Wheat:

- Chicago wheat fell 8.25 Usc/bu

- Kansas wheat dropped 8.5 Usc/bu

- Minneapolis wheat was down 10 Usc/bu

- Matif wheat lost 0.5 EUR/mt

- ASX Jan ’26 wheat settled at $336.50 AUD/mt, down $6.50

Row Crops:

- Corn declined 16.75 Usc/bu

- Soybeans dropped 39.5 Usc/bu

- Soybean meal eased $3.30 USD/st

- Soybean oil slipped 0.61 Usc/lb

Canola:

- Matif canola fell 8 EUR/mt

- Winnipeg canola settled at 686.3 CAD/mt, down 22.9 CAD/mt

Energy & Macro:

- Crude oil finished slightly higher at $66.49 USD

- Dow Jones retreated 422.17 points

- AUD/USD softened to 0.65026

Weather: Local weather is improving, with decent falls forecast across WA, SA, and Vic over the next week. Totals of 25–50mm are expected in most parts, which could be crop-saving for northern SA and the Vic/SA Mallee if it eventuates.

Markets: Red across the board overnight, as production looks rosy across the board and harvest pressure builds in the northern hemisphere. Corn and soybeans appear in good shape, and there’s still no news on a China trade deal.

Australian Day Ahead: Not a good night for futures to start the week. A slightly softer Aussie dollar may offset part of the move, but we’ll see bids lower across the board today, particularly canola.

Offshore

Offshore

Wheat

US wheat futures fell sharply (WU down over 3pc) as harvest pressure builds across the northern hemisphere, with US winter wheat harvest nearing average pace.

Russian wheat export tax was cut to zero for the first time since 2021, adding to global supply pressure.

Russia maintained its 90Mt wheat crop forecast despite drought in the Rostov region and rain delays elsewhere.

France AgriMer reported French soft wheat harvest at 11pc by June 30, well ahead of the 5-year average (4pc).

The EU announced an 80pc cut in Ukrainian wheat import quotas, redirecting Ukrainian supply to Africa and Asia.

Turkey’s wheat imports for 2025–26 were revised up by 2.75Mt to 10.3Mt due to poor local production.

Other grains and oilseeds

Corn futures fell sharply (CZ down 3.7pc to $4.21½) on improving US crop conditions and non-threatening pollination weather.

Soybeans also fell (SX down 2.7pc to $10.21¼) as benign weather and lack of China trade news weighed on the market.

USDA corn inspections reached 1.49Mt, up 30pc YoY; Japan and South Korea remain major buyers but could be impacted by new tariffs.

USDA expects record-high soybean crush volumes this year driven by biofuel and animal feed demand.

ADM is expected to benefit from improving crush margins due to stronger RVOs and domestic feedstock incentives.

Ethiopia gained approval to export soybean meal to China, expanding China’s protein sourcing options amid trade tensions.

Macro

President Trump announced new 25–40pc tariffs on 12 countries including Japan, South Korea, Malaysia, and South Africa; effective August 1.

An additional 10pc tariff was threatened on nations aligning with BRICS policies, escalating trade tensions.

Equity markets fell (S&P 500 down 0.8pc), US 10yr bond yields rose to 4.39pc as trade tensions flared.

The AUD/USD dropped below 0.65 amid USD strength and ahead of the RBA decision, where a rate cut is expected.

Crude oil rose 1.6pc to $68.1/bbl as OPEC+ output hikes were offset by signs of tight physical supply.

Base metals, including copper and iron ore, fell on fears of weaker demand and higher tariffs, while gold rose 1.1pc on safe-haven demand.

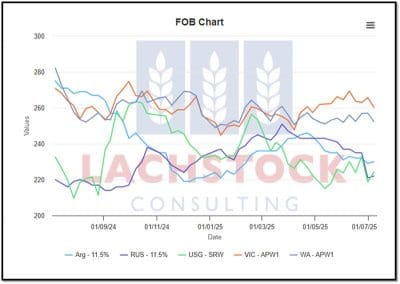

Australia

Wheat bids were down in the west of the country to begin the week, with new crop APW off A$8/t at $356 FIS. Canola was stronger at $885, while barley was firm at $330.

Through the east, the new crop track wheat market was a little softer, with APW at $360, canola at $838, and barley at $318.

New crop faba bean bids continue to be published, with solid demand from Egypt, though not at the high prices seen last year. Delivered Geelong/Melbourne values are around $560.

Sorghum bids delivered Brisbane are holding around $370, supported by some spot demand for short covering into bulk vessels over the past 2–3 weeks.

Australia became India’s top exporter of frozen and chilled lamb and mutton in 2024, overtaking New Zealand. Exports rose 85pc year-on-year to over $2.3 million, driven by tariff removal, supply chain reliability, and targeted promotion.

HAVE YOUR SAY