Weather: Same themes as yesterday – rain forecast in the areas harvesting in the US – some rain for the Canadian plains and scattered rain through EU and the Black Sea.

Markets: Wheat showed independent strength overnight as the markets weigh up what a full blown US Iranian strike could look like. Ultimately, this is about the domino effects – if the market was simply trading Iran demand erosion, its bearish. Russian drones have been hammering the Ukraine over the last 48 hours which should also be factored into todays extended rally

Australian Day Ahead: A higher US futures market gets the global consumer to sit up. However, with the northern hemisphere harvest underway it is going to be hard for the physical market to maintain the rage. Having said that, it does dry up the offer as the grower waits to see how far this can push.

Offshore

Offshore

Wheat

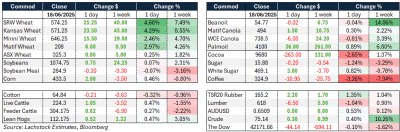

Wheat futures rose in Chicago, with soft and hard red winter contracts gaining over 1pc, as early US winter wheat harvest progress came in behind both last year and analyst expectations.

Heavier rains, particularly in Kansas, have delayed harvesting efforts. The Hightower Report noted that the intense precipitation is “not ideal with harvest starting,” and forecasts suggest more rain is on the way. Despite the delays, crop condition ratings for spring wheat improved, with USDA raising the good-to-excellent rating to 57pc, above the previous week’s 53pc and ahead of market expectations.

There has been renewed international buying interest, with Algeria and Tunisia issuing tenders, likely to secure early-season coverage. This underscores the persistent global demand, even as Black Sea supply remains dominant.

The futures market appears to be supported in part by short covering, as well as by technical buying after pushing to the top end of recent trading ranges. Still, prices remain historically low.

Winter wheat led the rally, reflecting a combination of deteriorating condition scores, harvest delays, and broader geopolitical risk.

Market participants are watching closely for any news from Russia and Ukraine or potential port disruptions in the Black Sea, which could quickly shift the tone. Traders also flagged the potential for volatility in July, as harvest combines ramp up and market focus returns to both physical supply flows and geopolitical flashpoints.

Other grains and oilseeds

Corn futures edged higher, with CN up 2c and CZ gaining 5.25c.

The Corn Belt forecast shows a mix of warmth and scattered rain, but no sustained weather risk is driving the market for now.

Traders are shifting focus toward potentially larger ending stocks expected in the upcoming report.

Ethanol output was solid at 1.109 million barrels/day (slightly above expectations), while ethanol stocks climbed to 24.120 million barrels, up from 23.197 million barrels.

Friday’s export sales for corn are expected to come in around 950,000t.

Chinese bean demand remains steady but unremarkable, with Brazil and Argentina continuing to dominate supply.

The U.S. weather outlook remains benign, with no heatwaves and adequate moisture forecast through month-end.

Bean oil has held relatively firm despite recent sharp rallies, while soymeal faces some headwinds as oil-led crushing continues.

Expected Friday sales:

Soybeans: 310,000t

Soymeal: 270,000t

Bean oil: 11,000t.

Macro

US Fed leaves policy unchanged; maintains projection for 50bp of cuts in 2025.

President Trump said Iran has reached out and suggested a possible White House visit, adding that he “may or may not” take action on potential strikes. He also spoke with President Putin, who offered to mediate. The comments are seen as signs the Iran-Israel conflict may de-escalate.

Tensions in the Middle East remained elevated, keeping energy markets on edge, while a stronger USD dampened investor appetite in both base and precious metals.

Crude oil prices hit a year-to-date high amid US involvement speculation in the Israel-Iran conflict. Trump said Iran missed its nuclear deal chance but didn’t confirm US participation in Israel’s offensive.

Australia

WA wheat bids were firmer yesterday with new crop at A$367 and current crop at $355. Canola was also steady, with new crop bids at $882, while barley held firm at $331.

Through the east, canola was slightly stronger, with new crop bids at $840 for conventional and $775 for GM. Wheat was bid at $368 for new crop and barley at $320.

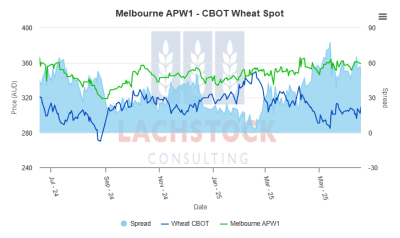

Old crop wheat may see some uplift today on the back of stronger global markets, though it’s unlikely the full move will be reflected domestically. Strong basis levels are expected to give up some ground.

Trade wheat offers remain strong into domestic homes across Victoria, as export demand slows and traders look to trim length.

Generally, the outlook in Southern Australia has improved, with recent rainfall getting crops out of the ground in most regions. This shift is evident in delivered wheat bids through SA, with Wasleys easing from $400 to $367 over the past couple of weeks.

HAVE YOUR SAY