Weather: Rain popping up for the Canadian Prairies in the back end of the forecast but the next the next 7 days are hot and dry. Massive rains through the HRW/SRW belt again – the last 14 days has seen over 6 inches fall throughout KS and OK – pretty mature crop there.

Markets: I don’t know if Mum (Donald) and Dad (Elon) are going to stay together – things are pretty toxic right now – it’s a shame because Donald’s call with Xi was actually pretty constructive. But markets are seemingly more interested in Epstein’s flight log than international trade stability.

Australian Day Ahead: Rain, long weekend, Tweet-a-palooza = a very quiet trading day.

Offshore

Offshore

Wheat

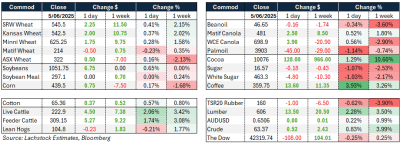

Wheat futures posted modest gains, with WN closing above its 50-day moving average for a second consecutive session, providing technical support.

Export sales were mixed: old crop saw a net reduction of 49.1kt, while new crop sales totalled 445kt, slightly below expectations. Nigeria and Mexico featured prominently across HRW and SRW demand, indicating consistent interest from key importers despite broader trade headwinds.

Globally, Ukraine raised its 2025/26 wheat crop estimate to 22.6 million tonnes (Mt) on the back of favourable May rains, with exports expected to reach 17.1Mt.

Russian 12.5 percent protein wheat is facing weaker demand at deep-sea ports, and while concerns persist over southern Russian yields, no major revisions have taken production below 80Mt yet.

In France, Matif wheat remains under pressure due to heavy shorts and a lack of Chinese or Algerian buying, raising concerns about port congestion and domestic stock build.

Weather remains a key driver. Excessive rain in the US HRW and SRW belts could affect yield and quality, while the Northern Plains and Canadian Prairies face model disagreement on upcoming rainfall. Dryness in China continues, and Argentina’s 2025/26 planting pace jumped to 23.6pc complete, suggesting good early-season conditions. Total planted area remains on track at 6.7 Mha, modestly above last year. Overall, wheat markets are caught between improving global production prospects and uncertain demand, with short-term direction still largely weather-driven.

Other grains and oilseeds

Corn prices firmed on new crop weather risks and potential delays in the Eastern Corn Belt.

Old crop continues to trade counterintuitively for a market supposedly below a 10pc stocks/use ratio.

Ukraine raised its 2025/26 corn crop to 28.3Mt with strong export potential.

In Argentina, the 2024/25 corn harvest is nearing the halfway mark at 43.8pc complete, with total production unchanged at 49.0Mt, still trailing last year’s 51.6Mt.

Soybeans were modestly higher, supported by renewed trade optimism post Trump-Xi call, though follow-through remains limited. Chinese demand remains centred on Brazilian and Argentine supply.

Argentina’s soybean harvest has reached 88.7pc, up 8pc on the week, with final production steady at 50.0Mt, virtually in line with last season’s 50.2Mt.

Products were lacklustre and July crush margins narrowed.

Macro

The US trade deficit narrowed sharply in April to US$61.6 billion from $138.3 billion in March, driven by a 16.3pc fall in imports—largely a correction after front-loading ahead of tariff changes. Despite the improvement, the year-to-date deficit is still 65.7pc wider than in 2024, underscoring the ongoing impact of trade policy distortions.

Markets took a cautiously positive tone after a cordial Trump-Xi phone call, focused on trade cooperation and rare earths. While no breakthroughs were announced, the planned follow-up meeting with key US trade officials signals that formal negotiations are progressing.

Tensions within the Republican Party are rising as Elon Musk and Donald Trump clash over the GOP tax bill. Musk’s criticism—framing the bill as fiscally reckless—has introduced political risk, particularly around donor alignment heading into the midterms.

The Federal Reserve’s Beige Book noted a slight economic slowdown, with agriculture cited as a weak spot due to low prices, drought, and weak export demand. At the same time, the IEA forecasts global fossil fuel investment to decline in 2025 for the first time since COVID, reflecting weaker oil prices and broader economic uncertainty.

Australia

In the west, bids were unchanged to slightly firmer yesterday, with canola at A$810 for conventional and $720 for GM. Wheat was bid at $354 and barley at $345.

In the east, bids were mixed. Canola was slightly stronger, bid at $780 for conventional and $708 for GM. Wheat was marginally softer at $347, while barley was $344.

ABARES is currently forecasting a 2025 wheat crop of 30.6Mt, 11pc above the 10-year rolling average, and a barley crop of 12.8Mt, 9pc above the 10-year average.

Strong Chinese demand for Australian barley, active domestic feed demand, and tight local supply have supported prices. However, domestic consumer demand is now easing amid improved crop and feed outlooks.

HAVE YOUR SAY