Weather: Looking good. Finally, a forecast everyone can get excited about – models are largely aligned and the next week looks solid for a chunk of Australia. According to the China Meteorological Administration, they are flat out cloud seeding in the north.

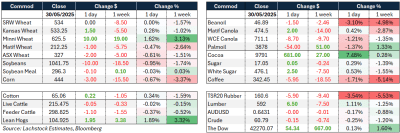

Markets: June is always a solid trading month – US row crop weather volatility meets winter crop harvest actual data. The global end user has been rewarded for dragging their collective heels. As we drift into northern hemisphere new crop we will get more clarity around the size of the inverse with Russian cash showing around US$20/t.

Australian Day Ahead: Super interesting week if we get somewhere near what is forecast. Vic barley keeps finding export demand to a point that inventory numbers are getting extremely tight. A huge issue is price and availability of fodder so winter growth will be important.

Offshore

Offshore

Wheat

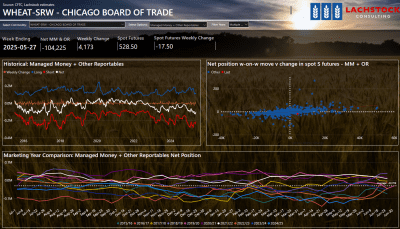

Minneapolis wheat remains the upside driver, rallying another US10c/bu as poor crop conditions in the Northern Plains and Canadian Prairies coincide with a large managed money short position that’s struggling to unwind.

Monday’s crop condition update will be key, with some anticipating improvement while others warn dryness may worsen.

KC and Chicago markets are more subdued, with KC weighed by burdensome carryout near 450 million bushels despite decent demand.

Chicago is caught between following Minny and weakness in corn and Matif.

Weekly US export sales were 583kt all-class, 57pc of which was HRW, with new crop unknowns suggesting demand from Nigeria, Morocco, and The Americas.

Russian cash for LH June/FH July is around $230, and Paris Matif Sep wheat was up €1.25.

Other grains and oilseeds

Corn markets have lost momentum. South American FOB offers continue to pressure nearby contracts while ideal US weather discourages new crop buying.

Safras raised Brazil’s corn crop forecast to 139 million tonnes, much higher than USDA’s 130. Weekly US corn sales were 917kt (old crop), just under expectations, plus 210kt announced in a daily sale.

Soybeans were weaker, with July and November contracts down 10c. Bean oil dropped 150 pts and meal slipped slightly, leading to a 6.5c decline in July crush margins.

Old crop soybean sales were just 146kt, but soybean meal sales beat expectations at 424.6kt and bean oil sales were also firm at 19.5kt.

Overall, there was little enthusiasm in the soy complex despite mixed product signals and strained US–China relations.

Macro

Inflation data from the US and euro area shows price pressures are returning to target.

In Europe, inflation may soon undershoot, supporting the case for the ECB to cut rates 25bp to 2.0pc on June 5.

Trade tensions with the US reinforce the need for precautionary easing. In contrast, the US Fed remains sidelined by uncertainty over the legality and inflationary impact of President Trump’s April tariff actions. Some inflation expectations have lifted, but underlying disinflation momentum suggests the Fed could begin cutting rates from Q3 if tariffs prove transitory in effect.

Australia

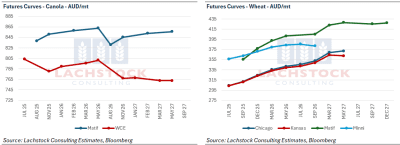

Canola was steady to end the week in the west, with current crop bid at A$805 and new crop at $845. Wheat was $352 and $365, with barley at $347 and $333.

In the east of the country, canola was softer on Friday, with current crop bid at $775 and new crop at $800. Wheat was $350 and $367, with barley at $345.

Models are starting to converge on what looks to be a crop-saving rain for parts of SA and Victoria, with at least an inch forecast for most cropping regions over the next week.

Sorghum exports have been more heavily front-ended than usual, highlighting the strength of Chinese demand this year and strong export margins, with exports largely expected to be completed by July.

HAVE YOUR SAY