Weather: A large portion of Canada remains dry with little rain in the forecast, raising concerns for spring wheat and canola yields. In Europe, showers are moving through France and Germany, offering some relief after recent heat, though Eastern Europe remains warm.

Markets: Ag markets lost ground late last night, with no sign of a China deal and harvest momentum weighing on sentiment. Adding to the pressure, Russian crop forecasts continue to climb.

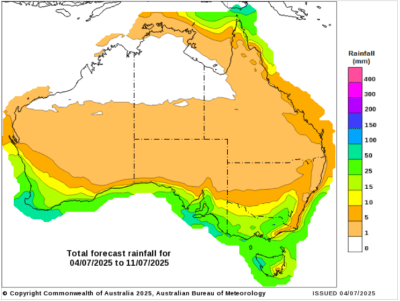

Australian Day Ahead: Locally, bids will be lower as global markets eased, and promising rainfall in the 10-day outlook. While crop development remains slow and well behind average across much of the south, it’s not a today problem for buyers.

Offshore

Offshore

Wheat

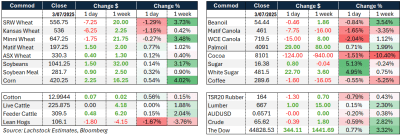

Wheat futures gave back early gains heading into the US long weekend, with Chicago down 7.25c, Kansas off 6.25c, and Minneapolis slipping 1.75c. Spring wheat held up best due to worrisome Canadian weather.

Russian crop estimates were raised by IKAR to 85.2 million tonnes, up from 84.5. The change, combined with harvest progress and no China buying, weighed on market sentiment.

US export sales beat expectations at 586k tonnes, with The Philippines a major buyer. The breakdown included strong volumes of HRS and HRW.

Market support from Matif wheat (up €1.50) and Russian cash values ($226–228/t) wasn’t enough to offset bearish harvest and export dynamics.

Weak demand for French wheat, with no China or Algeria interest, adds bearish pressure globally. Questions are now focused on where French stocks will go.

The SRW harvest over the long weekend will provide more clarity on production. Traders are watching to see if crop quality or size surprises the market.

Other grains and oilseeds

Corn rebounded off its lows this week, with December futures up 20c from the bottom. Support came from short covering, slightly warmer weather, and demand optimism.

Weekly corn sales totalled 1.47 million tonnes (532.7k old, 940.2k new), above expectations. Mexico drove new crop demand while South Korea and the “unknown” helped old crop.

Soybeans saw early strength fade, with August ending up just 2c. Despite a strong 40c intraday bounce during the week, the market lacked follow-through.

Soymeal outperformed with short covering ahead of the EPA’s biofuel hearing on July 8. Soymeal export sales were solid at 703.6k tonnes combined old and new crop.

Soy oil was weaker, with BOQ down 47 points, and August crush margins narrowed 6c. Export sales for oil were modest but beat expectations.

The market is waiting for weather clarity and Chinese demand signals. A new crop soybean bid from China remains critical to pricing direction.

Macro

President Trump’s visit to Iowa stirred speculation, but expectations were low for market-moving news. Markets remain alert to possible Chinese demand announcements or trade commentary.

The US EPA public comment period on the RFS begins July 8, drawing attention from the biofuels and oilseed markets. The outcome could influence crush margins and demand outlook.

The three-day weekend and July 4th holiday limited volume and added caution. Many traders were squaring positions ahead of the break.

Tariff negotiations conclude July 9, and any resolution could shift sentiment. For now, uncertainty continues to cloud the trade outlook.

CFTC data release is delayed until Monday due to the holiday. Positioning updates will be watched closely given recent volatility.

Broader commodity sentiment remains cautious. Big South American crops and strong US production potential continue to weigh on upside across grain.

Australia

In the west, canola bids were also stronger, with GM reaching A$820 for new crop. Wheat was bid at $370 and barley at $330.

Through the east of the country, cereal bids were firm yesterday with APW bid at $342 and barley at $333 for current crop. Canola was stronger, with new crop bids at $835 for conventional and $770 for GM.

Consumers remain wary of the slow start across SA, Vic and SNSW, with a kind spring needed to deliver decent yields. Grower selling is slow, but consumers aren’t yet prepared to lift new crop bids—especially with good rainfall forecast over the next two weeks.

ASW delivered Griffith market zone has held up surprisingly well, considering last year’s NSW crop. It peaked around $355 but has since eased $20 to $335, effectively halting the flow of wheat south into Victoria.

HAVE YOUR SAY