Weather: Wetter conditions in the Southern U.S. Plains contrast with continued dryness across parts of the EU, Black Sea, and China. Talk of over 4-5 inches of rain through TX and OK – the TX crop is 72pc headed, OK is 41pc.

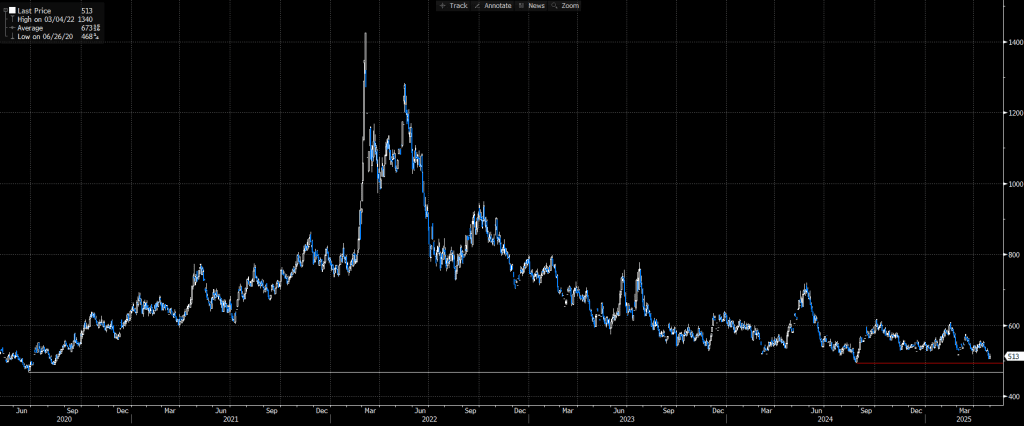

Markets: You’re telling me there is a chance. Chicago wheat is finally whispering about demand – not loudly, but with China returning to the wheat market it is starting to feel like Chicago wheat is cheap enough. Full disclosure, I thought that 50usc/bu ago. US economic data is starting to reflect what the market has suspected. Donald’s strategy is both inflationary and is slowing growth.

Australian Day Ahead: Today will be fascinating – offshore is a push overnight so the domestic trade will have a blank sheet to start the day. No real change on the domestic weather front. Feels like the southern market may hold its own today.

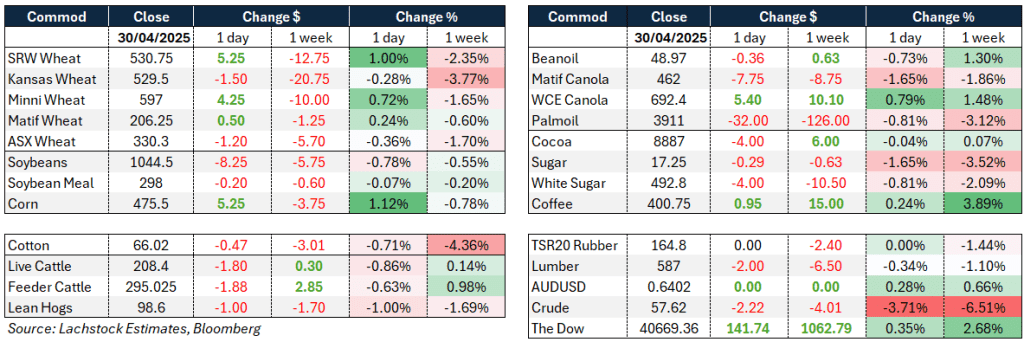

Offshore

Wheat – Wheat futures continued a modest recovery, with July CBOT wheat rising 1.2pc to $5.32 ¼, helped by short covering and technical positioning ahead of the new month. The recent upturn reversed two consecutive days of losses.

Physical demand remains a key focus: China’s re-entry into the market with 400k tonnes from Australia and Canada was modest but notable after months of absence.

Inquiries from Brazil and Nigeria suggest U.S. wheat is gaining traction at current price levels.

Egypt secured 645k tonnes locally, and South Korea purchased 65k tonnes of feed wheat.

Argentina’s 2025/26 wheat output is estimated at 20.5Mt on 6.7M ha.

Meanwhile, European soft wheat exports are sharply down 34pc y/y amid weather-related supply issues across Europe and Russia.

Matif remains under pressure, with speculative short positions at a record 263k contracts.

Wetter conditions in the Southern U.S. Plains contrast with continued dryness across parts of the EU, Black Sea, and China.

Other Grains and Oilseeds – Corn futures rose 1.1% to $4.75 ¼ on short covering and technical repositioning.

Demand indicators remain strong: South Korea selected U.S. over South American corn for old-crop needs, and another 120k tonnes were sold to unknown destinations.

China remains active in global feed markets, raising the risk it may crowd out U.S. export opportunities later this year.

Ethanol production reached the high end of estimates at 1.04m b/d, while stocks fell modestly to 25.39m bbl. Soybeans fell 0.8% to $10.43 ¾ amid persistent lack of Chinese demand and heavy South American selling.

China’s exports of used cooking oil (UCO) to the U.S.—its largest market—are expected to collapse following the imposition of a 125pc import tariff by the Trump administration. Valued at $1.1 billion last year, shipments have already started to dry up, with the final cargoes departing in late March and early April, forcing Chinese sellers to seek alternative markets in Europe and beyond

Argentine soybean sales remain sluggish year-to-date despite policy support, although a single-day spike of 230k tonnes marked the year’s highest daily sale.

The Brazilian Supreme Court ruling against the Soy Moratorium has raised alarm over potential deforestation-fueled acreage growth.

Macro – U.S. Q1 GDP shrank 0.3pc seasonally adjusted annual rate basis, the first contraction in three years, driven by a sharp 41.3pc rise in imports outpacing modest export growth.

Consumer spending slowed to 1.8pc saar, impacted by winter weather and falling confidence. Federal spending also declined.

The March PCE deflator showed flat monthly inflation, with annual core inflation easing to 2.6pc y/y. Market-based PCE (ex-food and energy) dropped to 2.2pc.

Tariffs are now seen as a key source of inflation uncertainty.

April ADP employment rose only 62k vs 115k expected, suggesting possible labor market softening.

Meanwhile, the U.S. and Ukraine signed a resource development deal granting Washington privileged investment access in exchange for sustained diplomatic and financial backing. The agreement strengthens U.S. influence in ceasefire negotiations with Russia and creates a U.S.-controlled reconstruction fund backed by future resource profits.

Domestic political focus remains on Trump’s 100-day milestone, with sharp partisan divides over economic direction, trade policy, and institutional reforms like the delayed Farm Bill.

Australia – Slightly softer in the west of the country yesterday with canola bid $835 on new crop, with GM at $750. Current crop wheat was steady at $350 with barley at $347. New crop wheat worked lower to be bid at $365 and barley at $335.

Through the east of the country, canola bids were lower with current crop at $765 and new crop at $800. Wheat is bid at $340 and barley at $332.

As has been the case for most of this marketing year, the end user/consumer market continues to underpin wheat values. SFW/ASW delivered through the GV, Western Districts and Central Vic are bid around $360, SA market zone around $390, and Griffith at $345 — putting a floor in the market with lacklustre exporter demand for the most part.

The barley market in the east continues to be well supported with strong export programs out of Vic and NSW, domestic demand, and low grower liquidity.

With seeding now underway in most parts, buyers are having to pay up to remove it from growers’ hands.

Hay is becoming scarce through SA and Vic as feeding continues. As we move into May, any pasture growth that follows rain is likely to slow in the cooler temperatures. Many growers are feeding more cereals than usual due to low hay stocks.

Expect some canola hectares across SA, Vic, and southern NSW to be lost to lower-risk hay production.

HAVE YOUR SAY