Weather: Nothing overly concerning on the weather front. Canada remains patchy in terms of recent rainfall, and the 10-day outlook is not convincing—worth keeping an eye on. US row crops have been receiving rain so far this summer, along with heat. Heavy rain and flooding in parts of Texas shouldn’t cause alarm, with over 80 percent of the winter wheat crop already harvested. The recent heat in Europe has shifted eastward, which should support harvest progress in Ukraine and Russia this week.

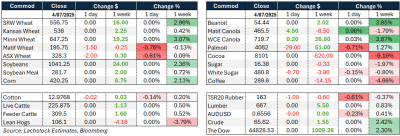

Markets: MATIF wheat fell €2/t on Friday night as Northern Hemisphere harvests continue to advance and with news that Russia will remove its export tax from July 9—likely adding further pressure to wheat markets. The Wednesday tariff deadline is approaching, with countries eager to strike deals with the US, particularly those involving ag purchases. No news yet on China, but any development there could be a significant mover for US futures.

Australian Day Ahead: With US markets closed on Friday, MATIF wheat will guide local direction, likely pushing domestic wheat markets $1–2 lower. Canola is stronger on the back of MATIF gains. Decent rainfall is forecast for southern cropping regions over the next week, so limited interest is expected from both growers and buyers in the short term.

Offshore

Offshore

Wheat

Indonesia has pledged to buy $500 million worth of US wheat as part of a trade pact, with local millers planning to import 2 million tonnes via tender. This forms part of a broader tariff negotiation aimed at securing US market access for Indonesian exports.

Russia has announced it will eliminate its wheat export tax from July 9, the first time since the tax was introduced in 2021. The move could increase global wheat flows and is expected to support Russian export competitiveness.

French wheat harvest is well ahead of average, with 11pc completed by June 30 compared to the five-year average of 4pc. Hot weather across Europe has accelerated harvest but is not expected to negatively impact yields.

Russia’s indicative wheat price sits at US$228.7/t, supporting current competitiveness. With the tax at zero, more aggressive pricing may emerge.

US wheat faces pressure from rising Russian supply and strong French harvest pace, even as Indonesia’s commitment offers some demand-side support.

SRW production and broader global trade dynamics remain key watchpoints, with China absent and Algeria also out of the market.

Other grains and oilseeds

French barley harvest has surged ahead, with 70pc of winter barley collected by June 30 vs a 5-year average of 39pc. Durum and spring barley are also tracking well ahead of normal pace.

Indonesia’s trade negotiations also covered expanded US agricultural imports beyond wheat, though specifics on corn or soybeans were not detailed.

European maize is becoming a concern as hot, dry weather approaches the critical pollination stage. Crop ratings for French maize declined to 78pc good/excellent from 81pc the previous week.

The barley and durum harvests in France continue to advance rapidly, putting downward pressure on nearby prices. Good yields are expected if weather holds.

Russia’s zero export tax applies to wheat but not yet to other grains, maintaining some relative price stability in non-wheat cereals for now.

Global oilseed markets were quiet in the latest trade talks, but Indonesia’s willingness to cut tariffs on US agricultural goods could open space for soybeans if negotiated further.

Macro

Global markets are bracing for the July 9 deadline marking the end of Trump’s 90-day tariff reprieve, potentially reigniting trade uncertainty. Talks are still ongoing, with Indonesia offering near-zero tariffs and expanded imports to secure US market access.

Trump’s tariff strategy aims to close trade deficits and bolster US manufacturing, but risks raising average import duties from 3pc pre-presidency to around 20pc. Most of the tariff burden still falls on US importers.

Fed officials are watching closely, with June minutes and upcoming speeches expected to offer insight on whether rates may be cut. US job growth has held up, though most recent strength came from public education.

Across Asia, central banks in Australia, NZ, South Korea, and Malaysia are weighing rate moves as inflation softens. Australia is expected to cut rates again, while others may hold steady.

In Europe, German industrial data was weaker than expected and UK GDP is forecast to show a modest rebound in May. A slowdown in factory orders reflects early impact from tariff anxiety.

Latin America is focused on inflation this week, with Brazil, Mexico, Colombia, and Chile reporting June CPI. Most are trending down, with central banks cautiously easing where inflation permits.

Australia

Bids in Western Australia were steady to end the week, with APW new crop bid at A$366, barley at $332, and canola at $866 FIS.

In the east of the country, new crop canola bids were around $825, wheat at $365, and barley at $320 track.

Some rainfall is forecast for the Vic and SA Mallee this week, which has the potential to be crop-saving in some areas. It’s also hoped the rain will begin to slowly grow some feed, giving growers a much-needed reprieve from the relentless task of hand feeding, which has been ongoing for the better part of eight months.

Expect the domestic market to be subdued to begin the week, with grower selling slow and buyers content to sit back and see what this week brings on the rainfall front.

Pasture growth remains slow in the south, with frosty conditions dragging down soil temperatures. This has seen hay coming in from the NT and WA, with prices now anywhere from $500–$800 a tonne.

HAVE YOUR SAY