Loading wheat on to a vessel on a berth at Geraldton earlier this month. Photo: Andrew Young, Plum Grove

JUNE has been a big month for newcomers to bulk grain exporting from Western Australia, with Plum Grove Logistics loading its first wheat hatch, and Commodity Ag loading its first barley cargo.

The 26,200-tonne barley cargo left Albany on June 17, while the PGL hatch bound for a flour mill in Indonesia left Geraldton the following day.

Grain Central understands this marks the first time two vessels using infrastructure not owned by CBH Group have loaded in WA in the same week.

While being far from a challenge to the might of CBH as WA’s major grain exporter, the moves indicate expanded marketing options for WA growers and exporters.

Slow road to growth

Bunge’s building of a terminal at Bunbury was the first to add non-CBH grain-exporting capacity to WA.

The terminal loaded its first cargo in 2014, and in recent times it has been exporting wheat, barley and canola.

Pulses are also finding a fit in the supply chain operating outside the CBH network.

Trading as Esperance Quality Grains, Neil Wandel and family in February loaded a 4200t hatch of faba beans using Qube’s Rotabox on to a vessel bound for Egypt.

In April, Alan Richardson and family’s Gnowangerup business Commodity Ag used a mobile shiploader to fill a hatch with 6000t of faba beans.

This followed Commodity Ag’s maiden cargo in July last year of 24,000t of wheat bound for Indonesia; a 26,000t wheat cargo, also heading for Indonesia, is due to load next month.

In its March 2023 application to the Australian Competition and Consumer Commission for an export licence, Commodity Ag said it planned to export around 50,000t of grain per month from the common-user berth at the Port of Albany.

While yet to reach those volumes, Commodity Ag has clearly found a niche in exporting bulk grain from WA’s Great Southern region.

PGL’s maiden consignment was 6800t of wheat loaded in a combination cargo containing other commodities.

“This is a trial cargo of wheat loaded by Plum Grove Logistics in cooperation with local growers,” Plum Grove chair Andrew Young said.

“It’s a culmination of a lot of work to secure export accreditation and local development approval, and working with the Mid West Ports Authority.”

Mr Young said the trial cargo demonstrates niche marketing opportunities that can become available to WA growers as non-CBH assets, namely mobile shiploaders, appear in port precincts.

“It’s a more common feature of the supply chain in other states.”

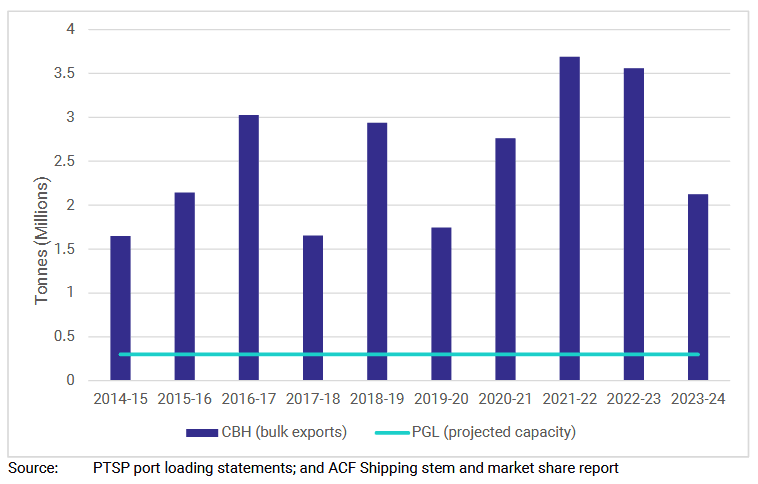

PGL’s application to the ACCC dated March 11 estimates the company’s annual shipping capacity at 300,000t, and came with a letter of support from Mullewa grower and former CBH chair Tony Critch.

Mr Critch’s letter acknowledges the opportunities of a direct-to-ship exporting option from Geraldton which can make use of dedicated on-farm storage.

“As a grain grower in the Geraldton region, I believe that granting this exemption will trigger the provision of significant benefits to growers, exporters, and to the broader agricultural sector in Western Australia,” Mr Critch said in the letter.

Figure 1: Total bulk exports from CBH Geraldton compared to projected PGL Geraldton capacity. ACF refers to Australian Crop Forecasters. Source: ACCC

The Pastoralists and Graziers Association of WA has also voiced its support for PGL as an alternative exporter out of Geraldton.

“The PGA is of the view that such an exemption would lead to increased competition in exporting grain, better access to markets and badly needed additional export capacity,” it said in its letter dated May 7.

Adding surge capacity

WA Farmers grains section president Mark Fowler said WA Farmers supported competition in the supply chain, and was therefore pleased to see the uptick in vessels loading outside the CBH system.

“The more capacity we see built into system, the better,” Mr Fowler said.

With CBH now comfortably able to export 2 million tonnes (Mt) per month of grain, and building to 3Mt in its Path to 2033 strategy, Mr Fowler said novel hatches or cargoes as seen this month were not going to challenge CBH’s position.

“We’re talking about a cargo here and a cargo there.

“It’s not exactly undermining the CBH freight path.”

That is underpinned by CBH’s export terminals at Geraldton, Kwinana, Albany, and Esperance supported by a rail fleet and up-country storage-and-handling network.

“CBH’s Path to 2033 is the most significant one we need to see.”

“We also want to see innovation and competition in this space.

“It improves transparency, and it makes the monopoly work harder; it creates different markets for WA growers.”

Mr Fowler said that could be for grain of different specifications, or deliveries which do not match CBH’s top receival grades because of metrics like high moisture.

He said operators outside the CBH network also add valuable capacity in WA’s bumper seasons.

“We had 25Mt crops in 2021 and ‘22 executed largely in ‘22 and 23 largely, and all of our grain prices were discounted by $50-$100/t.

“The kicker wasn’t just the (extra) 5Mt; it applied to all of the grain they bought.”

Outside of CBH, Bunge’s Bunbury facility is WA’s only permanent grain terminal in WA. File photo: Bunge WA

Mr Fowler said while Bunge and CBH capacity at the time could comfortably handle a crop of 21Mt, crops of 25Mt plus put pressure on the fixed bulk-handling system.

“The steep trajectory of grain production in WA is about the productive capacity of the farmer, and it’s also the extra hectares going in the ground because of the decline in sheep numbers.

“Having a bit of competition in the supply chain will ensure greater investment discipline from CBH.”

As a grower, Mr Fowler has been able to access Bunge sites at Arthur River and Kukerin as well as Bunbury, on top of what CBH offers.

“I farm in the Bunge catchment…and we’ve had the benefit of that.”

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY