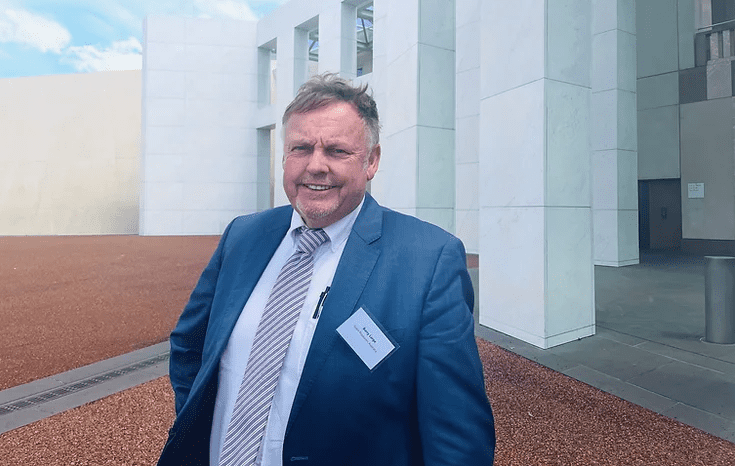

GPA chair Barry Large. File photo: GPA

GRAIN Producers Australia is hosting a webinar on Thursday to inform its members and others about potential implications of the Federal Government’s proposed tax on superannuation earnings.

Entitled Super tax impacts on Aussie farming families, the webinar will be led by GPA chair and Western Australian grain producer Barry Large.

It will also hear from RSM partner and superannuation specialist Katie Timms, and Seer Financial Group founding partner and accountant John Thomson.

Free of charge to GPA members and others, the webinar will kick off at 7pm eastern standard time on June 26.

Registered participants are welcome to submit questions in advance, and the recording will be made available online through the GPA website in coming days.

“This proposed super tax doesn’t recognise how farming businesses operate,” Mr Large said.

“Taxing farmers on a theoretical paper gain, especially on family farmland that’s not actually being sold, puts enormous pressure on cashflow and long-term viability and is poor policy that has the potential to (set) an even more worrying precedent.”

NSW Farmers chimes in

NSW Farmers has warned the Federal Government that its proposed super tax could shut young farmers out of the agricultural industry.

NSW Far North Coast beef producer Craig Huf, Burringbar, said the proposed changes to superannuation laws could make it impossible for his family’s cattle farm to pass to the next generation.

“Many hardworking Aussie farming families like my own have their farm assets in structures such as self-managed superannuation funds, which could soon have huge taxes slapped on them if these new laws come into effect,” Mr Huf said.

“These changes will tax our families on money we haven’t earned, because we’ve supposedly made money on assets we haven’t sold.

“The Albanese Government’s failure to recognise a common business structure in these laws could well mean farms are ripped off families, leaving the next generation with no land to produce the food and fibre that we need for the globe.”

Mr Huf said changes to tax laws must not unfairly impact family farms or other small family-owned businesses, and farm bodies were firmly opposed to the proposal to tax unrealised gains in superannuation holdings.

“Farmers just want to keep farming, and the next generation just wants a fair go at producing food and fibre for the world.”

“Sensible amendments to the proposed superannuation changes are what we need if we want to set Aussies up for a better future beyond this cost-of-living crisis.

“Slapping family farmers with another tax is not building a future made in Australia.”

Source: GPA, NSW Farmers

For further reading on the proposed super tax’s impact on property, read Linda Rowley’s first instalment and second and final instalment.

HAVE YOUR SAY