Weather: The Canadian Prairies and Northern Plains will need to continue receiving rain. US row crop weather remains generally favourable through mid-July — a critical period for temperature and rainfall as corn enters the silking stage. Locally, there are good falls forecast over the next week, with most parts of WA, SA, and Vic expected to receive close to an inch.

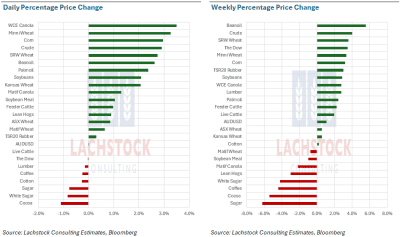

Markets: Green across the board overnight as a trade deal was finalised with Vietnam and rumours swirled of a potential China deal on Friday, which would see both countries back in the market for US ags. Crude oil rallied as Middle East tensions re–emerged, dragging the vegoil complex higher with it.

Australian Day Ahead: Expect canola to be $10–$20 stronger on the back of Matif and Winnipeg strength. Cereal values will improve, but it’s unlikely the full futures move will be passed on, with basis expected to weaken.

Offshore

Offshore

Wheat

Chicago wheat rallied 2.9pc as bargain buying and short covering accelerated, with funds exiting long-held short positions.

Fresh demand optimism followed news Vietnam will purchase US$2.9B in US ags as part of a new trade deal, sparking hopes for US wheat demand.

Additional bullish tone came from rumours of a potential US-China deal involving symbolic US ag purchases.

Concerns around US SRW production remain in the background, supporting the market as harvest gets underway.

Russian wheat logistics issues—specifically a rail bottleneck—added supply-side uncertainty and helped push futures higher.

Technical levels in the September Chicago contract ($5.52–$5.56) were tested, with targets now shifting toward $5.70 and potentially $6.00 if momentum holds.

Other grains and oilseeds

Corn reversed early weakness to close 2.8pc higher, as oversold conditions and Vietnam/China trade hopes triggered short covering.

Speculation that Vietnam may shift away from SAM-origin corn imports opened the door for potential US participation in their 13Mt demand.

Soybeans gained 2pc, with November futures bouncing from $10.15 support amid strength in both soybean oil and meal.

Technical resistance for beans is layered between $10.31–$10.38; a breakout could see a move toward $10.65–$10.70.

Ethanol production fell slightly to 1.076 mb/d, but better-than-expected data and a draw in stocks supported corn sentiment.

India’s total edible oil imports surged 30pc in June, though soyoil specifically fell 9pc, helping steady palm and veg oil prices in the region.

Macro

The US-Vietnam trade deal, cutting tariffs to 20pc on Vietnamese goods and eliminating them on US exports, boosted sentiment and risk assets.

Traders are increasingly hopeful for more trade deals before the July 9 tariff deadline, particularly with China and India still in talks.

Crude oil rallied as Iran suspended IAEA cooperation and closed western airspace, reigniting geopolitical tension in the Middle East.

Broader equity and commodity markets were supported by the “risk-on” mood heading into the US long weekend, with funds squaring up.

US 10-year yields edged higher, but UK gilts spiked on fiscal concerns after welfare reforms were abandoned.

President Trump’s expected speech in Iowa on trade kept markets alert, while traders avoided being caught short into the weekend.

Australia

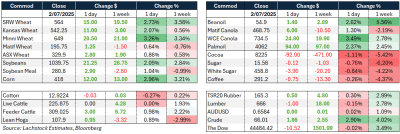

Yesterday, canola bids were firmer in the west, with GM improving the most — new crop bids reached A$795. Wheat was slightly stronger at $364, and barley was $329.

Through the east, bids were largely unchanged. New crop GM canola was $750, with conventional at $825. Wheat was bid at $363 and barley at $323.

Global ag markets were stronger overnight, but it’s unlikely the full extent of the move will be passed on domestically, particularly in the east. Prices are already well above export parity, and next week’s models are building in some decent rainfall.

New crop lentil bids are showing around an $80 inverse to current crop. Liquidity is expected to remain thin with a long way to go on production through key lentil-growing regions of SA and Victoria.

Feed mills and domestic consumers across SA and Vic are largely covered through to September, with prompt demand now thin.

HAVE YOUR SAY