Weather: Get used to hearing about the US row crop belt. It’s that time of year. Not that we can’t alter the winter wheat crop prospects but, from a market perspective, I feel like US corn and beans will drive all pits for the next month or so. At the moment, it’s all about setup with some signs of dryness but nothing threatening today. As mentioned yesterday, OK is set to get pounded with rainfall, it’s not raining in Rostov and Australia is set to get a drink in the most needed parts.

Markets: Last night was a classic example, wheat showed signs of concern when reports leaked through about attacks on the Kerch Strait bridge, only to give it up when no threat was confirmed. Russian/Ukraine conflict just doesn’t drive any market value it would seem. However, given the escalation I’m nervous about what Russia does next.

Australian Day Ahead: Rain is sticking around and we are within sight of the next financial year. Values in the south probably manage to hold while the north feels a little heavy.

Offshore

Offshore

Wheat

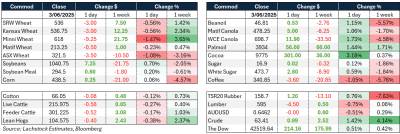

Wheat futures continued to decline, with Chicago soft red winter wheat (WN) and Kansas City hard red winter (KWN) each down US3c/bu, while Minneapolis spring wheat (MWN) dropped 9.25c. Paris Matif Sep eased €0.50/t and Russian spot offers remained stable at US$228–230/t FOB.

Weakness reflects improving US crop conditions: USDA reported 50 percent of US spring wheat rated good-to-excellent (up 5pts w/w), beating the top end of analyst estimates and narrowing the gap from historical averages. However, it remains 24pts below the same time last year (74pc G/E in early June 2024).

Winter wheat also held at the upper end of expectations, confirming a stabilised US production outlook.

Despite renewed geopolitical tensions — including Ukrainian strikes on the Kerch Strait bridge and deep Russian incursions — global wheat markets have shown limited reaction.

Russian exports remain uninterrupted, with weekly volumes continuing near 0.8–1.0Mt according to port-level data. Ukraine is forecasting 20–22Mt of wheat this season (vs ~22.5Mt in 2023), with early sowing delays from excessive rains and lower soil moisture following an abnormally warm winter.

In the EU, soft wheat exports from July 1 to June 1 reached 19.1Mt, down from 28.8Mt last year (–34pc), driven by a slower French export campaign and increased Black Sea competition. Algeria (1.62Mt), Morocco (2.66Mt), and Nigeria (2.67Mt) remain the top destinations.

Meanwhile, Egypt’s Mostakbal Misr has begun sourcing French wheat directly via private contracts — a notable shift in procurement patterns, although cargoes are reportedly delayed.

US export prospects could improve with trade diplomacy ramping up: Agriculture Secretary Rollins has signalled new wheat access discussions with the EU, Vietnam, and others.

Speculators continue to hold a sizable short in Chicago wheat, with the CFTC-managed money position near net short 90,000 contracts. Despite weather volatility, fund covering has been limited, and repeated failures to break above technical resistance (notably WN’s 50-day moving average at ~543c) highlight the market’s lack of conviction.

Other grains and oilseeds

Corn prices firmed slightly on reduced rain forecasts and lingering wet planting delays, though gains were capped by fund apathy and a stronger US dollar.

USDA rated 69pc of corn in good/excellent condition, up 1pt w/w but still below last year.

Brazilian safrinha crop estimates held at 129Mt; Ukraine projects 26Mt. Algeria tendered for 240kt feed corn.

Iowa signed MoUs to sell 900kt corn and 250kt DDGS to Vietnam, which is also considering raising ethanol mandates—potentially adding 200 million gallons of US ethanol demand.

Soybeans rallied modestly, led by strength in soyoil linked to firmer WTI crude.

First USDA condition report showed 67pc of soybeans in good/excellent condition.

US export optimism remains a theme, with Vietnam, Italy, and China in trade discussions.

Still, sentiment is mixed: recent pressure had left the market oversold, but broader trend indicators remain negative, and funds are reluctant to hold long positions.

Macro

Macroeconomic developments remain heavily trade-driven.

US farmer sentiment hit a four-year high on optimism around crop exports and active US trade missions. However, scepticism around free trade has grown—only 28pc of surveyed farmers strongly agree it benefits agriculture.

President Trump formally raised steel and aluminium tariffs to 50pc, reigniting global trade tensions.

Markets continue to expect a pattern of escalation and retreat (The “TACO” trade – Trump Always Chickens Out).

The OECD downgraded global growth forecasts (2.9pc for 2025), citing policy uncertainty and rising protectionism.

US job openings rose to 7.39 million, with the ratio of openings to unemployed at near parity (1.03:1), supporting the Fed’s view that labour tightness—and associated inflation pressure—is easing.

Eurozone inflation continued to fall, with headline CPI at 1.9pc y/y and core at 2.3pc y/y, boosting expectations for continued ECB easing.

The RBA minutes showed a dovish bias, with cuts likely if downside scenarios materialise, but no change expected in July.

Australia

Prices were steady in the west yesterday. Canola was A$810 for current crop and $845 for new crop. Wheat was $350 and $361, with barley at $345 and $330.

Through the east of the country, more of the same, with bids largely unchanged — current crop canola at $775 and new crop at $800. Wheat was $348 and $367, with barley $349 for current.

The past week has seen domestic buyers largely go to ground, particularly through southern NSW, where barley bids are back $10–$15 and wheat $5–$10, as the forecast improves for southern Australia. Victoria and South Australia remain more supported, given the short crop in 2023/24, a poor start to 2024/25, and strong livestock prices.

Given recent media coverage about the lack of fodder through SA and Vic, you could be excused for thinking grain prices should’ve done more work than they have. Global demand has been subdued, and wheat prices are softening globally, which has seen export margins dwindle, allowing more grain to be put back into the domestic market — keeping a lid on prices.

When comparing WA wheat to the Geelong/Melbourne domestic market, it’s clear that significant work has been done domestically — but that’s largely due to WA markets softening on the back of weaker export markets.

HAVE YOUR SAY