Weather: Canadian forecasts are showing below-average rainfall for the Prairies through July, where more precipitation is still needed. Some rain across parts of the Texas Panhandle to Nebraska may slow harvest progress over the next week. The Central Corn Belt is set to receive 1 to 3 inches of rain this week.

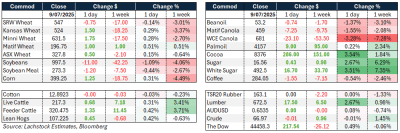

Markets: Mixed to slightly firmer for wheat and corn overnight, with some short covering helping wheat stabilise despite harvest pressure ramping up. The market appears content to wait for Friday’s WASDE and CONAB reports before making its next move. Beans and canola were lower, with tariff tensions returning to the spotlight.

Australian Day Ahead: Canola remains yo-yo-like and is set to give back all of yesterday’s gains. Wheat and barley are likely to be slightly firmer. ABS May export figures were stronger than expected for wheat and barley, further tightening an already tight east coast barley balance sheet.

Offshore

Offshore

Wheat

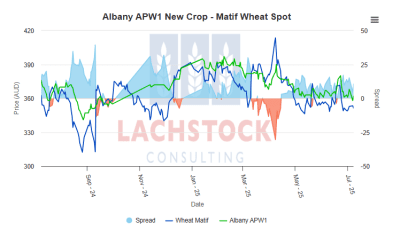

Wheat markets were relatively quiet midweek, with CBOT September slipping just 0.1pc to $5.47½/bu, while Matif in Paris added €1/t as harvest activity ramps up across the northern hemisphere.

Traders remain on the sidelines as the US harvest gains traction and spring wheat conditions show signs of deterioration, adding some uncertainty to the production outlook.

Iraq reported a bumper wheat harvest of 6.5Mt, well above earlier expectations of 4.5–5Mt, with strategic reserves now covering six months of national demand.

Ukraine’s wheat crop for 2025–26 is forecast at 22.5Mt, unchanged from last year, but export potential remains strong with 16.5Mt expected to be shipped.

Bangladesh’s latest wheat tender attracted a lowest offer of $268.90/t CIF, highlighting how global buyers are navigating current price and supply dynamics.

US weekly export sales are expected to come in at 400kt, roughly in line with USDA pacing, offering little fresh impetus for price action ahead of Friday’s WASDE.

Other grains and oilseeds

Corn futures staged a mild rebound, with December up 0.4pc to $4.16/bu, as traders squared up positions ahead of key reports from CONAB and the USDA later this week.

Crop scouts and analysts continue to highlight near-perfect US corn growing conditions, with yield expectations increasingly above 180 bu/ac — possibly even touching 185 bu/ac — setting the stage for a very heavy balance sheet.

Brazil’s safrinha corn crop is under the spotlight with private analysts suggesting a possible increase to 150Mt, well above CONAB’s last estimate of 128.2Mt; Argentina remains the cheapest export origin.

Ukraine’s corn production is pegged at 29.3–30Mt with favourable weather potentially lifting yields; exports could reach 24Mt in 2025–26, up from 21.5Mt this season.

Soybeans dropped 1pc on the day, driven by strong US crop conditions; Brazil came under additional pressure after Trump announced a 50pc tariff, sending the BRL tumbling and clouding future export competitiveness.

Palm oil extended its rally for a third session amid reports of improved demand from India, while falling corn prices supported feed margins and helped live cattle futures hit record highs for a second straight day.

Macro

President Trump reignited trade tensions, slapping a 50pc tariff on Brazil and floating sweeping new levies on copper, pharmaceuticals, semiconductors, and imports from BRICS nations — stirring fears of escalating trade retaliation.

Hope for a US-EU trade agreement continues, but the EU is struggling to secure immediate tariff relief or protection against future measures; some form of quota-based compromise appears likely, as seen in the recent UK-US deal.

Minutes from the latest Fed meeting revealed growing internal debate about the inflation outlook, particularly around how tariffs might impact price pressures, though most members still see scope for rate cuts this year.

The Reserve Bank of New Zealand held its cash rate steady at 3.25pc but flagged a likely cut in August as downside risks to growth outweigh short-term inflation pressures.

Crude oil prices bounced early on geopolitical concerns in the Red Sea and new sanctions on Iranian crude exports, but reversed lower after the EIA reported a surprise 7.1mbbl build in US stockpiles — the largest weekly gain since January.

Global LNG prices edged higher as a sweltering heatwave across Asia drove up cooling demand, with Japanese inventories hitting their lowest levels in nearly two months — likely prompting increased spot buying.

Australia

Canola made back a little of Tuesday’s losses yesterday, with bids up A$5–$10; conventional was at $870 and GM at $790 for new crop. Wheat was bid at $358, and barley has remained solid this week, bid at $336 yesterday.

In the east of the country, canola was $3 higher at $827, wheat was $360, and barley was $317 for new crop.

Cash markets in the east were a little firmer ($1–$2) yesterday, with end users keen to get a little more old and new crop on the books.

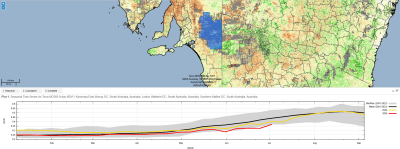

Some decent falls were recorded in SA yesterday: 10–25mm for the Eyre, 15–35mm for the Yorke Peninsula/Mid North, and Southeast. Unfortunately, the areas that needed it most — the Mallee and Northern regions — saw little more than 5mm.

Soybean meal is currently around $640 FOT Geelong/Melbourne for prompt pickup.

HAVE YOUR SAY