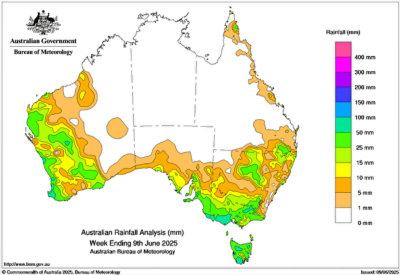

Weather: Wheat weather is mixed globally. The US sees excessive rain in the south but dryness in key areas. Russia is turning drier after a wet spring in the northern areas. Europe and China have patchy rain, with some improvement expected. Australia and Canada remain too dry for early crop establishment. Argentina is dry for now, but rain is expected soon.

Markets: When wheat breaks, it feels super heavy. Global FOB levels are lacklustre at best with Russian cash feeling under pressure. Even this late in the game, ie on the doorstep of harvest, balance sheets can be skewed.

Australian Day Ahead: The south eastern cropping belt got a drink. More on the way, particularly for the Eyre Peninsula in South Australia. AUD the sunny side of 0.6500 will keep bids on the defensive.

Offshore

Offshore

Wheat

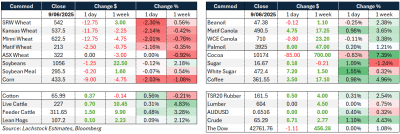

Wheat futures declined sharply across all major US contracts, with Chicago (WN), Minneapolis (MWN), and Kansas City (KWN) all losing over US11 cents per bushel.

The downturn followed a combination of bearish developments: SovEcon increased Russia’s 2025 wheat production forecast by 1.8 million tonnes (Mt) to 82.8Mt, citing improved weather in the southern regions such as Krasnodar and Stavropol, though conditions remain poor in Rostov — Russia’s top producing region.

Weather outlooks have improved across key spring wheat areas in North America, with better rain chances this week. US crop ratings surprised to the upside, with spring wheat conditions rising 3 points to 53pc good/excellent and winter wheat up 2 points to 54pc.

US weekly wheat inspections were just 291,000 tonnes — the lowest since March — reinforcing the view that US wheat remains uncompetitive amid ample Black Sea supplies and a firmer dollar.

Paris Matif wheat dropped €3/t, offering no support to the market, while Russian cash wheat is still holding slightly above $225/t. Negative seasonals and lack of clear trade deal momentum also weighed on sentiment.

Meanwhile, Canadian farmers are reportedly shifting more area into wheat in response to reduced attractiveness of canola exports amid ongoing tariff risks.

Tunisia’s harvest is expected to nearly double to 2Mt.

Ukraine’s wheat production forecast was lowered by 100,000 tonnes to 21.7Mt, though this offered little market support.

Other grains and oilseeds

Corn futures fell sharply (CN and CZ), driven by ideal weather, improved crop ratings (71pc good/excellent), and harvest pressure from South America, which is becoming the dominant exporter.

Brazil’s second corn crop harvest is at 1.9pc, the slowest since 2021 due to late planting.

US old crop corn inspections reached 1.66Mt.

In soybeans, old crop held better than new, with SN down only 1.25c while SX lost 6.25c. US is competitive into non-China markets for August. China imported a record 13.92Mt of soybeans in May, up 129pc m/m and 36pc y/y.

Ukrainian corn production was cut by 2.1Mt to 24.9Mt.

Speculators are heavily short across US grains and oilseeds, holding more than 400,000 net short contracts.

Macro

US consumer inflation expectations declined across all timeframes in May, with 1-year expectations at 3.2pc, 3-year at 3.0pc, and 5-year at 2.6pc.

The improvement follows partial tariff rollbacks between the US and China.

Trade talks resumed in London with both sides expressing interest in resolving disputes, including rare earth export restrictions.

US trade policy uncertainty remains elevated despite the recent easing.

ECB’s Peter Kazimir said the ECB is now at neutral policy rates after the June cut, but highlighted downside risks to growth and potential further fine-tuning based on incoming data.

Talks are also ongoing with India and South Korea on resolving tariff disputes.

Australia

Canola prices were firmer in the west to end the week, with new crop bid at A$850 for conventional and $775 for GM. New crop wheat was bid at $367 and barley at $330.

In the east of the country, new crop canola made it back to $820 on Friday with GM at $730. Wheat was bid at $367, with barley at $325.

Some good rainfall for SA and Vic over the weekend, with 50mm falling throughout Southeast SA and 50–100mm through the Western Districts. Some rain also fell in the SA/Vic Mallee, with up to 20mm in parts, but a follow-up will be needed given the lack of any subsoil moisture.

Delivered crush new crop canola is bid around $840 into Footscray/Newcastle for Jan+. After being bid as high as $880 delivered Brisbane in late April, new crop chickpea bids have fallen to $760, highlighting the prospects of the NNSW and SQLD chickpea crops and question marks around Indian demand.

HAVE YOUR SAY