Weather: It’s all about the US today – Oklahoma winter wheat is 5 percent harvested – and is set to get 6 inches over the next 7 days. In fact, there is rain right through the US winter wheat belt on the doorstep of harvest – I’m sure this will be a swing and roundabout given there will be some areas that will benefit – but it is one to watch.

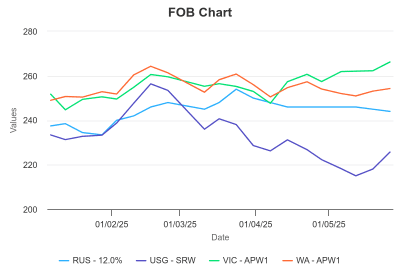

Markets: From an Australian perspective, US futures are back to being relevant. SRW has held the mantle as the cheapest wheat on the planet so, any change to value will impact Australia. A wet harvest is an interesting one for US futures – if it’s a disease event, ie vomitoxin, US futures can attract higher deliveries given they have a sliding scale but they still accept downgraded wheat. SRW FOB values however would rally in this environment. Aussie should ultimately benefit but US futures go back to not really being relevant.

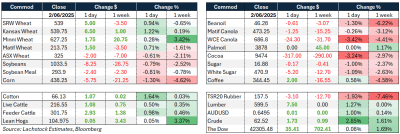

Australian Day Ahead: AUD higher and rain on the way = quiet, defensive bids.

Offshore

Offshore

Wheat

US wheat futures found support from adverse weather and geopolitical risk.

WN and KWN posted moderate gains, while MWN was relatively flat.

Heavy rain in parts of the US Plains is raising concerns over disease pressure and harvest delays, particularly in Oklahoma.

US winter wheat conditions increased 2 percent to 52pc good-to-excellent. Spring wheat, recovered 5pts overall and 11pts in North Dakota.

US wheat inspections are running 16.6pc above last year.

Global drivers include increased wheat imports by Morocco (+9.4pc YoY), including more from France and Russia, and continued drought pressure across parts of France, Canada, and the BSEA region.

ABARE increased Australian 2025–26 wheat production to 30.6 million tonnes (up 0.1Mt), although southern regions remain dry.

Russian wheat exports are forecast at 44.5Mt, sharply lower than last season’s USDA estimate of 55.5Mt. Ukrainian wheat exports are also down nearly 15pc YoY. Rising Russia–Ukraine tensions and stalled peace talks are reintroducing risk to Black Sea wheat flows.

Other grains and oilseeds

Corn markets remain weak, pressured by benign US weather, ample old crop supplies, and aggressive South American offers. CN and CZ both dropped from session highs.

US corn inspections are 28.5pc above last year, and planting progress reached 93pc. Conditions rose slightly to 69pc.

Brazilian production was updated to 128.5Mt by AgRural, slightly below prior lofty estimates.

Moroccan corn imports rose to 2.96Mt, mainly from Brazil and Argentina. Barley imports fell YoY, while durum wheat imports rose.

Soybeans continued to sag amid export uncertainty and lack of clarity on US biofuel mandates.

SN and SX declined, as did bean oil and meal, pressuring the July crush margin.

US soybean inspections are 10.7pc ahead of last year; 84pc of the crop is planted and initial crop ratings came in at 67pc good-to-excellent.

US soybean crush in April came in at 202.4 million bushels, roughly in line with estimates.

Meanwhile, overseas soybean sales from the next US crop are running 79pc below the five-year average, while corn sales are 36pc lower.

Macro

Geopolitical and trade tensions continue to dominate the macro narrative. Russia–Ukraine talks in Istanbul yielded no progress, and escalated military activity threatens Black Sea export routes.

Trump announced a doubling of US steel tariffs to 50pc, provoking EU retaliation threats and adding pressure ahead of further US–EU and US–Japan trade talks. US–China tensions are also rising, with disagreements over chip access and critical minerals.

Legal scrutiny of Trump-era tariffs adds uncertainty, though the administration suggests it has alternate powers to maintain trade restrictions. The ISM US manufacturing index fell to 48.5 in May, the third consecutive contraction, with export orders dropping to pandemic-era lows.

US ethanol production has eased from record highs, but inventories remain large.

OPEC+ announced another 411k bpd oil production hike for July, citing seasonal demand.

Asia’s factory activity weakened in May due to soft Chinese demand and US tariffs. India’s monsoon has stalled temporarily, delaying rainfall critical for summer crop planting.

Australia

The week started largely unchanged in the east of the country, with current crop canola at A$781 and new crop at $800. Wheat was $348 and $367, with barley at $345 for the current season.

In the north, delivered Darling Downs barley markets are trading around parity for both new and old crop at $337. Wheat is $348 for current crop and $353 for new crop. Chickpeas are bid at $850, delivered Brisbane for Oct–Nov.

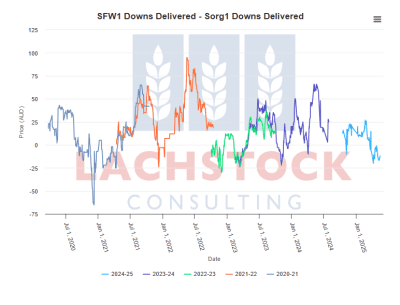

Sorghum export pace has been strong this year, supported by good export margins on the back of Chinese demand. This has seen less sorghum fed through Qld and NNSW, displaced by wheat due to the current spread.

HAVE YOUR SAY