Weather: Hard to focus in international weather given the outlook at home. Rostov had around 1 inch, and the China wheat belt received some rain. There was nothing really in northern EU. But, as we have learnt it doesn’t really matter for the moment, particularly for US wheat which is plumbing new lows daily.

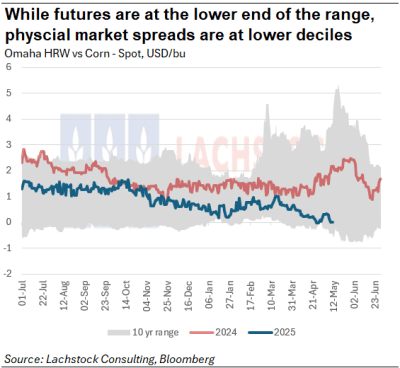

Markets: Markets remain a tale of two – US futures and Black Sea FOB. Russian cash has largely been unchanged through the relentless clean out of US futures. Spec positioning used to be a trading indicator – too short was bullish – not these days. The structural set up is significant but isn’t having any impact on price at all.

Australian Day Ahead: Just rain. Delivered markets are still seemingly focused on keeping grain in their drawing arch but not necessarily pulling in grain from other areas. If things continue, grain will have to work from north to south – a flow we haven’t seen for a good while.

Offshore

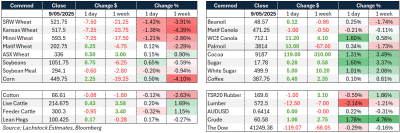

US wheat markets continued to deteriorate, with Chicago, Kansas City, and Minneapolis contracts all posting fresh or near-contract lows.

Despite sporadic rallies linked to weather headlines, the bearish narrative persists amid expanding HRW production expectations and limited export demand.

Managed money remains heavily short, with a new record short in KC wheat at 72.2k contracts, and substantial positions in Chicago and Minneapolis.

Global production signals are mixed: Western Australia’s crop area forecasts were revised slightly lower due to dryness, although sowing continues. French wheat crop ratings remain stable and well above last year’s levels, while Ukrainian planting is progressing in line with 2023.

Chinese wheat areas received helpful rain, and parts of the EU remain in need of precipitation.

The market continues to ignore these stories for now, with no compelling catalyst to shift sentiment or reverse technical weakness.

Other Grains and Oilseeds

Corn posted modest gains, led by strength in deferred contracts, but sentiment remains fragile.

A confirmed sale of 288,000t to Mexico (including both old and new crop) supported prices temporarily. US corn continues to flow, but with ideal planting conditions and Brazil expected to soon dominate exports, forward momentum is limited.

In soybeans, modest strength was sustained by ongoing sales to Pakistan—120,000t for 2025/26—and diplomatic progress with China. However, Chinese soybean imports for April fell 29 percent YoY due to customs delays and tight domestic supplies that forced some crushers to halt operations.

Imports are expected to rebound in May/June.

Brazilian sales are progressing slowly, with 2024/25 at 57pc sold versus a 5-year average of 70.3pc.

Palm oil continues to struggle, pressured by weak demand from India and Pakistan, and expectations of rising production and inventories in Malaysia.

Macro

Trade talks between the US and China concluded with “substantial progress” and plans for a formal mechanism to continue dialogue, led by Treasury Secretary Bessent and Vice Premier He Lifeng. While no concrete agreements were announced, negotiators struck a constructive tone, and Trump publicly praised the talks.

Markets reacted with strength in the USD and Chinese yuan, alongside optimism for de-escalation. However, scepticism remains about the depth of any near-term resolution. Tariff cuts are being considered, but the impacts on inflation will take time to materialize. US economic focus now shifts to the April CPI print, with expectations for a 0.3pc m/m rise in both headline and core.

Analysts believe front-loaded imports and delayed shipment impacts will mute early inflation signals from tariffs, pushing out any FOMC rate cut to September.

Underlying disinflationary pressures persist, and tariff-induced price effects are expected to be temporary and margin-absorbed.

The macro backdrop remains one of policy caution amid slower growth, sticky inflation expectations, and geopolitical noise.

Australia

A slightly firmer end to the week in WA with canola bids at A$837 for new crop and $790 for current. New crop wheat was $366, with current at $355, and barley at $335 and $347.

In the east of the country, canola ended the week a little stronger with new crop bids +$6 at $805. Current season wheat was $348, with barley at $346.

National barley exports sit at 78pc of total forecast exports, canola at 91pc, and wheat at 70pc through to the end of May.

Another dry week is forecast for Southern Australia, which will keep feed grains well supported as they continue to be pulled north to south to meet demand.

Consumers through the south will hope for some more liquidity on the offer side once growers have the crop in the ground by early June, especially if it is coupled with some rain. Expect NSW wheat to increasingly continue to work south, with plenty of wheat to work through and a carryout of 1.61 million tonnes.

HAVE YOUR SAY