops remain vulnerable.

World wheat trade will be down significantly this marketing year, but optimism builds for a rebound next season, with China potentially returning as an importer of more than 10 million tonnes (Mt), and Turkiye resuming imports after last season’s ban. Indian flour millers, buoyed by a bumper crop, are pressing to lift export restrictions. India’s wheat output is expected to be bumper, potentially pressuring global prices but easing domestic inflation.

SovEcon lifted Russia’s wheat production forecast to 81Mt for 2025-26, supported by recent improved weather, although moisture remains below average in key regions.

Structurally, MATIF wheat shorts hit a fresh record at -287,000 contracts, signalling strong speculative bearish sentiment. Shorts remain unfazed, despite weather-driven price bounces, with Northern Hemisphere harvest approaching and ample carry to collect. Major crop issues or fresh weather threats will be needed to force out shorts.

US current-crop exports are expected at around 50,000t, the same as new crop.

Other grains and oilseeds

Soybean oil prices edged up 0.93pc, supported by heavy rains in Argentina threatening supply, and rising crude oil prices boosting biofuel demand. Rising crude oil prices continue to underpin oilseed markets, linking energy and agriculture sectors closely.

Argentine soy concerns resurfaced as analysts flagged potential quality losses in late-planted beans due to excessive rains in key provinces, even with harvest nearing completion.

Chicago corn extended gains overnight, supported by spillover strength from wheat and a weaker US dollar, as traders continued to unwind short positions ahead of key US crop-development stages.

Palm oil futures declined slightly amid higher Malaysian production costs and calls from Indonesia to delay export levy hikes due to trade uncertainties.

Canola prices dipped on improved weather easing drought fears in Europe, but remain supported by tight supplies from Ukraine.

Macro

Crude oil prices jumped nearly 1pc to $62.55 a barrel on reports that Israel might strike Iranian nuclear sites, raising supply disruption fears.

US economic indicators showed slight improvement in the Philadelphia Fed’s non-manufacturing index, but it remained in contraction, while employment gains were steady but new orders softened.

Australia

In the west of the country yesterday, canola bids were higher with new crop bid at A$870 and GM at $790. Wheat firmed by $2, with new-crop at $368 and current-crop at $359. Barley was $355 for current crop. Through the east, canola was $805 and new-crop $830, with GM at $745. Wheat was $349 and barley $345.

Australian feedlot numbers hit a record 1.497M head in the March quarter, up 142,000 year on year, driven by strong global demand for grainfed beef, record exports of 90,329t, and high pen utilisation at 90.3pc, with stable margins supported by softer feedgrain prices and rising feeder steer values reinforcing the sector’s critical role in food security and drought resilience.

Sorghum bids remain strong, with delivered Newcastle/Brisbane bids around $385. With harvest largely done and the grower well sold, prices remain firm.

Seeding is starting to be completed through southern NSW, Vic, and parts of SA. With some rainfall in the forecast, those still going will be aiming to wrap up soon.

HAVE YOUR SAY