Weather: Weather remains broadly favourable for US row crops, with recent rains across South Dakota, Minnesota, and Iowa supporting development. The 6–10 day outlook calls for near- to below-normal temperatures across the Corn Belt, reinforcing talk of record yields. In western Canada, recent rainfall has helped stabilise spring wheat and canola yield potential.

Markets: Wheat futures led the way overnight, with the Russian grower proving a reluctant seller and lineups building—forcing exporters to pay up. US export sales came in better than expected for both wheat and corn, while sales across the bean complex were mixed. The WASDE is due today and should provide traders with more conviction on the next move.

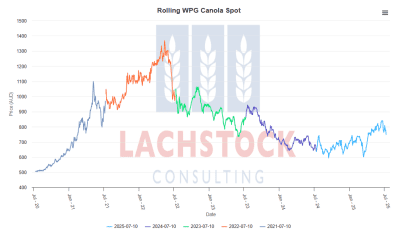

Australian Day Ahead: Wheat is expected to be $3–$5 higher today, with global values lifted by similar local themes—slow grower selling. Don’t expect that to change today, with no incentive for growers to move and a long way to go on production particularly in the east. Canola is likely to be slightly firmer.

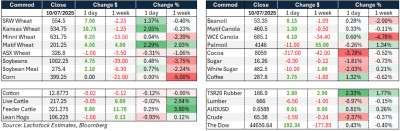

Offshore

Wheat

Wheat futures led CBOT gains on short covering ahead of WASDE and expectations of reduced harvested acres. September HRW tested contract lows earlier this week but found support on improved export demand.

US weekly wheat export sales totalled 567.8kt, above trade expectations (400k) and the pace needed to meet USDA forecasts. Top buyers were South Korea, Japan, and Mexico.

Stratégie Grains held EU wheat production steady at 130.7Mt, while China’s wheat crop dipped just 0.1pc YoY to 138.16Mt despite drought.

In Russia, Stavropol’s record crop may offset drought-hit Rostov, keeping total exportable supply relatively stable.

Spring wheat in North America may be down by up to 2Mt, though recent rains stabilized Canadian yields. Futures market activity in HRS wheat has dropped sharply.

Canadian durum output was cut to 5.16Mt, while Turkish output is forecast at 3.6Mt — the lowest since 2021. New-crop bids are firming in western Canada.

Other grains and oilseeds

Corn US corn export sales were strong: 1.26Mt old crop (vs. 650k expected) and 889k new crop (vs. 425k expected), with 110k to unknown destinations. Weekly demand was led by Mexico, Japan, and South Korea.

Brazil’s CONAB raised corn production to 132Mt and soybeans to 169.5Mt. Soy exports from Brazil are strong, aided by a weaker BRL.

EU maize output was cut 5pc by Stratégie Grains to 57.4Mt due to hot/dry weather. Canadian barley supplies are forecast down 5pc, likely trimming feed use.

Soybeans recovered mid-session on short covering but remain under pressure from US-China trade tension and weak demand sentiment.

Malaysian palm oil stocks rose to an 18-month high as exports dropped sharply, despite stronger domestic use.

Feed barley bids have seasonally declined at Canadian elevators, and Canadian beer sales have softened malt barley demand.

Macro

US jobless claims fell to 227k but continuing claims rose to 1.97m, suggesting a stable but slowly softening labour market.

Fed’s Musalem noted the economy is in a good place but said it’s too soon to judge whether tariff-driven inflation will persist.

Oil fell on rising US inventories and concerns over weak demand, with WTI down 2.1pc to $66.9/bbl. Houthi attacks in the Red Sea have renewed fears of supply disruption.

Natural gas prices rose in Asia and Europe due to heatwaves and tight LNG stocks; Japan’s inventories are near 2-month lows.

Copper prices gained after Trump’s announcement of a 50pc tariff on imports starting August 1. US domestic smelting capacity remains constrained.

Equity markets shrugged off Brazil tariff threats largely unchanged.

Australia

In the west of the country, canola was down A$10–$20, with new crop conventional bid at $860 and GM at $765. Cereals were unchanged, with wheat at $359 and barley at $335.

A similar theme played out in the east, where canola bids pulled back, with new crop at $818. Wheat was bid at $361 and barley at $318.

It’s interesting to see wheat into Griffith now being bid in the low $340s again for August, with grower selling drying up.

Delivered Darling Downs markets are bid around $342 for wheat and $328 for barley for Jan+ delivery.

The flow of wheat from NSW to Vic certainly isn’t working today on paper with ASW deld Griffith $342 and Geelong $370. It might not have to at the moment, but Sep-Nov will see consumers looking for coverage through to new crop.

HAVE YOUR SAY