Weather: Rainfall across the US Central and Southern Plains is aiding winter wheat development, though the southwest remains too dry. Wet conditions in the Delta and Midwest are problematic for SRW wheat. The Black Sea region is receiving helpful rain, but frost may have caused minor northern damage. Europe’s crop is benefiting from scattered showers, though the northwest remains dry. North Africa’s drought persists, but recent showers have been helpful despite harvest-time disruptions. China’s wheat areas remain dry with little relief in sight. In Canada, rain is improving soil moisture but delaying planting, while heavy rain in parts of Argentina may restrict wheat seeding despite good conditions elsewhere.

Markets: Despite the insipid end to the week, US wheat futures actually had a good 5 day trading window. Certainly some international focus on Australian conditions but, as has been the case for the last few months, other spot fires are still ticking away. French conditions are not a disaster but are bleeding into harvest. Trump is back pushing markets around with the EU trade/tariff talk which is a wet blanket on the USD if nothing else.

Australian Day Ahead: fingers, legs, eyes – all crossed and praying for rain through SA and Vic. I reckon i got 45 separate weather warnings over the weekend with wind the key feature. As long as there is rain with it, i dont care. Southern markets probably a little quiet waiting for this rain event.

Offshore

Offshore

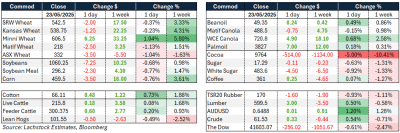

Wheat markets were mixed with light pressure overall.

Minneapolis wheat rallied on dry Canadian Prairie forecasts and a surprising 6.6k increase in managed money shorts, lifting prices by US17c/bu over the week.

Russia’s removal of its $250/t minimum export price allows greater pricing flexibility, though gains in exports may be tempered by constrained supply and tepid global demand.

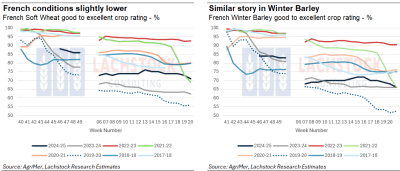

French crop ratings slipped 2pts to 71pc good-to-excellent, with dryness threatening yield in key northern and western regions.

Australian weather maps are wetter into the 11-15 day period, which may support wheat establishment.

In Argentina, planting is well behind average due to persistent rainfall, with only 3.4pc of area seeded vs 13.4pc last year.

Turkish production is forecast to fall 5.8pc year-on-year to 19.6 million tonnes (Mt).

Ukraine’s wheat exports are down 14pc y/y, and the EU has reinstated quotas on Ukrainian grain, adding pressure on Black Sea trade routes.

Other grains and oilseeds

Corn lost ground as Brazilian production estimates continued to rise, with some private estimates nearing 140Mt after USDA’s May WASDE pegged it at 130Mt.

Argentine corn remains the cheapest in the world, weighing on US competitiveness.

China continues to avoid US corn, though that is benefiting US exports to Japan, South Korea, and Vietnam, where market share is rising.

Ukrainian corn exports are down 21.4pc year-on-year.

Taiwan tendered for up to 65,000t of feed corn.

In soybeans, futures declined with soft meal values and only mild support from bean oil.

The July soybean crush margin firmed 4.75c to 134.25. US exporters are concerned about potential 50pc tariffs from the EU starting June 1, which would significantly impact trade.

Argentina’s harvest is delayed due to rain.

Morocco announced a US$670m plan to rebuild its livestock herd following prolonged drought, indicating future feed grain demand.

Japan’s rice prices surged nearly 95pc y/y in April, although broader inflation remained stable.

Macro

Geopolitical risks are sharply elevated. Russia launched one of its largest missile and drone attacks of the war on Ukraine.

Simultaneously, Israel stepped up airstrikes in Gaza and responded to a Houthi missile strike with six airstrikes on Yemen’s Hudaydah Port.

India and Pakistan exchanged airstrikes, triggering a brief ceasefire mediated by the US, though violations were reported soon after.

Trump reignited trade tensions with a call for 50pc tariffs on the EU and floated 25pc tariffs on Apple and other device manufacturers. This comes after rejecting Brussels’ latest proposal and could significantly impact global markets.

The escalation is pushing expectations for a Fed policy rate cut further out, with Chicago Fed’s Goolsbee calling the new threats “really scary” for business investment.

Inflation expectations are climbing, according to St. Louis Fed’s Musalem.

Meanwhile, the US and China resumed high-level talks and issued a rare joint statement signalling temporary easing of tariff tensions.

Separately, China allocated $194m in disaster relief funds to support agricultural production across 30 provinces.

Deere & Co. acquired drone firm Sentera to boost high-resolution crop monitoring.

Australia

Canola bids in the west were A$850/t for new crop yesterday and $791/t for current crop. Wheat was $350/t and $360/t, while barley was $350/t and $335/t. In the east, bids improved, with current season canola at $785/t, wheat at $357/t, and barley at $350/t.

Corn bids continue to strengthen, with ex-farm MIA prices around $385/t, driven by strong feed demand from mills, dairies, and sheep farmers.

The next 14 days show no widespread rainfall in the forecast, which is expected to push feed values higher and continue pricing grain further north into NSW to meet demand.

The domestic barley market is trading above export parity, with EC track at approximately $345/t versus export parity around $320/t, reflecting strong local demand.

HAVE YOUR SAY