Weather: Heat – yes its summer but the east coast of the US and, next week, a chunk of EU will be baking. The top and tail for Ukraine production is starting to widen out with an 18-23.5mmt reflecting the challenging growing conditions their winter crop went through. Meanwhile, Russian estimates are getting tighter, despite much of their belt suffering the same conditions.

Markets: It’s far from over. The western press today is focused on just how much damage the US bunker busters actually did. If you assume they are right and the Iranian bunkers are in tact…. what then? Long story short, grains are simply heavy with harvest underway – rallies will find sellers until something changes.

Australian Day Ahead: The Aussie market has held in pretty well all things considered. The assumption that we get some Asian demand out of the Middle East/Black sea conflicts as consumers make sure they get their deliveries is just that, an assumption. Despite all the headlines, there simply isn’t any panic today from the consumer.

Offshore

Offshore

Wheat

Wheat markets continued to slide, pressured by the fading impact of Middle East tensions and ongoing heavy harvest pressure.

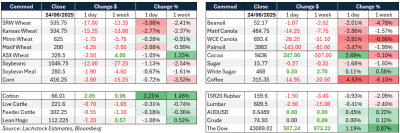

WU dropped US17.5c/bu, KWU lost 15.25c, and MATIF Sep was off €4.25/t. Russian cash is quoted around US$226–228.

Chicago wheat is trading at its lowest in a week, with earlier support from geopolitical volatility now unwinding as Israel and Iran edge toward an unstable ceasefire. Despite accusations of violations, the reduction in conflict has removed short-term demand fears.

In the US, strong winter wheat yields persist, though HRW quality remains sub-par. Spring wheat saw relative firmness due to poor crop ratings and a quality push.

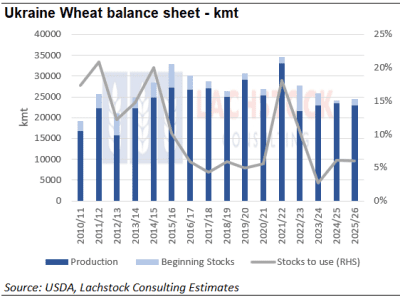

Ukraine’s 2025 wheat harvest is expected to fall 3 percent y/y to 21.74Mt, with exports forecast at 15Mt amid EU import quotas and increased Russian competition. Interestingly, some private forecasters are actually calling for a wheat crop closer to 18Mt which would take 3Mt out of available exports.

Stratégie Grains cut Russia’s crop forecast to 84.09Mt (still above USDA).

Bangladesh tendered for 50kt of wheat again.

EU exports sit at 19.9Mt YTD (vs 30.5Mt LY), with Algeria, Morocco, and Nigeria the top buyers.

Kazakhstan increased grain rail exports to China by 46pc y/y. CBA analysts flagged that although short-term disruptions in Middle East & North Africa can lead to wheat import surges, prolonged instability encourages domestic self-sufficiency and reduced demand longer-term.

Other grains and oilseeds

Corn futures fell again (CN -3c, CZ -4.75c) despite a 630kt flash sale to Mexico — the biggest since Nov 2024.

Agroconsult shocked the market by raising Brazil’s corn crop estimate to 150Mt (vs USDA’s 130Mt), citing huge productivity.

Harvest is slow at 13pc (vs 34pc LY), but big supply hangs over the market.

US Gulf corn is the cheapest FOB globally, and PNW remains best value into Asia.

Algeria reissued a 240kt corn tender after an unsuccessful first attempt.

EU barley exports are down 24pc y/y.

In soybeans, Aug-25 Soybeans fell 11.75c, Aug-25 Beanoil dropped 110pts, and Aug-25 Meal lost $2.10, dragging crush margins lower.

US-China trade uncertainty weighs on demand, and energy markets added pressure.

Malaysian and Indonesian palm markets slipped due to weaker soyoil and crude, plus Indonesia’s palm stock surge (+50pc m/m).

Brazil may raise its ethanol and biodiesel blending mandates (to 30pc and 15pc, respectively), which would offer support to sugar and oilseed markets if passed.

Macro

Oil prices sank sharply, with WTI down over 6pc to near $64/bbl, as Trump’s announcement of a ceasefire between Israel and Iran and a surprise statement allowing China to resume Iranian oil purchases undercut fears of supply disruption. The comment reportedly surprised US Treasury and State officials, leaving sanctions policy in confusion. While Treasury insists sanctions remain in force, markets interpreted the statement as a potential carveout for China amid broader US-China trade talks.

Iran supplies ~14pc of China’s crude imports (possibly more via shadow routes), and cheap Iranian oil is critical to its independent refiner base. Trump’s move may be seen as a strategic concession to both China and Iran in pursuit of de-escalation and a broader trade reset. However, uncertainty around US enforcement remains.

The fragile Israel-Iran truce is holding shakily, with violations from both sides casting doubt on its durability. Trump criticized both nations publicly, expressing frustration over their inability to maintain order.

At NATO, Secretary General Mark Rutte is trying to contain alliance strain as Trump again questioned US commitment. Rutte has proposed a 5pc defence spending goal to appease Trump and prepare for the risk of a more isolated NATO.

On the economic front, US consumer confidence fell in June to 93.0, its second lowest since Jan 2021. Present and expectations indices both declined, with Republicans showing the sharpest drop in sentiment.

Australia

Current crop bids in the west softened yesterday, with canola at A$855 and GM at $760. Wheat was down $5, bid at $356, and barley at $336.

In the east, bids also eased, with current crop canola at $840 and GM at $755. Wheat was $345 and barley around a similar level.

SA, Victoria, and southern NSW received some welcome rainfall over the past day, with totals of 10–20mm. Unfortunately, northern SA and the Mallee regions of both Vic and SA missed out, with strong winds whipping up dust and ‘sandblasting’ newly germinated crops.

Old crop canola is well supported, with domestically a tight balance sheet . Despite the export program largely completed there’s still strong container export and domestic crush demand providing support to old crop bids.

Cheaper heifer prices have driven a shift toward feeding heifers for supermarket programs, as strong export demand pulls steers into longer-fed export markets. Despite downsides like lower growth rates and fat penalties, some yards now feed only females, with more heifers also entering 100-day grainfed export programs.

HAVE YOUR SAY