Weather: The recent run of sustained heat across Europe continues, though there’s been no major impact on cereals apart from some reports of farmers shifting harvest hours to reduce the risk of field fires. The US Midwest is expected to heat up for the 4th of July holiday, but row crops remain in good shape as precipitation continues. Canada and the Northern Plains remain a watchpoint over the next 14 days, with most models calling for below-normal rainfall.

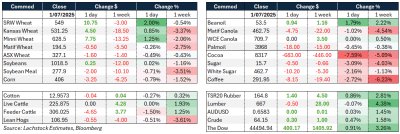

Markets: SRW traded higher overnight amid talk that the crop may come in at or below 300 million bushels, with most estimates in the 330–340 million range. Bean oil moved higher on biofuel optimism tied to the Big Beautiful Bill.

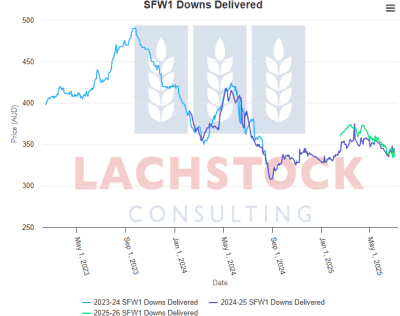

Australian Day Ahead: Not much change expected domestically today—wheat may be A$1 firmer while canola is slightly softer. Rainfall is starting to build in the outlook for next week, with 10–25mm likely across cropping regions in SA, VIC, and WA. Delivered markets slightly softer as growers meet nearby demand.

Offshore

Offshore

Wheat

Chicago Sep wheat (WU) rose 10.5c to US$5.50/bu, supported by US winter wheat condition slipping to 48pc good/excellent, down 1pt from last week.

The SRW crop continues to draw attention, with some market talk of yields under 300 million bu, though most forecasts remain around 330–340 million; current carryout is only 103 million bu, leaving little room for demand shocks.

SRW spreads firmed and KW-W weakened as HRW cash prices softened; SRW now being revalued against HRW given tighter expected balance.

In global wheat, Russian FOB export prices slipped $3 to $224–$225/t (12.5pc protein); SovEcon kept June exports at 1.2Mt while IKAR lifted July estimate to 2.2–2.3Mt.

EU soft wheat exports reached 20.19Mt as of June 29, down 35pc y/y due to poor French crop and Black Sea competition.

Ukraine wheat exports were 15.72Mt for the season, down 15pc y/y; total Ukrainian grain exports fell 20.5pc to 40.6Mt.

Argentina wheat plantings forecast at 7.1 million hectares (vs 6.9m last year); Rosario Exchange cited strong subsoil moisture, comparable to record yield years like 2021 (23Mt).

Matif Sep wheat slipped €0.50/t; Black Sea cash remains the export floor, capping upside despite US SRW concerns.

Market focus remains on SRW/China demand potential—if China steps in with volume buys, US balance could tighten rapidly.

Other grains and oilseeds

Corn July futures fell 0.9pc to $4.21 1/2/bu; crop rated 73pc good/excellent, up 1 point; models project yields of 185–189 bu/acre.

Brazil’s 2024/25 corn output forecast lifted: StoneX at 136.1Mt (was 134), Celerus at 147.6Mt (from 135.4); second crop now estimated at 108.2Mt.

May corn use for ethanol was 449.4 million bu (vs est. 447.4m); this week’s ethanol production expected at 1.08m b/d with 24.296 million bbl in stocks.

USDA confirmed corn acres at 95.2 million and soybean acres at 83.4 million; grain stocks reported higher than analyst expectations.

Soybean oil gained 1.7pc on biofuel policy optimism from the Big Beautiful Bill, which mandates use of North American feedstocks.

EU soybean imports hit 14.27Mt as of June 29, up 8pc y/y; Indonesia’s May palm oil exports surged 53pc y/y on stronger global demand.

Macro

Fed Chair Powell said more data is needed before any rate move; without tariffs, rate cuts would likely be underway.

Senate passed Trump’s ‘One Big Beautiful Bill’ if approved by House, could be law by July 4. CBO sees $3.3trillion added to deficit over 10 years.

WTI crude rose 1.1pc to $65.60/bbl on Iran tensions and US demand; Saudi, UAE and Kuwait exported 11.9 mb/d in June—fastest pace in over a year.

European gas prices rallied as heatwave boosted cooling demand; French nuclear curbed, LNG market tightens.

Copper rose to a 3-month high on Chinese recovery signs; Caixin PMI rose to 50.4 (from 48.3), official PMI at 49.7.

Gold rose to $3,340/oz on deficit concerns but cooled after strong US jobs data; iron ore stable despite China home sales down 23pc y/y.

AUD/USD trading in the upper 0.65 range; weaker USD may support US ag exports.

Purdue/CME Ag Sentiment Index fell to 146 in June (from 158); only 41pc of producers expect higher ag exports over next five years (down from 52pc).

Australia

Bids were softer in the west yesterday across all commodities except GM canola. New crop conventional canola was bid at A$865, with GM at $778. Wheat was $360, and barley $331.

In the east, new crop canola was $823, with GM at $742. Wheat was $363, and barley was around $315.

Delivered Darling Downs markets were bid at $325 for new crop and $322 for current. Wheat was $333 and $341, with prompt-delivered sorghum at $353.

Old crop delivered markets were active through the east yesterday, albeit with small volumes traded. Barley offers eased slightly, with growers satisfying nearby demand.

New crop chickpea bids are currently $700 delivered Brisbane, down from $880 in April.

HAVE YOUR SAY