Weather: If you want a metaphor for this year’s crazy weather ranges, look no further than the US. The Northern Plains, ie Montana across to Minnesota, are forecast to hit 95-100°F over the next few days. This region then is expected to get down to 34-36°F this weekend.

Markets: Markets are still trying to digest the latest in the tariff merry-go-round. The WASDE put a full stop on the recent theme – nothing to see here. Corn has some work in front of it and global wheat is still must be harvested – right now though the focus is on global trade flows and that means Donald still has the conch.

Australian Day Ahead: another day, another blank forecast. There are signs of life through NSW but it seems to be stopping at the border again. We almost forget that there are amazing parts of the country – NNSW, Southern WA are off to a cracker. When east coast lupins are A$700/t and corn is circa $380/t its hard to gauge the domestic disappearance via containment feeding.

Offshore

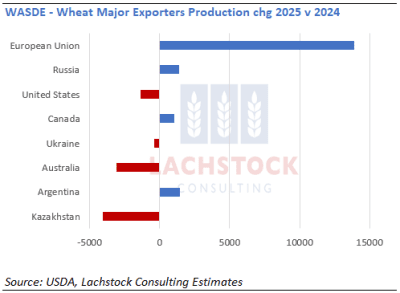

The May WASDE was another punch in the wheat market’s face – adding production to both the US and the global market – well above the average trade guess. This is the first WASDE projecting 2025 balances with the USDA pushing a return to normal for EU wheat production after last year’s shocker. Based on these numbers, the only hope for wheat in the short term is a corn rally.

The USDA projects higher US wheat beginning stocks and a 10pc increase in ending stocks to 923 million bushels, driven largely by a better-than-expected Hard Red Winter (HRW) crop (784 million bu) and upward revisions for Soft Red Winter and White Wheat.

Despite a modest increase in domestic food use, US exports are projected lower due to strong competition from the EU, Russia, and Argentina.

Globally, production is forecast at a record 808.5 million tonnes (Mt), more than offsetting lower beginning stocks.

Chinese import demand was revised down to 6Mt, limiting bullish potential.

Market reaction has been tepid, with futures declining despite generally constructive macro sentiment, highlighting structural supply pressure and a need for demand-led support.

Other Grains and Oilseeds

Corn and soybeans had contrasting reactions.

Corn saw mixed performance—despite tighter old crop US ending stocks (1.415 billion bu vs. expectations of 1.445) and ambitious new crop exports (2.675 billion bu), futures declined as the bearish pull from wheat weighed on sentiment.

The global corn outlook includes lower ending stocks (USDA: 277Mt vs. market 297Mt) and upward revisions for Brazil’s safrinha crop (130Mt this year, 131Mt next), yet speculative long unwinds and low conviction around USDA’s new crop export estimates limited follow-through.

Soybeans rallied sharply on Chinese trade optimism and a bullish WASDE report. Old crop US ending stocks were cut to 350 million bushels and new crop to 295 million, with crush and export demand both revised higher.

Despite speculative long reductions in the prior week, Chinese buying (including a flash sale to Mexico) and weather risk have reignited bullish sentiment.

Soymeal and soybean oil also gained.

The soy/corn ratio is expected to widen further in favour of soy, as farmers are largely locked into corn acreage.

Macro

US-China trade negotiations are a central driver of agricultural market sentiment.

President Trump’s comments about a “total reset” in trade relations and mutual tariff reductions have lifted commodities broadly, with soybeans being the primary beneficiary. However, some tariffs remain in place, limiting the full upside.

The US and China have agreed to reduce tariffs sharply—by 115 percentage points—for 90 days while negotiations continue, marking a significant de-escalation in trade tensions. US tariffs on Chinese goods will fall from 145pc to 30pc, and Chinese tariffs on US goods from 125pc to 10pc. This has sparked a rally across global equity markets, with the S&P 500 up 3.3pc and the Nasdaq up 4.3pc, and driven bond yields and the US dollar higher.

Commodities reacted positively, although oil markets remain watchful of President Trump’s Middle East visit amid Iran tensions. The agreement includes commitments to roll back some non-tariff barriers, with both sides signalling they do not seek full decoupling but rather a more strategic rebalancing of trade. Markets view the 90-day reprieve as reducing near-term recession risks, though the Fed remains alert to inflationary risks from tariff shifts.

Australia

WA grain markets opened the week slightly firmer, with canola up $5 to $795/t for current season and new crop at $837/t. Wheat held steady at $355/t and barley at $347/t.

Eastern states grain remained mostly unchanged. Canola was steady at $770/t with new crop at $800/t. Wheat hovered around $350/t, while barley firmed slightly to $346/t.

Hay prices continue to rise, with cereal hay in South Australia quoted at $380/bale through the Mid North and Adelaide Hills. Lupins are trading around $700/t delivered, and barley hay bids have edged up to $362/t delivered.

Victorian cattle yardings topped 21,000 head last week — nearly double the average — as dry conditions and limited feed prompted early offloading. Mortlake alone yarded a record 7,877 head, applying downward pressure on price.

HAVE YOUR SAY