Weather: Benign on the global weather front at the moment for the most part, with good harvesting conditions across most of the northern hemisphere. Canada remains a little dry but is okay for now. Domestic weather is little more exciting, with the rain radar likely to be one of the most frequently visited sites for SA and Vic growers today.

Markets: Offshore wheat was softer again overnight, with harvest pressure now in play and Russia increasing its export forecast by 2.1 million tonnes (Mt). The US corn crop has the potential to be a record, and Brazil’s crop is also large, both weighing on corn futures.

Australian Day Ahead: Canola is likely to claw back some of yesterday’s losses, though partially offset by a stronger Aussie dollar. Cereals are likely to be down $1–2 but more of the same with little engagement on either side

.

Offshore

Offshore

Wheat

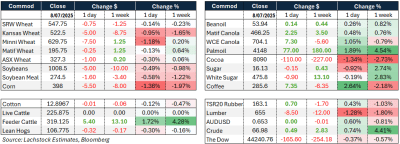

September wheat eased to US$5.48/bu as harvest pressure increased following early delays in winter wheat regions.

Spring wheat condition fell 3pts to 50pc G/E, while winter wheat held at 48pc; SRW mostly sound with isolated quality issues.

SovEcon raised Russian wheat export forecast by 2.1Mt to 42.9Mt for 2025/26, citing stronger crop outlook and price competitiveness.

Russian wheat offers remain at $225–$228/t FOB, undercutting Romania and Bulgaria.

HRW yields are large, but quality concerns remain; USDA’s Friday update to show class-by-class S&D for the first time this season.

Harvest pressure and fund selling continue to weigh on wheat futures as traders remain cautious amid tariff and macro uncertainty.

Other grains and oilseeds

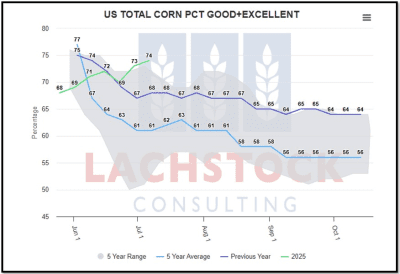

Corn made new contract lows with December down to $4.15/bu and September breaking below $4; crop rating improved to 74pc G/E.

Market is trading above trend yield expectations (181+ bu/acre), though USDA unlikely to adjust in July WASDE.

Brazil’s corn crop may be lifted by 4.85Mt to 133.1Mt in Thursday’s CONAB update; large South American supply caps upside.

Soybeans held steady at 66pc G/E; November futures dipped to $10.18/bu while meal sales of 144kt to The Philippines were announced.

Soybean oil gained on EPA biofuel policy support, while palm oil exports from Indonesia to the US may fall 20pc on tariff risks.

Ethanol production seen lower at 1.068m bpd with stocks at 23.969m bbl; Trump tariff uncertainty continues to pressure ag complex.

Macro

President Trump delayed tariff implementation to Aug 1 but reiterated this is the final deadline; 14 nations received letters with 25–40pc rates.

50pc tariff on copper imports triggered a 10pc spike in Comex futures; Chile remains unclear if exemptions apply.

Crude oil rose on Red Sea tensions after Houthi attack; gold fell as tariff delay eased immediate safe-haven demand.

US NFIB business optimism index dipped to 98.6; responses lowest since 2006, limiting data’s reliability.

Equity markets were mixed while US 10-yr yield rose to 4.41pc; AUD/USD gave back RBA-driven gains to trade in the low 0.65s.

Trade talks continue with Japan, South Korea, Thailand and Taiwan; deals remain at framework stage and lack key details.

Australia

Canola took a beating in the west yesterday with bids off A$20–$30 on new crop, now bid at $863 and GM $755. Wheat was firm, bid $360, and barley has been steady this week despite the global sell-off in corn/wheat, with new crop at $333.

In the east, canola losses weren’t as significant, highlighting there’s a longer way to go on production, with new crop canola at $828. Wheat was $360 and barley $317.

Up-country homes have been softer to begin the week as the trade pulls bids back and continues to exit length. Grower selling has been slow, with growers happy to wait and assess new crop production prospects.

Chickpeas are currently bid $715 delivered Brisbane for new crop.

Rainfall for SA and Vic today, with okay falls forecast. 10–20mm fell yesterday throughout the Yorke Peninsula, Eyre Peninsula, and Southeast of SA.

HAVE YOUR SAY