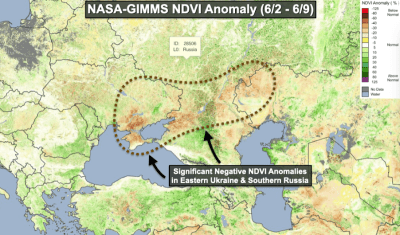

Weather: Nothing to see here. Rostov has declared a state of emergency but, most of the analysts are increasing their Russian yield – this could be, in part, due to the fact they are including the occupied parts of the Ukraine. Texas saw a massive increase in good to excellent – they would have a little over 50 percent of winter wheat to harvest with 2-6 inches on the way.

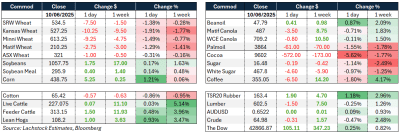

Markets: Headwinds. Despite some localised concerns around the globe – there is nothing concerning enough to challenge the shorts. Demand remains the constant debate – Australian wheat demand aside from China has been robust but China is the barometer for global commodities, like it or not.

Australian Day Ahead: Local markets have softened in line with international markets – new crop pricing is well short of getting the grower engaged but provides little for the exporters. Southern old crop markets still face some challenges given pasture growth will struggle now things have got cold.

Offshore

Offshore

Wheat

Wheat markets remain weak under the weight of improving global supply outlooks.

US winter wheat conditions have improved, reaching the highest early June ratings in six years, just as harvest begins.

Russian wheat production is now expected around 82.8–83Mt, with total Russian grain output seen at 135Mt, including harvests from occupied Ukrainian regions.

Ukrainian wheat prospects have been downgraded due to water stress and reduced tillering, with forecasts lowered to 21.7Mt.

French wheat is facing demand headwinds as harvest nears, and Chinese and Algerian buying remains absent.

Prices are under pressure in both US and European markets, with Matif wheat remaining heavy.

Analysts warn that the July contract could sag below US$5.30/bu.

Despite improved US exports earlier this year, overall demand remains light globally. US-based agricultural market analyst AgResource and others suggest bearish trends will intensify into late June unless crop-threatening weather materialises.

Other grains and oilseeds

Corn rebounded modestly midweek as cash markets firmed and old crop execution remained active.

US new crop CZ futures recovered above $4.40/bu but face downside risk if benign weather continues.

Brazil’s second-largest corn harvest on record is expected to reach 5 billion bushels, driven by strong yields despite minimal area expansion. However, rising domestic use for feed and ethanol is likely to reduce export availability.

South Korea’s NOFI and KFA tendered for large volumes of feed corn.

On the oilseeds side, soybeans are holding a bid in old crop due to firm CIF values, Brazilian strength, and a lack of US farmer selling. However, new crop remains capped by favourable US weather and limited fresh demand drivers. Analysts note the market is no longer oversold, but without a weather scare, rallies will be limited.

Palm oil stocks in Malaysia surged to an eight-month high in May as production and imports outpaced exports.

Iran tendered for large volumes of corn, barley, and soymeal, while global trade houses such as COFCO posted lower revenues and volumes for 2024.

Macro

US small business sentiment improved in May, with the National Federation of Independent Business index rising 3 points to 98.8, slightly above the long-run average.

Sales and business condition expectations lifted, partly on improved tariff headlines.

However, the uncertainty index also rose, and taxes are increasingly cited as a top concern.

In the UK, soft labour market data raised expectations for Bank of England rate cuts, with payroll employment falling for the seventh consecutive month and the unemployment rate edging up.

Meanwhile, US–China trade talks are reportedly progressing, but with no details provided.

Markets remain focused on upcoming US CPI data. Core inflation is expected to tick up slightly due to tariff impacts, but FOMC is likely to remain patient as it awaits clearer inflation and policy signals.

In parallel, adjustments to the EPA’s Renewable Fuel Standard rule-making process and stakeholder meetings may shift the focus toward waivers rather than broader mandates.

Australia

WA markets opened the week slightly softer for current crop wheat, with 24/25 APW1 bids down A$4/t across the board — $347 in Albany, and ASW9 at $339. Canola firmed to $820, while new season barley bids were $327.

In the east, current crop canola strengthened to $799, APW wheat held at $345, and barley was bid at $344. New crop canola bids remained strong at $825 for conventional and $745 for GM, with APW steady at $345 and barley at $320.

Australian milling wheat is losing ground in key Southeast Asian markets to competitive Black Sea offers, compounded by a firm Australian dollar.

Chinese wheat demand remains lacklustre, impacting Australian exports, though barley and sorghum exports to China remain solid with a strong pace from Australia.

HAVE YOUR SAY