Weather: Hard to find much exciting in global weather – nothing market moving at least..

Markets: Pre USDA report – markets were subdued ahead of the next round of data. Corn is fast becoming the only reason we can challenge the shorts in wheat – and with ideal US growing conditions and weakening Brazil basis even that is becoming debatable. Ethanol pace has been impressive and the latest stocks drawdown indicate margin. However, the risk is the USDA sees higher stocks which will set the tone into the growing season.

Australian Day Ahead: Same same – the Australian groundhog day. I reckon we are slightly up in the cricket; thats something!

.

Offshore

Offshore

Wheat

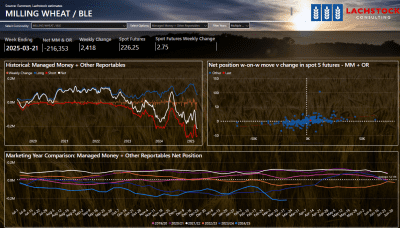

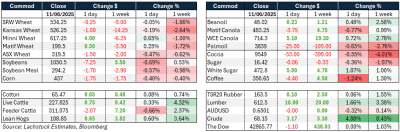

US wheat markets were mixed: WN slightly lower, KWN down 1c, and MWN up 4c. Spreads were flat to weaker in Chicago and KC, while Minny calendars were firmer.

Market remains in a holding pattern ahead of harvest. HRW exports are solid but any offsetting increase in production could limit carryout reductions.

SRW areas in the US mid-south face ongoing rain risks.

French wheat could use more rain, but no serious production threat yet.

Ukraine’s wheat exports are down 15 percent year-on-year as part of an overall 19pc decline in grain exports.

Reports indicate Russia has deliberately burned over 15,000 hectares of winter crops in the Kherson region.

Tunisia is aiming for self-sufficiency in durum wheat and plans to double its strategic grain inventory capacity.

MATIF wheat saw a modest €0.50/t gain; Russian wheat prices remain steady just above US$225.

Other grains and oilseeds

Corn markets were softer, with CN down 1.75c and CZ nearly unchanged.

Weather remains ideal, and the June seasonal pressure adds bearish weight—historically CZ has finished lower in 21 of the past 28 Junes.

Ethanol production hit a record 1.12 million barrels/day, though stocks declined more than expected.

Taiwan purchased 65,000 tonnes of Brazilian corn, while Iran reportedly made no significant purchases in recent feed grain tenders.

Ukrainian corn exports are down 23pc y/y. Barley exports fell 5pc y/y, and early barley harvest results from southern Ukraine indicate poor yields.

In soybeans, US old crop demand weakened on lower domestic bids and falling Brazilian premiums.

Meal and oil sales are expected to be modest. Bean oil firmed slightly on stronger RINs, but new crop fundamentals remain largely weather-dependent.

Macro

May US CPI data came in softer than expected: headline and core inflation both rose just 0.1pc m/m.

Annual CPI was 2.4pc y/y, and core at 2.8pc y/y. Early tariff effects have not yet filtered into consumer prices, suggesting businesses are holding back on pass-through. Having said that, it’s amazing how well the data has shrugged off the noise associated with Donald’s tariffs – the western press has been proven wrong so far.

Markets are now questioning when the Fed might cut rates, with September seen as a likely timing if the trend persists.

A US-China trade deal was declared “done” by President Trump, involving Chinese rare earth exports and US visa concessions, though details are thin and political risk remains high.

Trump also flagged unilateral tariff declarations within two weeks unless deals are struck.

EU trade negotiations are progressing slowly.

The World Bank cut its 2025 global growth forecast to 2.3pc, citing tariff pressures. US equities pulled back on concern that existing tariffs will remain entrenched.

Australia

In the west of the country, bids were steady with canola at A$860 for new crop. Wheat was slightly softer at $362, and barley was $329 — both for 25/26.

Through the east of the country, things were softer across the board, with current season canola bids at $790, wheat at $340, and barley at $338.

Basis levels remain strong for east coast wheat, highlighting weak global values and a firm domestic market, with grower selling slow through NSW and Qld. If production prospects continue to improve through southern Australia, and as we move into the next financial year, unsold grain is likely to add pressure to current basis levels.

Canola exports have slowed significantly, with only 91kt on the stem for June. Any further canola exports are likely to come from WA, with the eastern states effectively 100% complete on forecast export numbers.

HAVE YOUR SAY