Weather: There’s nothing significant on the global weather front. The main watch is on Canada, with the next two weeks forecast to bring below-normal precipitation. Across most of Europe and the Black Sea region, conditions remain on the drier side, which should support early harvest progress.

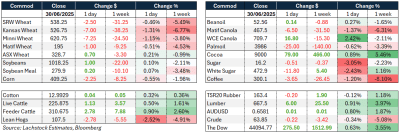

Markets: For those hoping for something to spark the agricultural commodity markets, the USDA Stocks and Acreage Report wasn’t it. Wheat numbers came in close to expectations, and row crops were no different. Winnipeg canola responded to news of Canada and the US resuming talks, making back Friday’s losses.

Australian Day Ahead: Not much is expected to change domestically, with cereals likely to be a little softer but still well supported by feed demand and the average new crop outlook across large parts of SA, Victoria, and southern NSW. GM canola is expected to be a little firmer on the back of Winnipeg.

Offshore

Wheat

USDA pegged total wheat acreage at 45.5 million acres, very close to expectations and down 1 percent from last year. June 1 wheat stocks were 851 million bushels, slightly above expectations (836 million), and 22pc higher year-on-year.

The implied Q4 usage was 386 million bushels, down 2pc YoY, reinforcing a soft demand tone.

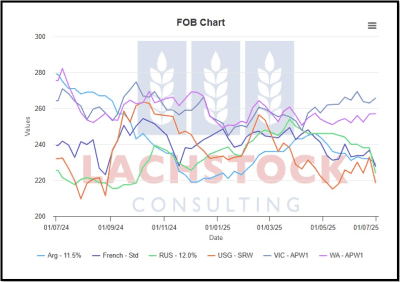

September wheat futures closed lower: WU -2.5c/bu, KWU -7c, MWU -7.25c. MATIF September wheat dropped €1.00/t, and Russian cash remains steady near US$225/t.

Winter wheat harvested acres were revised down by 900,000, but chatter of higher yields (HRW now 755mbu vs 782 prior, SRW 336mbu vs 344 prior) offsets any bullish read.

Egyptian state buying trails target, with only 3.9Mt of the targeted 4–5Mt collected by late June; local procurement centres are being shut early.

Ukraine’s 2025/26 wheat production estimate cut by Argus to 21.9Mt from 23.7Mt after virtual crop tour, with yields seen at 4.39t/ha on 4.98Mha.

The EU reached a new trade arrangement with Ukraine, replacing the temporary tariff-free regime with a framework that limits disruption to sensitive ag sectors.

Jordan issued a tender for 120,000t of wheat, with bids due July 1.

Germany’s 2025 grain harvest is forecast at 40.1Mt, up from 39Mt last year despite drought conditions.

Other grains and oilseeds

Corn acreage came in at 95.203 million acres, virtually matching expectations and up from 90.6 million last year.

3.63 million corn acres were unplanted at the time of survey; values below crop insurance guarantees raise the risk of these acres dropping out. Corn stocks were 4.644 billion bushels vs 4.997 billion last year and nearly matched the trade guess (4.641).

Q3 corn use implied at 3.5 billion bu, up 4.2pc YoY. USDA is expected to lower feed/residual in July’s WASDE.

Brazil’s Agrural put the corn crop at 130.6Mt, moving closer to USDA/CONAB and still below Agroconsult’s 150Mt. Harvest progress sits at 18pc vs 49pc last year, hindered by rain and frost.

Tensions in the Middle East are hitting Brazilian grain trade, with AgriBrasil estimating input and freight disruptions could cost R$5bn (~$900m USD).

South Korea’s MFG issued a tender for 60,000t soymeal from optional origins.

Soybean acreage was 83.380 million acres, slightly below expectations (83.655) and well below last year (87.050). Stocks were heavier at 1.008 billion bu vs 980 million expected, but the market anticipates USDA could adjust residual use in July or September.

The USDA confirmed 204,000t of soybean meal sold to unknown destinations. Soymeal inspections came in at 225k vs 275k expected.

Palm oil futures in Malaysia were weaker on Monday, with the benchmark contract falling 1.1% to 3,967 ringgit/ton.

Macro

US equities firmed as Treasury yields dropped and the dollar weakened; S&P 500 rose 0.5pc, 10y yield down to 4.23pc.

The AUD/USD touched a 2025 high at 0.658 as the DXY fell below 97.

Oil softened further, with WTI down 0.7pc to $65/bbl as OPEC+ may consider a fourth straight 411kb/d production hike for August.

Gold rose 0.5pc to $3,304/oz on dollar weakness and US tax uncertainty. Despite rising prices, dealers report a glut in retail gold with low premiums as investors offload holdings.

Copper held firm on stronger-than-expected Chinese factory data. Chile’s copper output in June rose 9.4pc YoY to 486.6kt.

Iron ore extended its slide amid persistent weakness in Chinese real estate, with top 100 developer sales down 23pc YoY in June.

Global LNG prices fell again as Chinese imports declined for an eighth month, down 12pc YoY. Norwegian gas exports also pressured European prices.

Canada has agreed to rescind its Digital Services Tax following Trump’s termination of trade talks; negotiations will resume with a target date of July 21.

Indonesia announced it will ease import rules for many goods and raw materials ahead of the July 9 US tariff decision.

Australia

Bids were steady to begin the week in the west, with new crop canola bid at $875, wheat at $363, and barley at $333.

Through the east of the country, bids were largely unchanged from Friday’s close, with new crop canola at $830, wheat at $355, and barley at $318.

Demand for faba beans from Egypt remains robust, with buyers looking to price new crop beans. However, most growers are waiting for more certainty around production. New crop bids are at $575 delivered Melbourne.

Australian canola could play a central role in a homegrown sustainable aviation fuel industry, with CSIRO projecting enough renewable fuel from canola to power 250,000 return Sydney–Melbourne flights, as jet fuel demand rises and government and industry back low-carbon fuel development.

Grower selling will be interesting as we move into a new FY, with the grower holding decent cereal length through NSW and into Qld.

HAVE YOUR SAY