Weather: Nothing to see here.

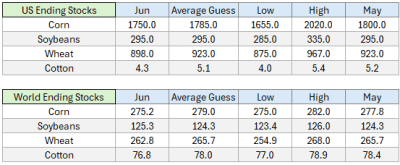

Markets: It’s that kind of market. The WASDE market reaction is built around pre report estimates vs the report rather than the actual data sometimes. In this case, global wheat ending stocks were lower, both from May and from last year. As always, there are a bunch of head scratchers but, honestly, it would have needed to be a wildly bullish report to get any one excited. Aussie production was unchanged at 31 million tonnes (Mt).

Australian Day Ahead: Will be an interesting day – forecasts are ok without being amazing – good to see some decent moisture forecast for the Vic Mallee. USDA report now behind us and the AUD above 0.65 should mean things are a little defensive – but the weather in the south is really only giving us the bare minimum.

.

Offshore

Offshore

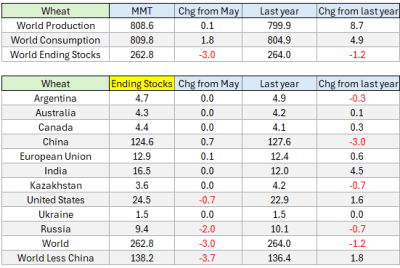

Wheat

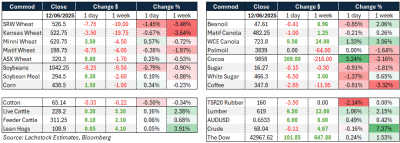

US wheat futures slipped with WN down US7.75c/bu and July delivery off 1.5pc to USD$5.26 1/2.

KC and Chicago spreads softened while Minny was mixed.

USDA raised US wheat exports by 25 million bushels, aligned with expectations, and maintained production figures.

Chinese old crop wheat imports increased slightly to 4Mt; new crop unchanged at 6Mt.

Global wheat stocks fell to 263.98 Mt due to higher EU and Indian production.

Russia’s wheat harvest remains forecast at 83Mt with 45Mt exports in 2025/26.

US HRW crop fears of 800Mb didn’t materialise, keeping domestic supply pressure moderate.

Wheat traders were disappointed by the lack of surprises in the WASDE update, with stockpile reductions already expected.

Market action was muted with implied vol in WN at 21.81pc. Despite tighter stocks, old crop wheat did the bare minimum, with possible supply appearing in the stocks report.

Other grains and oilseeds

Corn firmed with CN up 1.5c and CZ slightly higher.

USDA lifted old crop exports by 50Mb to 2.65Bb and trimmed ending stocks to 1.365Bb, with new crop carry-in also lowered.

Chinese old crop corn imports were cut 1Mt to 7Mt.

Global ending stocks declined to 275.2Mt, below expectations.

CONAB raised Brazil’s corn crop to 128.3Mt, near USDA’s 130Mt.

Ethanol production was near record levels, but markets didn’t respond positively. Corn’s near-term outlook is heavily tied to weather risks.

Soybeans struggled, with July futures down 0.8pc. Interior basis dropped sharply after ADM slashed bids.

Export sales were poor at 61.4k vs 300k expected.

USDA held domestic ending stocks flat while global stocks rose to 125.3Mt.

Record Brazilian soybean production was pegged at 169.6Mt by CONAB, supporting an overall grain output record of 336.1Mt.

Macro

US PPI rose just 0.1pc in May, with service inflation softening and inflation signals remaining tame.

Markets are now pricing in two Fed cuts (Sept, Dec), as inflation looks to be stabilising despite tariff concerns.

UK GDP slipped 0.3pc in May with declines in services and production offset slightly by a rise in construction; transaction-driven legal activity fell sharply post-stamp duty changes.

The global backdrop remains benign from a macro-inflation perspective.

Meanwhile, updated US Drought Monitor maps show improvement in Nebraska soil moisture, easing extreme drought concerns in key corn and soybean areas.

Australia

More of the same yesterday in the west, with canola bids firm for current crop and slightly softer for new crop, bid at A$815 and $855 respectively.

Wheat was $352 and barley $340 for current season. In the east, little change — canola was slightly firmer at $799 for 24/25 and $825 for 25/26. Current season wheat was unchanged at $348 and barley at $342.

Despite the old saying “it doesn’t rain feed”, this week has seen consumers pull bids back $10 through SA, Vic and NSW on the back of decent rain.

Given the solid job done on exports through SA/Vic and growers largely sold, expect bids to slowly rise back to pre-rain levels over the next few weeks.

New crop faba bids are beginning to be published, with delivered Melbourne bids around $550. Current season remains around $660–70 into Geelong/Melbourne.

The next 4–5 days look set to bring a little follow-up rain to parts of SA and Vic, with 10–15mm likely for most cropping regions. Unfortunately, only 5mm is forecast for the Vic/SA Mallee, where it is most needed.

Extra heavy lambs made $520 at Goulburn this week, with processors struggling to find enough volume as we move into winter.

HAVE YOUR SAY